- France

- /

- Gas Utilities

- /

- ENXTPA:RUI

Top 3 Euronext Paris Dividend Stocks For October 2024

Reviewed by Simply Wall St

As global markets respond to China's stimulus measures and European indices like the CAC 40 experience notable gains, investors are increasingly looking towards dividend stocks as a stable source of income amid fluctuating economic conditions. In this context, identifying strong dividend stocks on the Euronext Paris can provide both growth potential and reliable returns, making them an attractive option for those seeking to navigate the current market landscape.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Vicat (ENXTPA:VCT) | 5.71% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 8.25% | ★★★★★★ |

| Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC) | 8.00% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA) | 5.83% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.06% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 3.69% | ★★★★★☆ |

| Samse (ENXTPA:SAMS) | 6.73% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.69% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 7.94% | ★★★★★☆ |

| Eiffage (ENXTPA:FGR) | 4.88% | ★★★★☆☆ |

Click here to see the full list of 32 stocks from our Top Euronext Paris Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Bénéteau (ENXTPA:BEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bénéteau S.A. designs, manufactures, and sells boats and leisure homes both in France and internationally, with a market cap of €733.81 million.

Operations: Bénéteau S.A. generates revenue primarily from its Boat segment, which accounts for €1.21 billion.

Dividend Yield: 8%

Bénéteau's dividend yield of 8.02% ranks in the top 25% of French dividend payers, yet sustainability is a concern as dividends are not covered by free cash flows and have been volatile over the past decade. Despite a reasonable payout ratio of 65.8%, earnings alone cover dividends, raising questions about long-term reliability. Recent earnings show a decline with sales at €556.64 million and net income at €49.45 million for H1 2024, indicating potential challenges ahead for maintaining current dividend levels.

- Click here to discover the nuances of Bénéteau with our detailed analytical dividend report.

- The analysis detailed in our Bénéteau valuation report hints at an deflated share price compared to its estimated value.

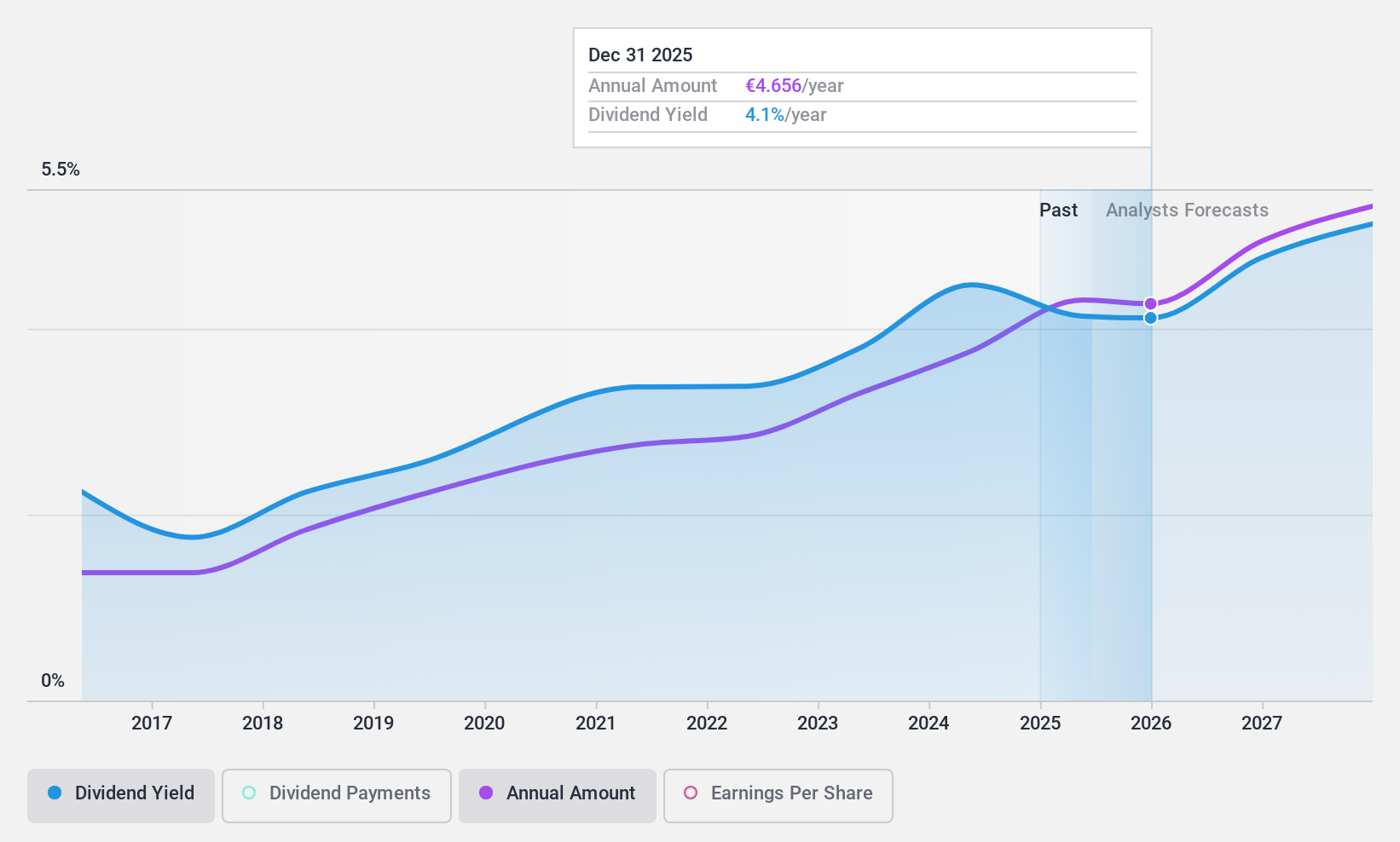

Eiffage (ENXTPA:FGR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Eiffage SA operates in construction, property and urban development, civil engineering, metallic construction, roads, energy systems, and concessions both in France and internationally with a market cap of €8.02 billion.

Operations: Eiffage SA generates its revenue from several segments, including Concessions (€4.04 billion), Construction (€4.01 billion), Energy Systems (€6.49 billion), and Infrastructures (€8.78 billion).

Dividend Yield: 4.9%

Eiffage's dividend yield of 4.88% is below the top 25% of French dividend payers, yet its dividends are well-covered by earnings and cash flows with payout ratios of 38.6% and 16.4%, respectively. Despite a volatile dividend history, Eiffage trades at good value compared to peers, significantly below fair value estimates. Recent earnings for H1 2024 showed sales growth to €11.41 billion; however, net income slightly declined to €382 million from the previous year.

- Delve into the full analysis dividend report here for a deeper understanding of Eiffage.

- Our valuation report here indicates Eiffage may be undervalued.

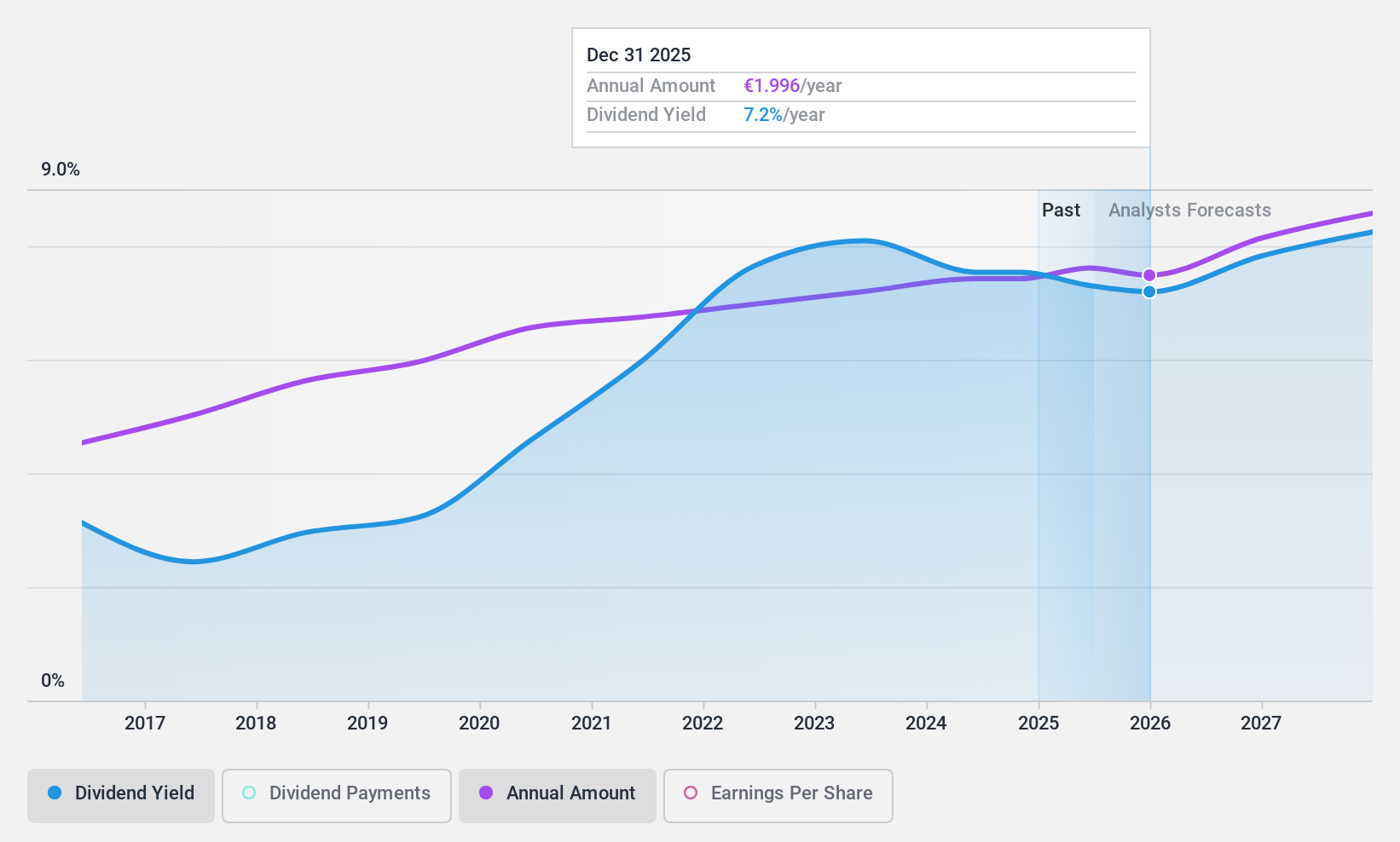

Rubis (ENXTPA:RUI)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Rubis operates bulk liquid storage facilities for commercial and industrial customers across Europe, Africa, and the Caribbean, with a market cap of €2.50 billion.

Operations: Rubis generates revenue primarily from its Energy Distribution segment, which accounts for €6.60 billion, and also from Renewable Electricity Production, contributing €48.02 million.

Dividend Yield: 8.2%

Rubis offers a compelling dividend profile with a yield of 8.25%, placing it in the top quartile of French dividend payers. Its dividends are well-covered by both earnings and cash flows, with payout ratios of 65.4% and 58.5%, respectively, ensuring sustainability. Over the past decade, Rubis has consistently increased its dividends without volatility. Despite recent earnings showing a decline in net income to €129.5 million for H1 2024, its price-to-earnings ratio remains attractive at 8x compared to the market average.

- Unlock comprehensive insights into our analysis of Rubis stock in this dividend report.

- The valuation report we've compiled suggests that Rubis' current price could be quite moderate.

Taking Advantage

- Unlock our comprehensive list of 32 Top Euronext Paris Dividend Stocks by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:RUI

Rubis

Engages in the operation of bulk liquid storage facilities for commercial and industrial customers in Europe, Africa, and the Caribbean.

6 star dividend payer with solid track record.