- France

- /

- Aerospace & Defense

- /

- ENXTPA:HO

A Deep Dive Into Thales (ENXTPA:HO) Valuation Following Its Strong Share Price Surge

Reviewed by Simply Wall St

Thales (ENXTPA:HO) has moved steadily in recent weeks, with investors keeping an eye on its broader performance metrics. Despite some ups and downs in the past month, the company’s longer-term returns have remained appealing for many market watchers.

See our latest analysis for Thales.

After a notable year-to-date share price surge of 79.43%, Thales has caught the attention of growth-focused investors, especially as momentum remains strong despite some short-term pullbacks. The company’s one-year total shareholder return of 68.09% reflects substantial value creation, reinforcing the sense that optimism about Thales' long-term prospects is building. This confidence appears to extend not just among traders but also among those with a longer investment horizon.

If Thales’ performance has you watching for the next big breakout, this could be the ideal moment to discover See the full list for free.

With shares already posting impressive gains, the key question for investors is whether Thales remains undervalued, or if the market has already priced in its next phase of growth, leaving little room for upside.

Most Popular Narrative: 11% Undervalued

Thales is trading below what the most-followed narrative considers fair value, relative to its last close of €246.90. The narrative frames current market optimism as rooted in strong future earnings potential and ambitious growth expectations.

“Acceleration of defense spending in France and across Europe (for example, France raising its defense budget from €50 billion in 2025 to €64 billion by 2027, earlier than previously planned) is set to significantly boost order intake and revenue for Thales' defense segment, supporting multi-year revenue growth visibility. Sustained global demand for cybersecurity and secure communications, combined with the successful integration of Imperva and Thales' premiumization strategy in Cyber Services, is expected to drive a rebound to organic growth and margin expansion in the Cyber & Digital segment, bolstering future recurring high-margin earnings.”

How are analysts justifying their optimistic price target? Hint: their calculations rest on projections for double-digit earnings growth and a future profit margin leap, paired with a multiple more often used for sector leaders. Craving the specifics? Discover what’s fueling this bullish valuation.

Result: Fair Value of €279.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent challenges in Thales' Cyber division and heavy reliance on government defense budgets could quickly shift sentiment if execution falters or if public spending slows.

Find out about the key risks to this Thales narrative.

Another View: What Do Multiples Say?

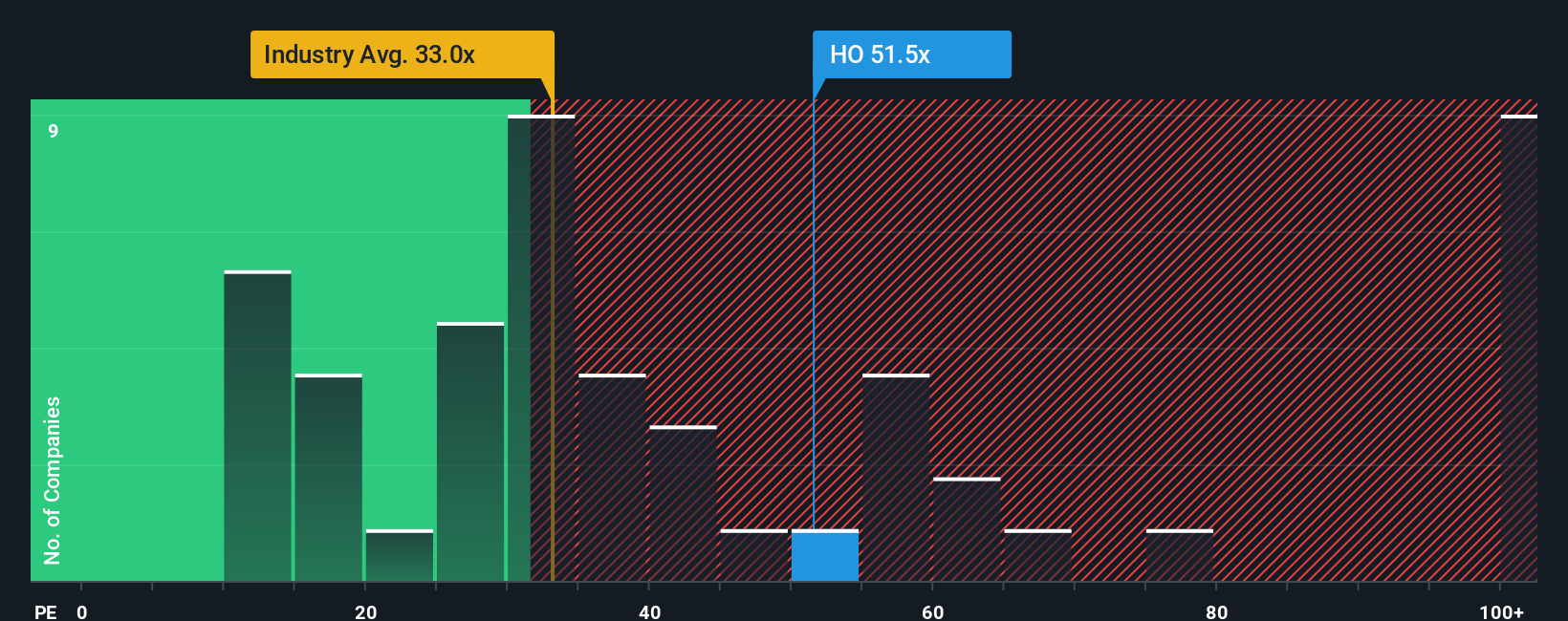

While our main fair value estimate suggests Thales is undervalued, another method that compares its price-to-earnings ratio with industry and peer averages presents a riskier picture. Thales trades at 48.5x, which is much higher than both the European industry average of 34.5x and the peer average of 31.9x. This is also above its fair ratio of 33.7x. This means that unless the company grows into its valuation, there may be less margin for error than the initial optimism suggests. Which outlook will the market ultimately reward?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Thales Narrative

If the current story does not match your view or you prefer a hands-on approach, you can shape your own insights in just a few minutes, and Do it your way.

A great starting point for your Thales research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Turn your curiosity into action and get ahead of market moves by checking out top-rated investment themes selected by Simply Wall Street’s powerful screeners. Don’t let another opportunity slip by. See what’s trending now:

- Capture high-yield potential by tapping into these 22 dividend stocks with yields > 3% delivering payouts above 3% for income-focused investors.

- Uncover next-generation breakthroughs by jumping into these 26 AI penny stocks transforming industries with real-world artificial intelligence advancements.

- Position yourself for growth with these 832 undervalued stocks based on cash flows that analysts believe are trading below their true worth and primed for upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thales might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:HO

Thales

Provides various solutions in the defence and security, aerospace and space, and digital identity and security markets worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives