- France

- /

- Aerospace & Defense

- /

- ENXTPA:HO

Has Thales’ Expansion Into Cybersecurity Created a Hidden Opportunity for Investors?

Reviewed by Bailey Pemberton

- Wondering whether Thales is a bargain or just riding a hot streak? Let's break down what the numbers and the latest events tell us about the company's real value.

- Thales has seen some wild swings lately, dipping 2.6% over the past week and down 8.5% in the last month. Zoom out, and you'll spot an impressive 74.5% jump year-to-date and a 58.4% gain over the past year.

- The big moves come as Thales has been making headlines with its expansion into new defense technologies and recent contract wins in cybersecurity. These stories are fueling the narrative that the company could be set up for longer-term growth, even with short-term volatility.

- Right now, Thales scores just 2/6 in our valuation check, meaning it's undervalued in only two out of six key metrics. We’ll explore why this matters and how typical valuation methods stack up. Stick around to discover an even smarter way to approach the question of fair value at the end of the article.

Thales scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Thales Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future free cash flows and discounting them back to today's value. This approach helps assess what the business is truly worth, based on its ability to generate cash in the years ahead.

For Thales, the most recent Free Cash Flow stands at €2.57 Billion. Analyst estimates suggest that free cash flow will grow steadily, reaching €3.52 Billion by 2029. Beyond that, projections are extrapolated further out based on recent trends, with the model showing figures approaching €5.05 Billion by 2035. All these forecasts are in euros, and reflect both analyst expectations for the next five years and extended estimates from Simply Wall St for years beyond that.

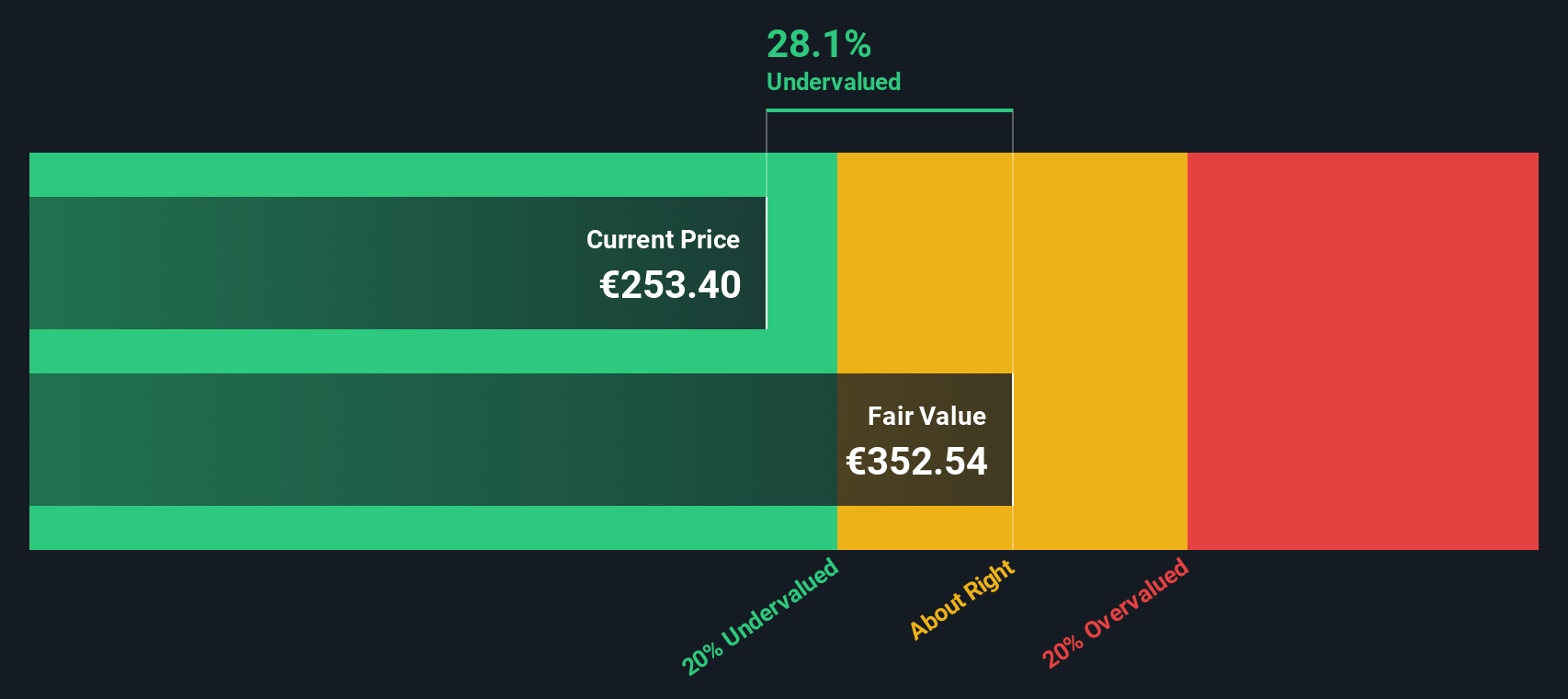

After discounting these future cash flows to present value, the model arrives at an intrinsic value per share of €380.28. Compared to the current share price, this implies the stock is trading at a 36.9% discount to its estimated fair value. This suggests it appears significantly undervalued by this measure.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Thales is undervalued by 36.9%. Track this in your watchlist or portfolio, or discover 839 more undervalued stocks based on cash flows.

Approach 2: Thales Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like Thales. It tells investors how much they are paying for each euro of earnings, making it especially useful for businesses with consistent profits.

A company’s “normal” or “fair” PE ratio is influenced by its expected earnings growth, the stability and predictability of those earnings, and the perceived risk of the business. Higher growth and lower risk can justify a higher PE, while slower growth or greater risk typically warrant a lower ratio.

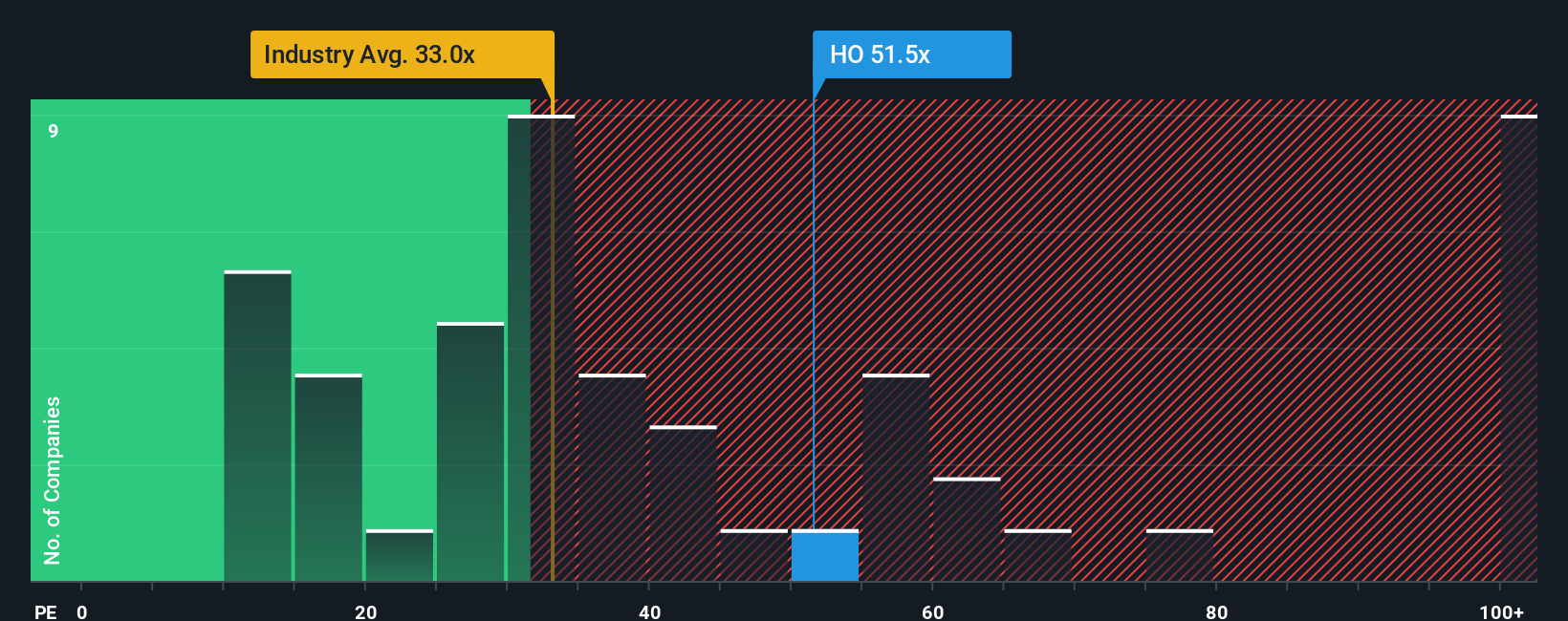

Currently, Thales trades at a PE ratio of 47.1x. For context, the average among Thales’ peers is 30.8x, and the broader Aerospace & Defense industry typically sits at 48.2x. On the surface, Thales is priced close to the industry average but noticeably above its peers.

Rather than comparing solely with industry or peer averages, Simply Wall St’s proprietary “Fair Ratio” goes a step further. This metric blends company-specific factors like projected earnings growth, profit margins, risk profile, and market capitalization alongside industry context. That tailored approach means investors get a clearer picture of what a reasonable PE ratio should be for Thales in particular, not just the sector in general.

For Thales, the Fair Ratio is 32.5x. Since the company’s actual PE of 47.1x is meaningfully higher, this suggests the stock could be overvalued based on its core fundamentals and outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1412 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Thales Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives.

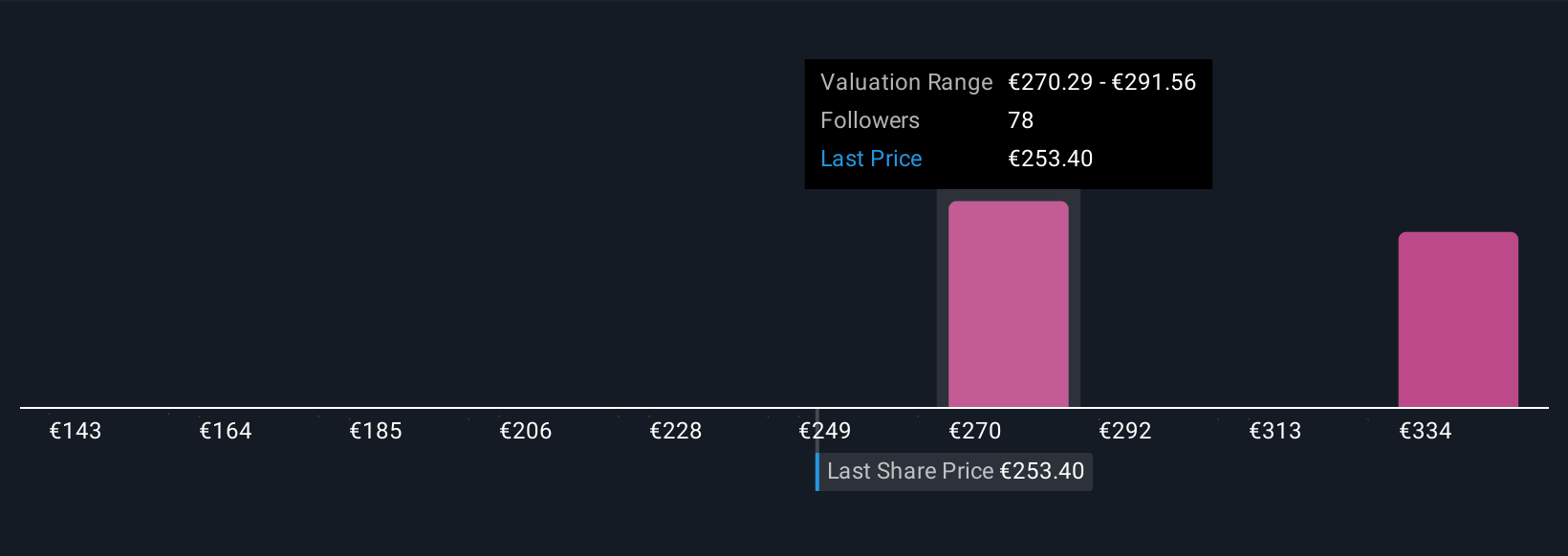

Narratives are a simple yet powerful tool that lets you define your own story for a company by connecting your view about Thales’ future growth, risks, and opportunities to actual financial estimates and a custom fair value calculation.

Instead of only relying on set formulas or expert consensus, Narratives give context to the numbers by allowing you to adjust assumptions like future revenue, earnings, and margins according to the story you believe makes sense for Thales.

Every Narrative directly links the company’s outlook (the “why”) with data-driven forecasts (the “how”) to deliver a fair value (the “what now”), helping you decide if Thales is a buy, hold, or sell by comparing this fair value to today’s share price.

Narratives are easy to use and available to all investors within the Simply Wall St Community page. They update automatically when news breaks or earnings are released, so your view is always current and relevant.

For example, some Thales investors see surging defense budgets and cybersecurity demand pushing fair value as high as €350.0, while more cautious users flag digital risks and heavy reliance on government contracts, estimating fair value closer to €240.0.

Do you think there's more to the story for Thales? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thales might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:HO

Thales

Provides various solutions in the defence and security, aerospace and space, and digital identity and security markets worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives