Uncovering 3 Euronext Paris Stocks That May Be Priced Below Fair Value Estimates

Reviewed by Simply Wall St

As the French CAC 40 Index recently climbed by 3.89%, buoyed by hopes of interest rate cuts and China's economic stimulus measures, investors are increasingly optimistic about potential opportunities in the Euronext Paris market. In this environment, identifying stocks that may be priced below their fair value estimates can be a strategic move, as these equities might offer attractive entry points for those looking to capitalize on broader market optimism and potential future growth.

Top 10 Undervalued Stocks Based On Cash Flows In France

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SPIE (ENXTPA:SPIE) | €34.24 | €53.56 | 36.1% |

| NSE (ENXTPA:ALNSE) | €29.60 | €57.57 | 48.6% |

| Vivendi (ENXTPA:VIV) | €10.26 | €18.08 | 43.3% |

| Lectra (ENXTPA:LSS) | €28.60 | €53.45 | 46.5% |

| Groupe Berkem Société anonyme (ENXTPA:ALKEM) | €3.07 | €5.10 | 39.8% |

| Vogo (ENXTPA:ALVGO) | €3.25 | €6.37 | 49% |

| Exail Technologies (ENXTPA:EXA) | €17.60 | €34.35 | 48.8% |

| Pullup Entertainment Société anonyme (ENXTPA:ALPUL) | €20.40 | €38.30 | 46.7% |

| Solutions 30 (ENXTPA:S30) | €1.348 | €2.46 | 45.3% |

| Aurea (ENXTPA:AURE) | €5.74 | €8.81 | 34.8% |

Here we highlight a subset of our preferred stocks from the screener.

Antin Infrastructure Partners SAS (ENXTPA:ANTIN)

Overview: Antin Infrastructure Partners SAS is a private equity firm that focuses on infrastructure investments and has a market cap of €2.21 billion.

Operations: The company generates revenue from its asset management segment, amounting to €291.66 million.

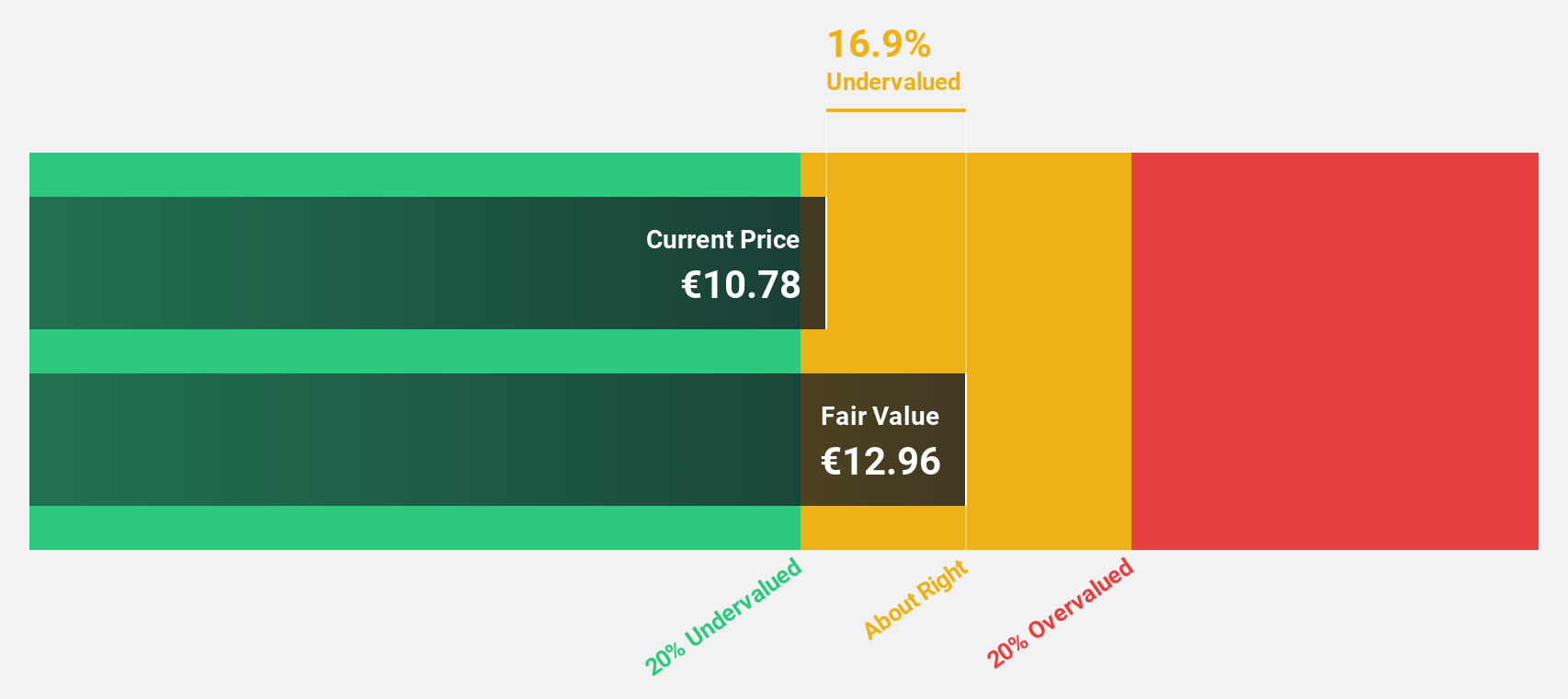

Estimated Discount To Fair Value: 27%

Antin Infrastructure Partners SAS is trading at €12.34, below its estimated fair value of €16.89, suggesting it may be undervalued based on cash flows. Despite being dropped from the S&P Global BMI Index, Antin reported a significant net income increase to €60.25 million for the first half of 2024 and forecasts earnings growth of 21.5% annually—outpacing the French market's 12.3%. However, its dividend yield isn't well covered by earnings or free cash flows.

- Our comprehensive growth report raises the possibility that Antin Infrastructure Partners SAS is poised for substantial financial growth.

- Dive into the specifics of Antin Infrastructure Partners SAS here with our thorough financial health report.

Exail Technologies (ENXTPA:EXA)

Overview: Exail Technologies offers robotics, maritime, navigation, aerospace, and photonics technology solutions both in France and internationally, with a market cap of €299.32 million.

Operations: The company's revenue is primarily derived from Navigation & Maritime Robotics, contributing €252.39 million, and Advanced Technologies, accounting for €87.50 million.

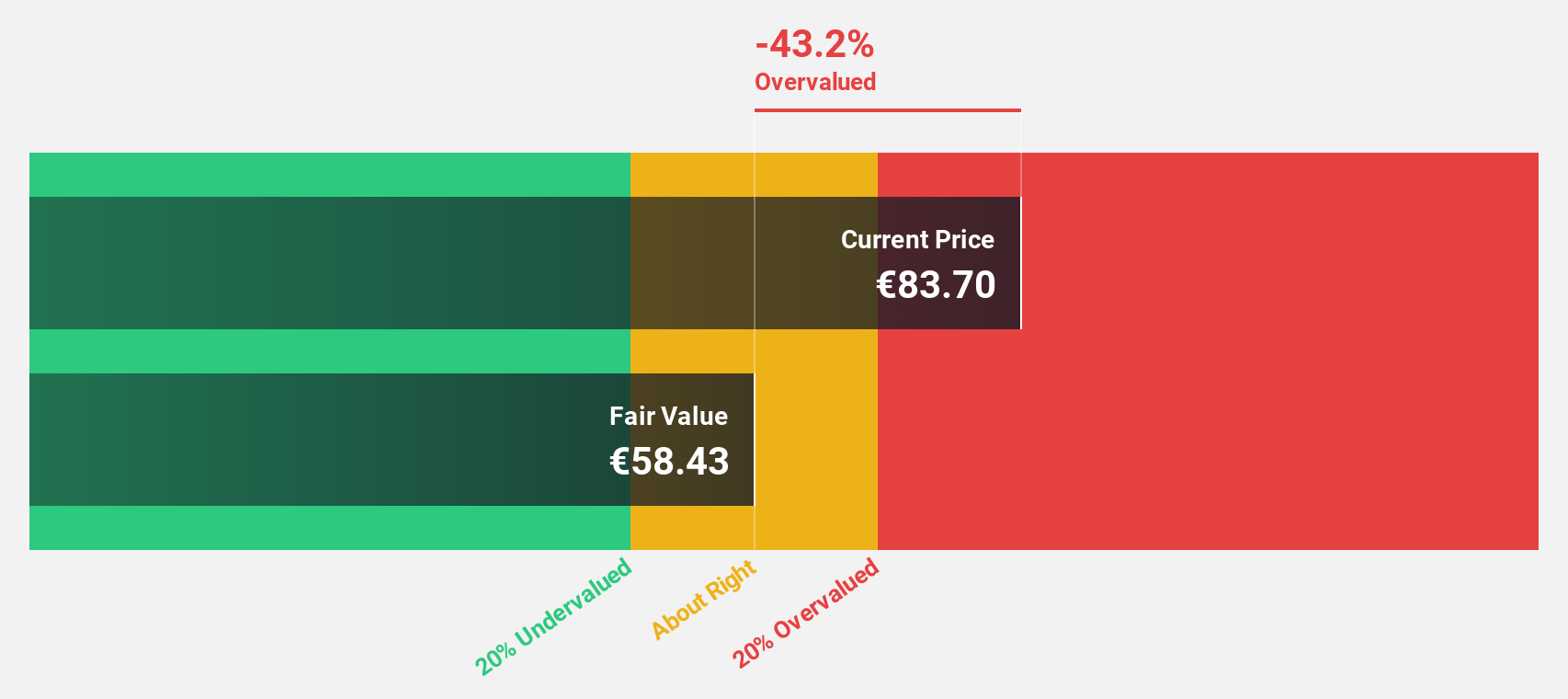

Estimated Discount To Fair Value: 48.8%

Exail Technologies is trading at €17.6, significantly below its estimated fair value of €34.35, highlighting its potential undervaluation based on cash flows. Despite reporting a net loss of €3.71 million for the first half of 2024, the company's revenue grew to €175.08 million from €164.93 million a year earlier and is forecast to grow faster than the French market average. Analysts expect profitability within three years, with earnings projected to rise substantially annually.

- Insights from our recent growth report point to a promising forecast for Exail Technologies' business outlook.

- Click to explore a detailed breakdown of our findings in Exail Technologies' balance sheet health report.

Exclusive Networks (ENXTPA:EXN)

Overview: Exclusive Networks SA is a global cybersecurity specialist focused on digital infrastructure, with a market capitalization of €2.14 billion.

Operations: The company's revenue is segmented into €480 million from APAC, €4.19 billion from EMEA, and €705 million from the Americas.

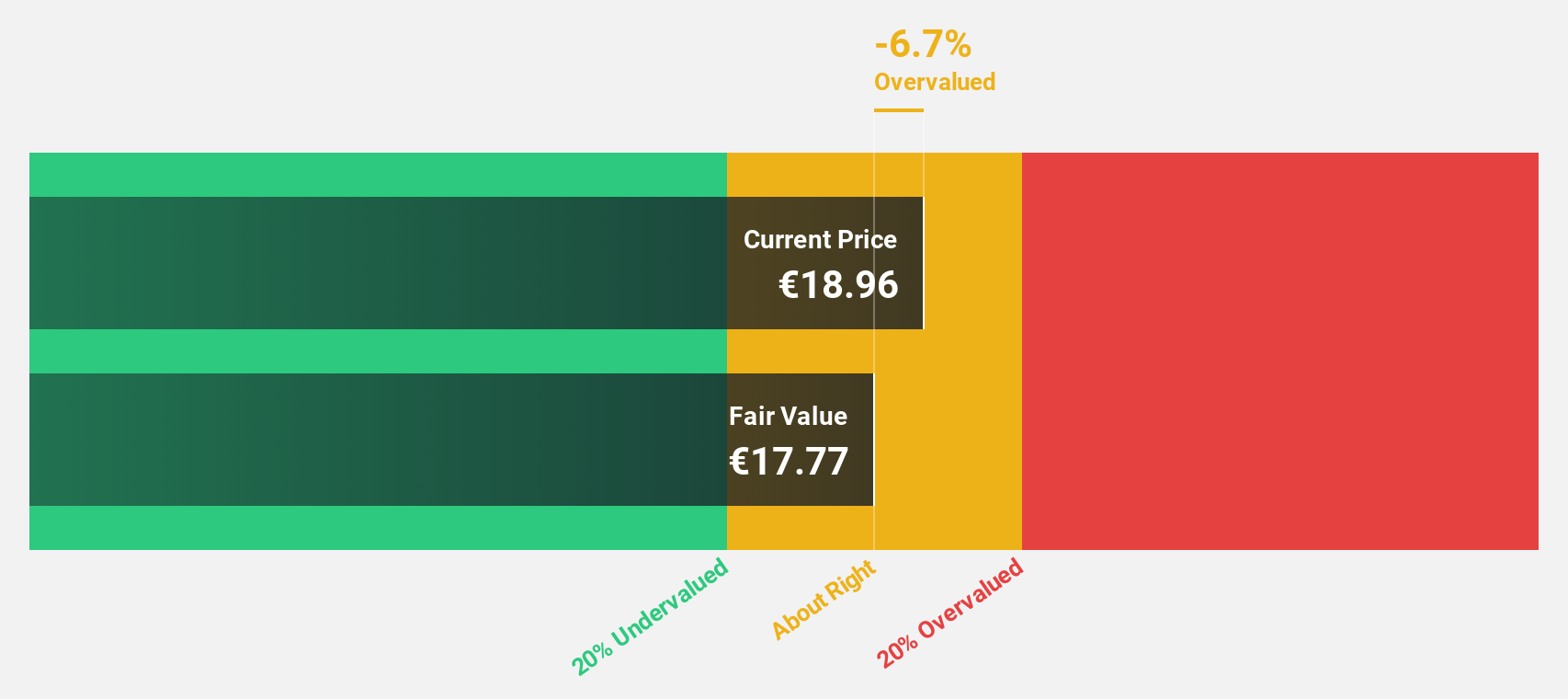

Estimated Discount To Fair Value: 14.7%

Exclusive Networks is trading at €23.6, below its estimated fair value of €27.67, which may suggest undervaluation based on cash flows. Despite a decline in net profit margin from 5.5% to 2.7%, earnings are forecast to grow significantly at 33.53% annually, outpacing the French market's growth rate of 12.3%. Recent developments include a proposed acquisition by CD&R and Permira valuing the company at €2.2 billion with a premium offer per share price of €24.25.

- The analysis detailed in our Exclusive Networks growth report hints at robust future financial performance.

- Click here to discover the nuances of Exclusive Networks with our detailed financial health report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 23 Undervalued Euronext Paris Stocks Based On Cash Flows by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exclusive Networks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EXN

Exclusive Networks

Operates as a global cybersecurity specialist for digital infrastructure.

Flawless balance sheet with reasonable growth potential.