Assessing Alstom (ENXTPA:ALO) Valuation: Is the Market Missing Something?

Reviewed by Simply Wall St

Most Popular Narrative: 11.9% Undervalued

According to the most closely followed narrative, Alstom is seen as undervalued relative to its fair value target, with room for upside based on future earnings projections and improving business fundamentals.

“Alstom's strategy of focusing on high-quality, margin-accretive orders, especially in Services and Signaling, is expected to improve revenue growth and increase future gross margins. The company is conducting industrial restructuring to optimize its manufacturing setup, which aims to enhance operational efficiency and potentially improve net margins and earnings.”

Can Alstom really hit these ambitious milestones? Behind the scenes, there is a playbook packed with key forecasts about profit leaps and next-level margins. Curious to uncover what critical financial assumptions analysts are banking on for that higher target? Unpack the bold figures and the reasoning that could shape the next chapter for Alstom.

Result: Fair Value of €23.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent supply chain delays or renewed weakness in key markets could quickly undermine these positive projections and put future profit growth at risk.

Find out about the key risks to this Alstom narrative.Another View: What About the Market Perspective?

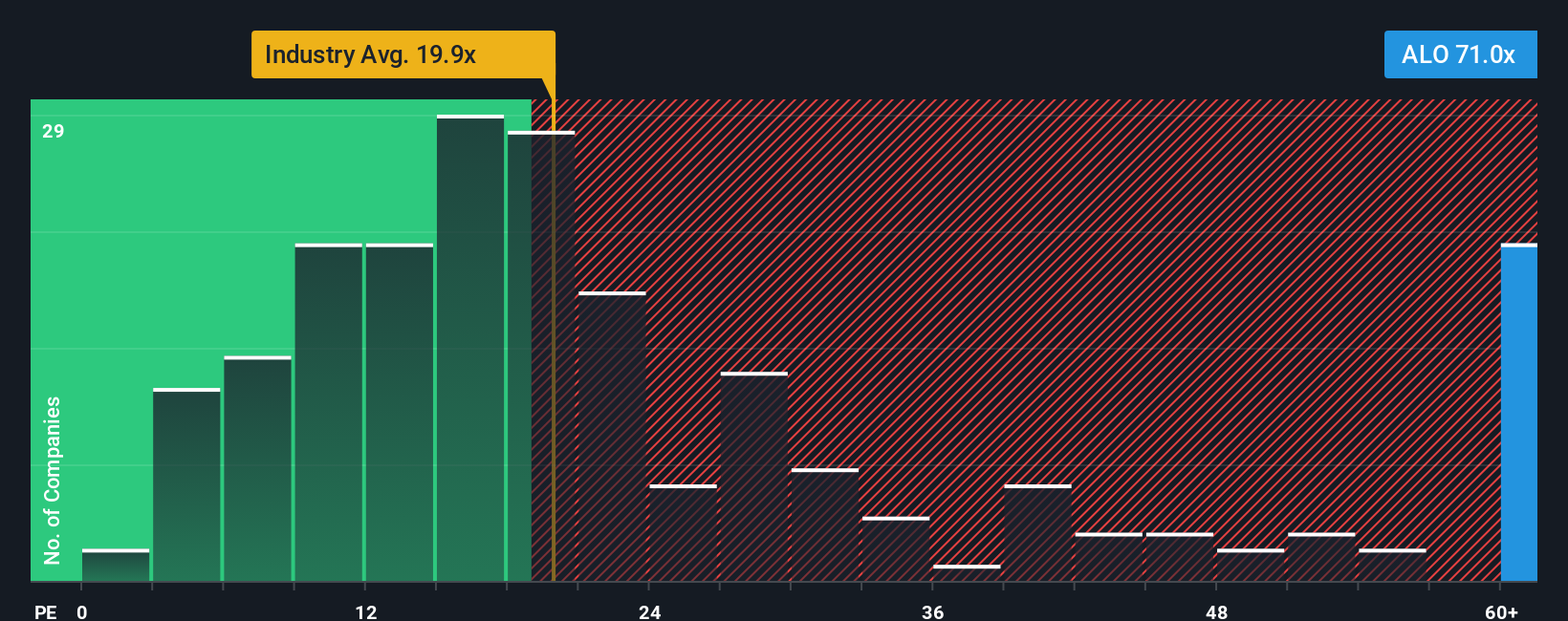

Taking a different lens, market-based valuation methods suggest Alstom may be expensive compared to its industry, painting a less optimistic picture than earnings forecasts. Is the price already factoring in too much hope, or is something being missed?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Alstom to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Alstom Narrative

If the story above doesn’t fit your view, or you want to challenge the consensus, you can build your own narrative in just a few minutes. Do it your way

A great starting point for your Alstom research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t let a single stock limit your potential. Set yourself up for success by uncovering fresh companies with standout financials, industry momentum, or future-ready technology using our powerful tools.

- Amplify your portfolio’s growth by targeting companies excelling in cash flow and value with our collection of undervalued stocks based on cash flows.

- Target financial strength by finding businesses that consistently pay higher-than-average income. Start with our screen for dividend stocks with yields > 3%.

- Get ahead of the curve by tapping into firms leading breakthroughs in healthcare automation and life sciences through our curated list of healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTPA:ALO

Alstom

Provides solutions for rail transport industry in Europe, the Americas, the Asia Pacific, the Middle East, Central Asia, and Africa.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives