- France

- /

- Electrical

- /

- ENXTPA:ALCUR

Arcure S.A.'s (EPA:ALCUR) 33% Jump Shows Its Popularity With Investors

Arcure S.A. (EPA:ALCUR) shareholders would be excited to see that the share price has had a great month, posting a 33% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 18% is also fairly reasonable.

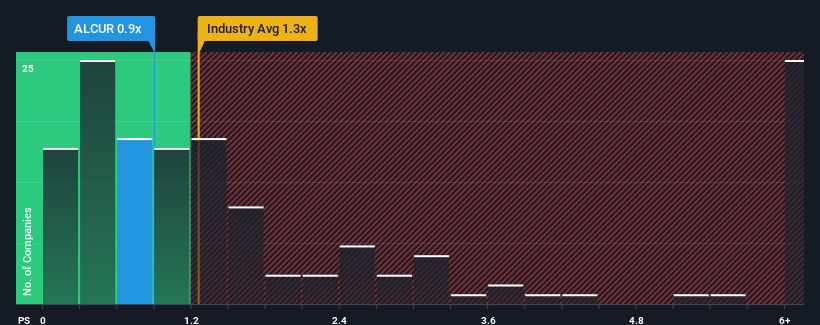

In spite of the firm bounce in price, there still wouldn't be many who think Arcure's price-to-sales (or "P/S") ratio of 0.9x is worth a mention when the median P/S in France's Electrical industry is similar at about 1.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Arcure

What Does Arcure's P/S Mean For Shareholders?

Recent times have been advantageous for Arcure as its revenues have been rising faster than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Arcure will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Arcure?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Arcure's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 39%. The latest three year period has also seen an excellent 59% overall rise in revenue, aided by its short-term performance. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 2.4% as estimated by the dual analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 2.5%, which is not materially different.

With this information, we can see why Arcure is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Its shares have lifted substantially and now Arcure's P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look at Arcure's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

It is also worth noting that we have found 2 warning signs for Arcure that you need to take into consideration.

If these risks are making you reconsider your opinion on Arcure, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALCUR

Arcure

Develops artificial intelligence (AI) solutions for the autonomy of industrial machinery in France.

High growth potential and fair value.

Market Insights

Community Narratives