- France

- /

- Construction

- /

- ENXTPA:FGR

Here's Why We Think Eiffage (EPA:FGR) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Eiffage (EPA:FGR), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Eiffage

How Fast Is Eiffage Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. Eiffage managed to grow EPS by 8.1% per year, over three years. That growth rate is fairly good, assuming the company can keep it up.

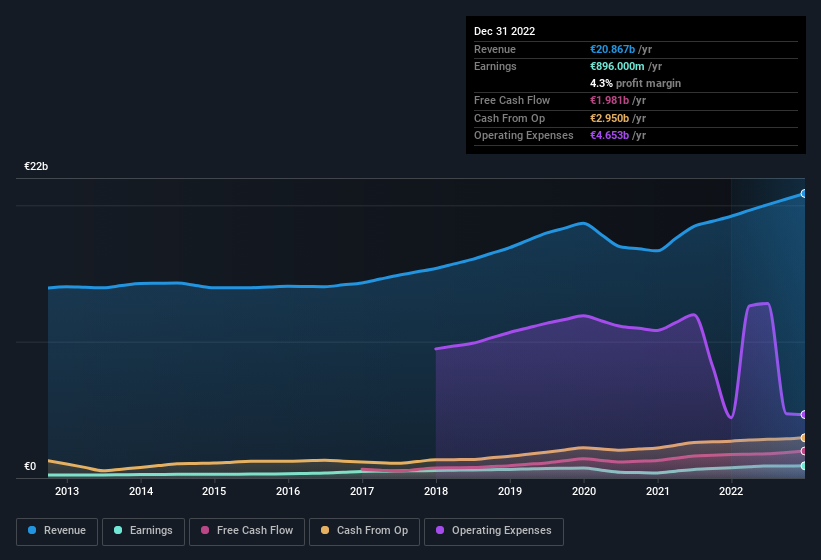

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for Eiffage remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 8.7% to €21b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Eiffage's forecast profits?

Are Eiffage Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a €9.0b company like Eiffage. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. Indeed, they hold €16m worth of its stock. This considerable investment should help drive long-term value in the business. Despite being just 0.2% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Does Eiffage Deserve A Spot On Your Watchlist?

As previously touched on, Eiffage is a growing business, which is encouraging. If that's not enough on its own, there is also the rather notable levels of insider ownership. That combination is very appealing. So yes, we do think the stock is worth keeping an eye on. Still, you should learn about the 2 warning signs we've spotted with Eiffage (including 1 which is a bit unpleasant).

Although Eiffage certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Eiffage might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:FGR

Eiffage

Engages in the construction, property development, urban development, civil engineering, metallic construction, roads, energy systems, and concessions businesses in France and internationally.

Very undervalued with adequate balance sheet and pays a dividend.