- France

- /

- Aerospace & Defense

- /

- ENXTPA:EXA

It's Down 26% But Exail Technologies (EPA:EXA) Could Be Riskier Than It Looks

The Exail Technologies (EPA:EXA) share price has fared very poorly over the last month, falling by a substantial 26%. The recent drop has obliterated the annual return, with the share price now down 7.9% over that longer period.

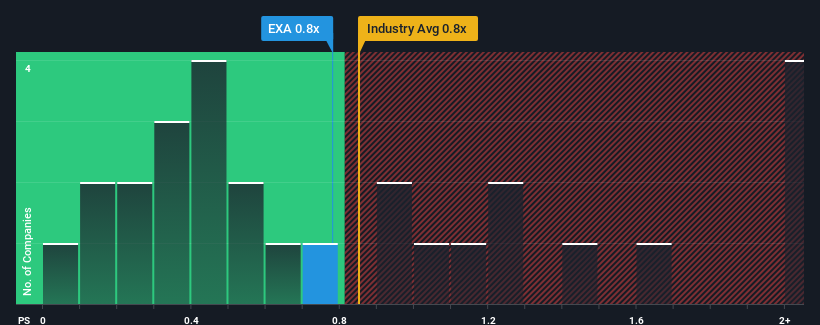

Although its price has dipped substantially, there still wouldn't be many who think Exail Technologies' price-to-sales (or "P/S") ratio of 0.8x is worth a mention when it essentially matches the median P/S in France's Machinery industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Exail Technologies

What Does Exail Technologies' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Exail Technologies has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Exail Technologies.Do Revenue Forecasts Match The P/S Ratio?

Exail Technologies' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered an exceptional 82% gain to the company's top line. The latest three year period has also seen an excellent 118% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 12% each year as estimated by the five analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 6.3% per annum, which is noticeably less attractive.

In light of this, it's curious that Exail Technologies' P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Bottom Line On Exail Technologies' P/S

Exail Technologies' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Looking at Exail Technologies' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Plus, you should also learn about this 1 warning sign we've spotted with Exail Technologies.

If these risks are making you reconsider your opinion on Exail Technologies, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Exail Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EXA

Exail Technologies

Provides robotics, maritime, navigation, aerospace, and photonics technologies solutions in France and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives