Take Care Before Diving Into The Deep End On Nurminen Logistics Oyj (HEL:NLG1V)

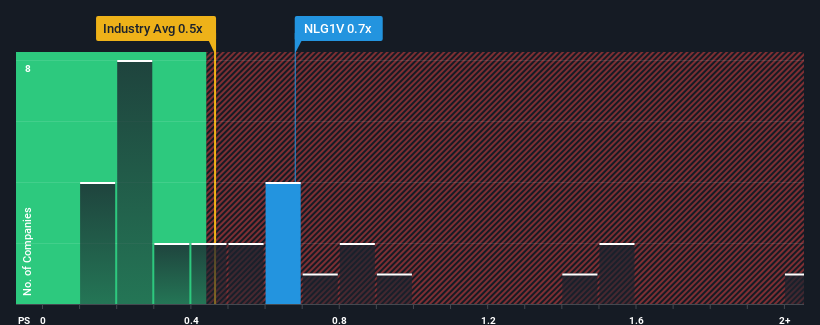

There wouldn't be many who think Nurminen Logistics Oyj's (HEL:NLG1V) price-to-sales (or "P/S") ratio of 0.7x is worth a mention when the median P/S for the Logistics industry in Finland is similar at about 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Nurminen Logistics Oyj

How Nurminen Logistics Oyj Has Been Performing

While the industry has experienced revenue growth lately, Nurminen Logistics Oyj's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Nurminen Logistics Oyj will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Nurminen Logistics Oyj's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 13%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 77% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 13% each year during the coming three years according to the sole analyst following the company. That's shaping up to be materially higher than the 0.2% per year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Nurminen Logistics Oyj's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite enticing revenue growth figures that outpace the industry, Nurminen Logistics Oyj's P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Nurminen Logistics Oyj (at least 1 which is concerning), and understanding them should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Nurminen Logistics Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:NLG1V

Nurminen Logistics Oyj

Provides logistics services in Finland, Russia, Sweden, and Baltic countries.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives