Stock Analysis

- France

- /

- Aerospace & Defense

- /

- ENXTPA:FGA

Further weakness as Figeac Aero Société Anonyme (EPA:FGA) drops 15% this week, taking five-year losses to 53%

Generally speaking long term investing is the way to go. But that doesn't mean long term investors can avoid big losses. Zooming in on an example, the Figeac Aero Société Anonyme (EPA:FGA) share price dropped 53% in the last half decade. We certainly feel for shareholders who bought near the top. And the share price decline continued over the last week, dropping some 15%. However, this move may have been influenced by the broader market, which fell 6.3% in that time.

With the stock having lost 15% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for Figeac Aero Société Anonyme

Figeac Aero Société Anonyme isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last five years Figeac Aero Société Anonyme saw its revenue shrink by 7.8% per year. While far from catastrophic that is not good. With neither profit nor revenue growth, the loss of 9% per year doesn't really surprise us. We don't think anyone is rushing to buy this stock. Not that many investors like to invest in companies that are losing money and not growing revenue.

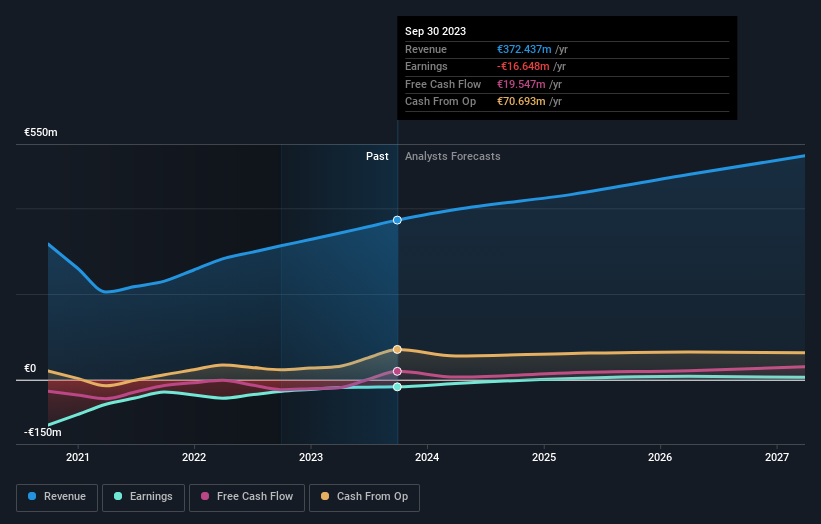

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free report showing analyst forecasts should help you form a view on Figeac Aero Société Anonyme

A Different Perspective

It's good to see that Figeac Aero Société Anonyme has rewarded shareholders with a total shareholder return of 10% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 9% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. You could get a better understanding of Figeac Aero Société Anonyme's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Figeac Aero Société Anonyme is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Figeac Aero Société Anonyme is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:FGA

Figeac Aero Société Anonyme

Manufactures, supplies, and sells equipment and sub-assemblers for aeronautics sector in France.

Good value with reasonable growth potential.