- France

- /

- Auto Components

- /

- ENXTPA:ML

Revisiting Michelin (ENXTPA:ML) Valuation After Recent Share Price Reversal

Reviewed by Simply Wall St

Should You Take Another Look at Compagnie Générale des Établissements Michelin Société en commandite par actions (ENXTPA:ML)?

Sometimes, a stock creeps onto your radar simply because its recent moves feel out of step with the broader market. That is where Compagnie Générale des Établissements Michelin Société en commandite par actions (ENXTPA:ML) sits today. Nothing has triggered urgent headlines this week, but investors might notice the share price eking out a small gain this month after what has otherwise been a pretty bumpy year. The lack of a major catalyst raises an interesting question: is the current price movement a signal, or just noise?

Stacking up this year’s picture, Michelin’s shares have drifted lower overall, with the past year bringing a 9% decline. Even so, shares squeezed out 2% growth over the last week and reversed trend in the past month. But when you look further into the past, over three and five years, Michelin has actually delivered healthy total returns. This suggests that the long-term trend is still positive, despite periods of fading momentum.

So, with the price sliding on no obvious news, is the market overlooking Michelin’s value, or is there a risk that future growth is fully priced in already?

Most Popular Narrative: 13% Undervalued

According to the most widely followed narrative, Michelin shares are currently trading below what analysts believe is their fair value, with a substantial discount implied by future expectations for earnings growth, margins, and ongoing business shifts.

"Recent restructuring and optimization of Michelin's manufacturing footprint, including plant closures and streamlining, is set to deliver a significant €200 million annual benefit to margin and efficiency. The full impact is expected to materialize in H2 2025 and beyond as volumes recover, supporting margin expansion and free cash flow."

What is fueling this bullish narrative? Dive deeper to see which ambitious growth forecasts and bold efficiency moves might justify a higher target price. Want to uncover the real drivers behind Michelin’s fair value estimate? Do not miss the details investors are buzzing about.

Result: Fair Value of €36.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent headwinds from currency swings and intensifying low-cost competition could quickly challenge bullish expectations if these risks persist or worsen.

Find out about the key risks to this Compagnie Générale des Établissements Michelin Société en commandite par actions narrative.Another View: Market Pricing Paints a Different Picture

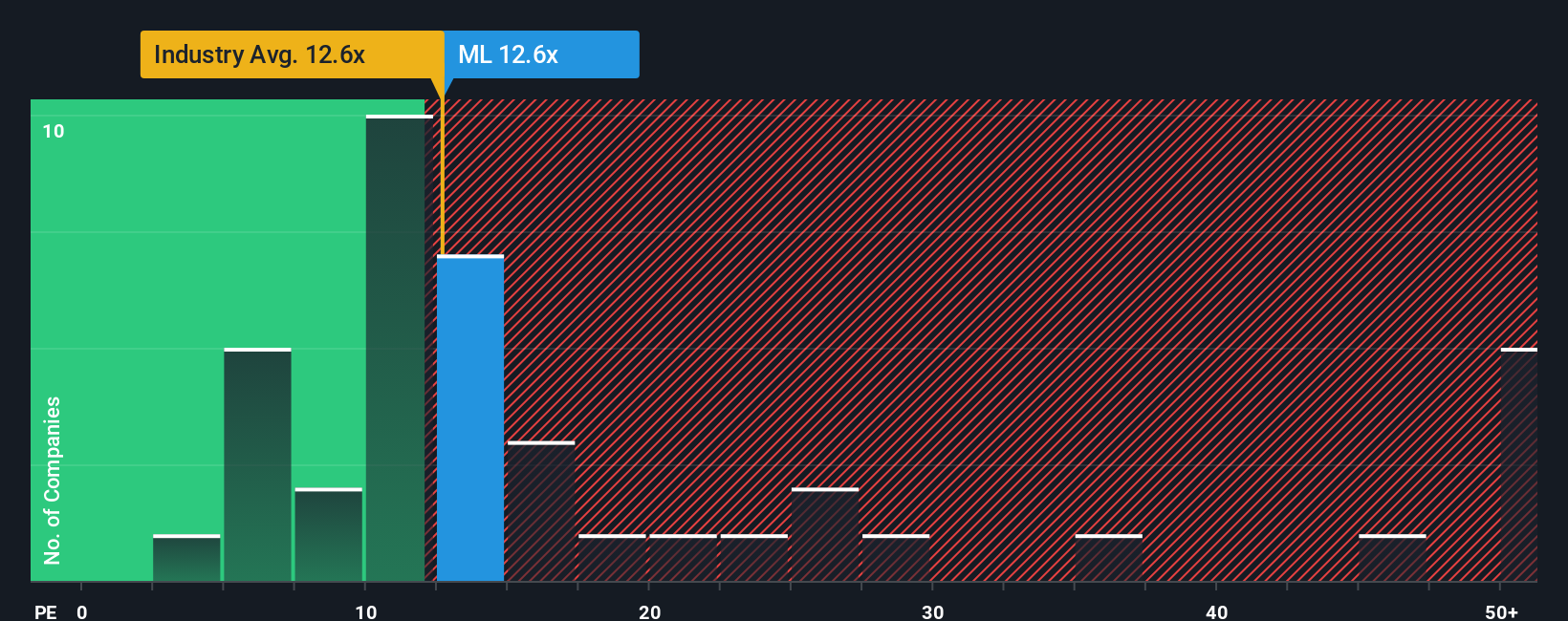

While the analyst forecast suggests undervaluation, looking at the stock’s price in relation to similar European industry names suggests Michelin may actually be trading at a premium. Does this signal the market is less optimistic?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Compagnie Générale des Établissements Michelin Société en commandite par actions Narrative

If these perspectives do not fully convince you, or if you would rather chart your own path, our tools let you assemble your own Michelin narrative in just a few minutes. Do it your way

A great starting point for your Compagnie Générale des Établissements Michelin Société en commandite par actions research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Discover additional ways to strengthen your investment portfolio using our powerful screener tools. Missing out could mean overlooking some of this year’s most exciting trends.

- Spot companies redefining medicine and patient outcomes with emerging technologies through our selection of healthcare AI stocks.

- Find undervalued gems primed for growth and market outperformance by checking out undervalued stocks based on cash flows.

- Tap into the future of computing by exploring businesses pushing the boundaries of quantum breakthroughs via our quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ML

Compagnie Générale des Établissements Michelin Société en commandite par actions

Engages in the manufacture and sale of tires worldwide.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives