- France

- /

- Aerospace & Defense

- /

- ENXTPA:EXA

Is Exail Technologies' (ENXTPA:EXA) Path to Higher Margins Hinged on Resolving Short-Term Cost Pressures?

Reviewed by Simply Wall St

- Exail Technologies recently reported earnings for the half year ended June 30, 2025, with sales reaching €230.79 million and net income turning positive at €1.31 million, compared to a net loss a year earlier.

- While year-over-year performance improved, the company's results missed analyst expectations due to temporary product mix and capacity costs.

- We will explore how management’s expectation of resolving these cost issues in the coming months could shape Exail Technologies’ investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Exail Technologies' Investment Narrative?

For anyone looking at Exail Technologies as a long-term opportunity, the core belief hinges on the company's ability to expand its footprint in defense and civil robotics as investment cycles accelerate around autonomous systems. The latest earnings miss and subsequent 13% share price drop have sharpened the focus on near-term profitability, but the drop appears to be driven by temporary product mix and capacity costs. Management has been clear they expect these costs to resolve in the coming months, reinforced by a robust stream of new contracts and product launches. This positions the company favorably for upcoming catalysts, like further defense orders and innovative product rollouts. On the risk side, increased short-term volatility and uncertainty around cost control now rank higher than before, given the recent news. While the underlying story of sales growth and expanding demand remains intact, investors should weigh the company’s ability to quickly bring profitability and margin recovery back on track against its ambitious market opportunities. In contrast, persistent cost issues may be more impactful than previously assumed and worth monitoring closely.

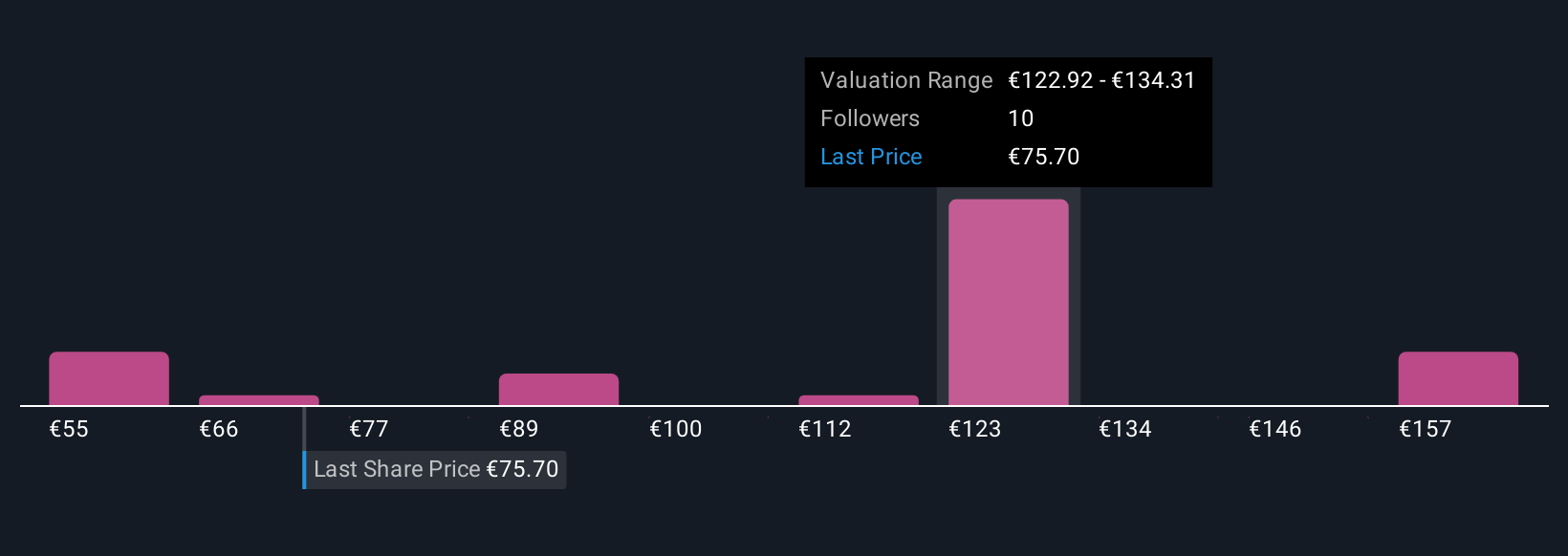

Exail Technologies' share price has been on the slide but might be up to 29% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore 9 other fair value estimates on Exail Technologies - why the stock might be worth as much as 28% more than the current price!

Build Your Own Exail Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Exail Technologies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Exail Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Exail Technologies' overall financial health at a glance.

No Opportunity In Exail Technologies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Exail Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EXA

Exail Technologies

Provides robotics, maritime, navigation, aerospace, and photonics technologies solutions in France and internationally.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives