- France

- /

- Auto Components

- /

- ENXTPA:ML

Does Compagnie Générale des Établissements Michelin Société en commandite par actions (EPA:ML) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Compagnie Générale des Établissements Michelin Société en commandite par actions (EPA:ML). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

How Fast Is Compagnie Générale des Établissements Michelin Société en commandite par actions Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. We can see that in the last three years Compagnie Générale des Établissements Michelin Société en commandite par actions grew its EPS by 5.0% per year. This may not be setting the world alight, but it does show that EPS is on the upwards trend.

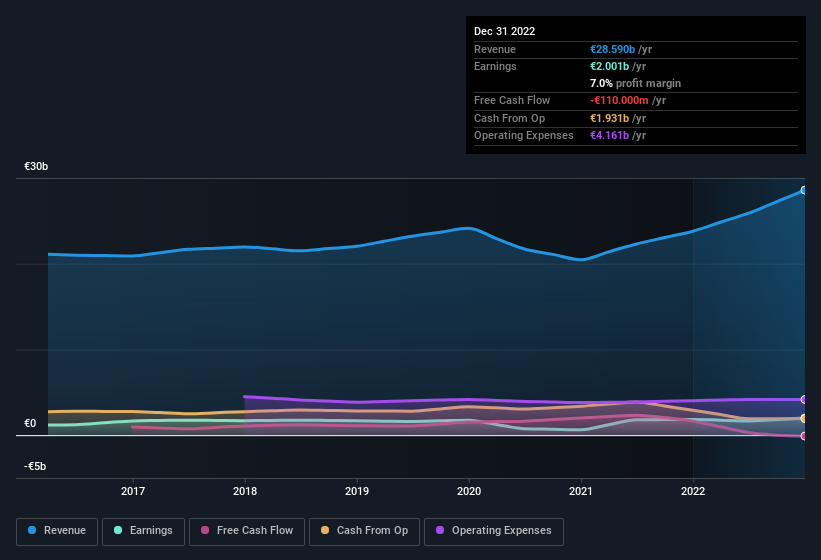

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While we note Compagnie Générale des Établissements Michelin Société en commandite par actions achieved similar EBIT margins to last year, revenue grew by a solid 20% to €29b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

You don't drive with your eyes on the rear-view mirror, so you might be more interested in this free report showing analyst forecasts for Compagnie Générale des Établissements Michelin Société en commandite par actions' future profits.

Are Compagnie Générale des Établissements Michelin Société en commandite par actions Insiders Aligned With All Shareholders?

It's a good habit to check into a company's remuneration policies to ensure that the CEO and management team aren't putting their own interests before that of the shareholder with excessive salary packages. Our analysis has discovered that the median total compensation for the CEOs of companies like Compagnie Générale des Établissements Michelin Société en commandite par actions, with market caps over €7.5b, is about €3.7m.

The Compagnie Générale des Établissements Michelin Société en commandite par actions CEO received €3.0m in compensation for the year ending December 2021. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Compagnie Générale des Établissements Michelin Société en commandite par actions Deserve A Spot On Your Watchlist?

As previously touched on, Compagnie Générale des Établissements Michelin Société en commandite par actions is a growing business, which is encouraging. On top of that, our faith in the board of directors is strengthened by the fact of the reasonable CEO pay. So based on its merits, the stock deserves further research, if not an addition to your watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Compagnie Générale des Établissements Michelin Société en commandite par actions , and understanding this should be part of your investment process.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ML

Compagnie Générale des Établissements Michelin Société en commandite par actions

Manufactures and sells tires worldwide.

Flawless balance sheet average dividend payer.