- Netherlands

- /

- Food

- /

- ENXTAM:FFARM

ForFarmers And 2 Other European Penny Stocks To Watch

Reviewed by Simply Wall St

European markets have recently experienced a pullback, with the pan-European STOXX Europe 600 Index ending lower amid concerns about overvaluation in artificial intelligence-related stocks. In this context, investors often seek out opportunities that offer potential growth without excessive risk. Penny stocks, though an older term, remain relevant as they represent smaller or newer companies that can provide value and growth potential. By focusing on those with strong financials and solid fundamentals, investors may uncover promising opportunities within this segment of the market.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €3.712 | €1.28B | ✅ 5 ⚠️ 2 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.06 | €15.75M | ✅ 4 ⚠️ 5 View Analysis > |

| DigiTouch (BIT:DGT) | €2.02 | €27.91M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €222.71M | ✅ 2 ⚠️ 2 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.58 | €404.8M | ✅ 4 ⚠️ 1 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.959 | €77.39M | ✅ 2 ⚠️ 4 View Analysis > |

| High (ENXTPA:HCO) | €4.04 | €79.03M | ✅ 1 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.01 | €277.82M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.876 | €29.34M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 282 stocks from our European Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

ForFarmers (ENXTAM:FFARM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ForFarmers N.V. operates as a provider of feed solutions for both conventional and organic livestock farming across several countries including the Netherlands, the UK, Germany, Poland, Belgium, and internationally with a market cap of €404.80 million.

Operations: ForFarmers generates revenue from its Food Processing segment, which amounts to €2.96 billion.

Market Cap: €404.8M

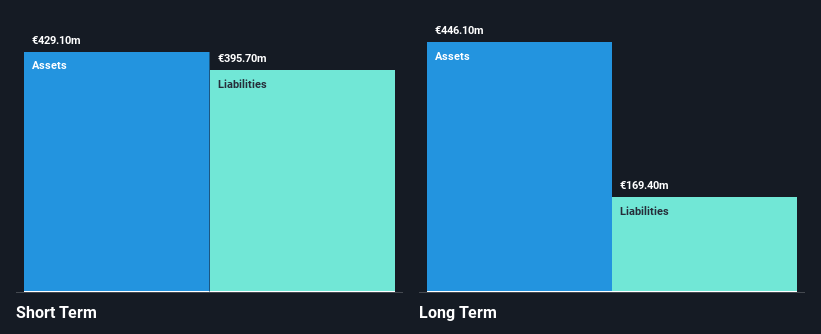

ForFarmers presents a mixed picture for penny stock investors. While the company trades at a significant discount to its estimated fair value, it exhibits low return on equity at 13.2%. Positively, ForFarmers has reduced its debt-to-equity ratio slightly over five years and maintains satisfactory net debt levels. The board and management team are experienced, contributing to stability. Earnings growth is robust, having surged by 193.1% last year, outpacing industry averages significantly. However, the dividend track record remains unstable. Overall financial health appears solid with short-term assets exceeding liabilities and high-quality earnings reported.

- Navigate through the intricacies of ForFarmers with our comprehensive balance sheet health report here.

- Evaluate ForFarmers' prospects by accessing our earnings growth report.

Groupe OKwind Société anonyme (ENXTPA:ALOKW)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Groupe OKwind Société anonyme designs, manufactures, sells, and installs green energy solutions in France with a market cap of €4.77 million.

Operations: The company's revenue is primarily generated from its B to B segment, accounting for €34.11 million, while the B to C segment contributes €5.06 million.

Market Cap: €4.77M

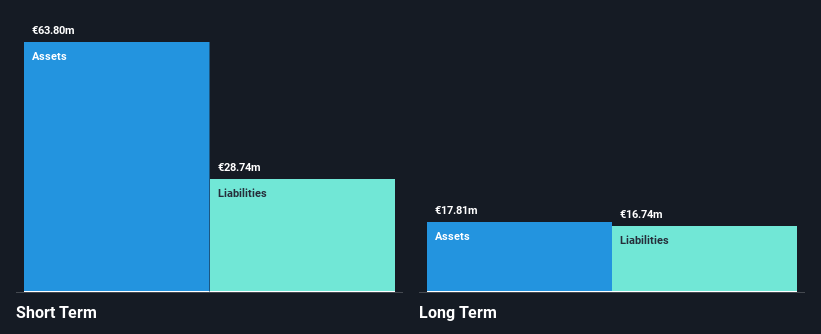

Groupe OKwind Société anonyme offers a complex profile for penny stock investors. Despite trading at a significant discount to its estimated fair value, the company faces challenges with unprofitability and increased losses over the past five years. Its recent earnings report showed a decline in sales to €13.4 million and a net loss of €6.7 million for the half year ended June 2025. Positively, Groupe OKwind's short-term assets comfortably cover both short- and long-term liabilities, while its debt level is satisfactory with operating cash flow covering debt well. The management team is experienced, adding some stability amidst volatility concerns.

- Jump into the full analysis health report here for a deeper understanding of Groupe OKwind Société anonyme.

- Examine Groupe OKwind Société anonyme's earnings growth report to understand how analysts expect it to perform.

CapMan Oyj (HLSE:CAPMAN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: CapMan Oyj is a leading Nordic private assets management and investment firm specializing in growth capital investments, industry consolidation, and various financing solutions for unquoted companies, with a market cap of €329.30 million.

Operations: CapMan Oyj has not reported any specific revenue segments.

Market Cap: €329.3M

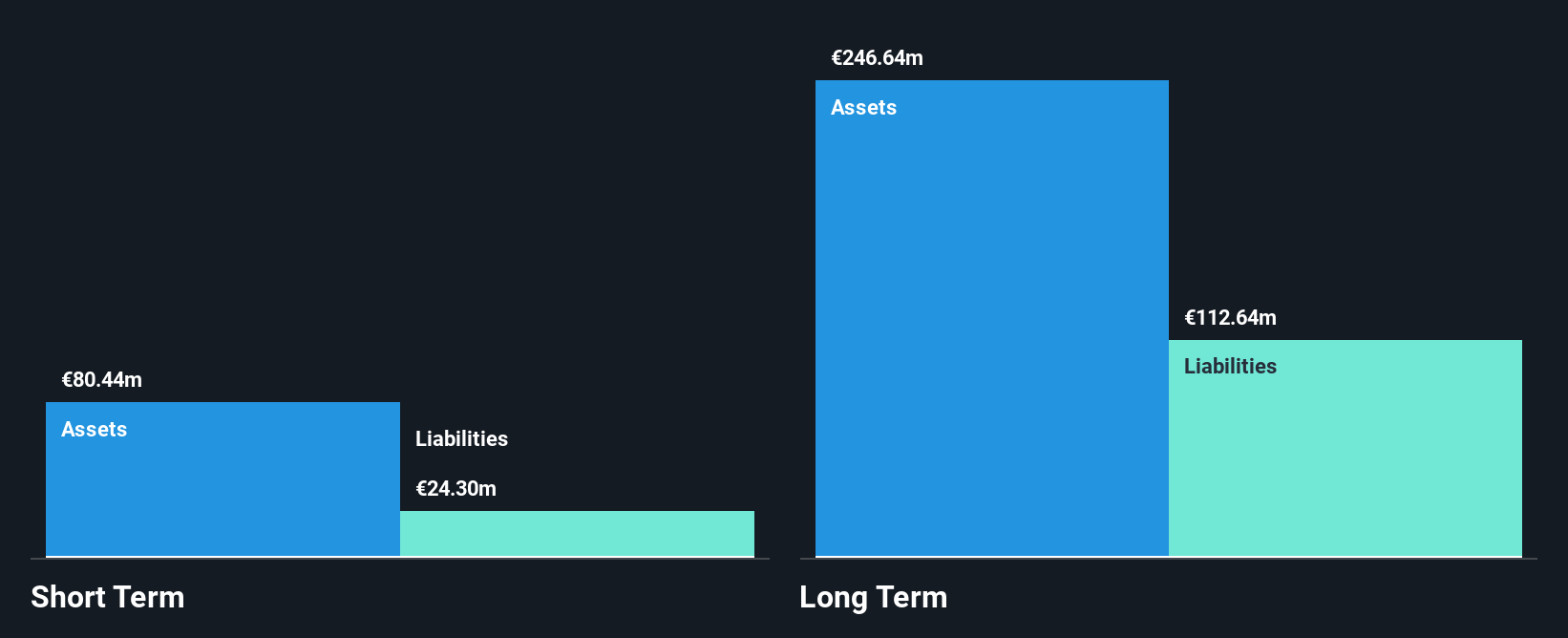

CapMan Oyj presents a mixed opportunity for penny stock investors. Recently achieving profitability, the company's earnings growth is forecasted at 28.29% annually, although past five-year earnings have declined by 27.2% per year. Its short-term assets of €80.4M exceed short-term liabilities but fall short of covering long-term liabilities (€112.6M). Debt management shows improvement with a net debt to equity ratio of 25.3%, though operating cash flow remains negative, impacting debt coverage negatively despite interest payments being well covered by EBIT (4.2x). The dividend yield is high but not well supported by earnings or free cash flows.

- Take a closer look at CapMan Oyj's potential here in our financial health report.

- Review our growth performance report to gain insights into CapMan Oyj's future.

Make It Happen

- Get an in-depth perspective on all 282 European Penny Stocks by using our screener here.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:FFARM

ForFarmers

Provides feed solutions for conventional and organic livestock farming under the ForFarmers brand in the Netherlands, the United Kingdom, Germany, Poland, Belgium, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives