Stock Analysis

- Finland

- /

- Communications

- /

- HLSE:NOKIA

The Market Doesn't Like What It Sees From Nokia Oyj's (HEL:NOKIA) Earnings Yet

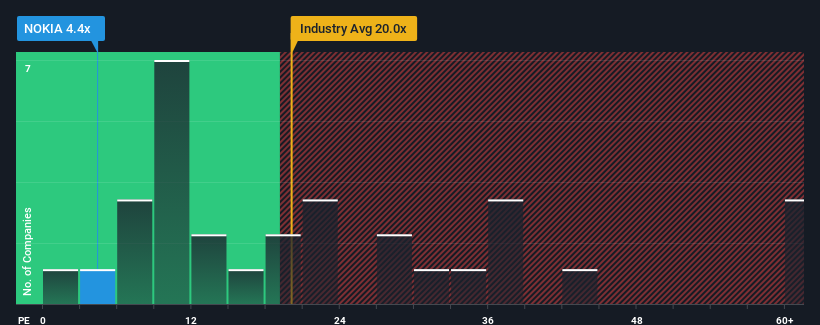

With a price-to-earnings (or "P/E") ratio of 4.4x Nokia Oyj (HEL:NOKIA) may be sending very bullish signals at the moment, given that almost half of all companies in Finland have P/E ratios greater than 19x and even P/E's higher than 31x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been pleasing for Nokia Oyj as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Nokia Oyj

How Is Nokia Oyj's Growth Trending?

Nokia Oyj's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Retrospectively, the last year delivered an exceptional 126% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 429% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to slump, contracting by 22% per annum during the coming three years according to the analysts following the company. Meanwhile, the broader market is forecast to expand by 17% per annum, which paints a poor picture.

With this information, we are not surprised that Nokia Oyj is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On Nokia Oyj's P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Nokia Oyj maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Nokia Oyj (of which 2 are potentially serious!) you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're helping make it simple.

Find out whether Nokia Oyj is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:NOKIA

Nokia Oyj

Nokia Oyj provides mobile, fixed, and cloud network solutions worldwide.

Flawless balance sheet, undervalued and pays a dividend.