- Finland

- /

- Electronic Equipment and Components

- /

- HLSE:BOREO

Improved Revenues Required Before Boreo Oyj (HEL:BOREO) Stock's 28% Jump Looks Justified

Boreo Oyj (HEL:BOREO) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 39% in the last twelve months.

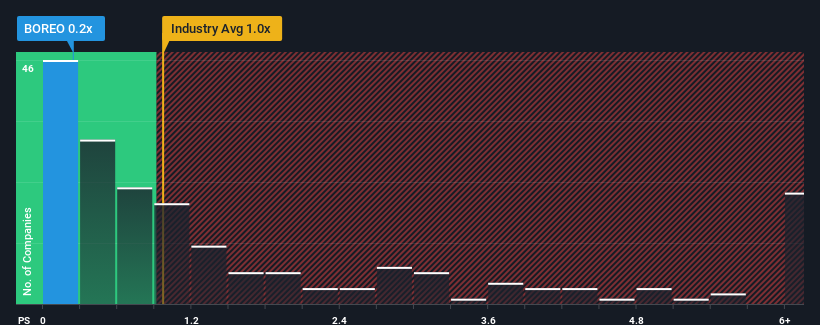

Even after such a large jump in price, when close to half the companies operating in Finland's Electronic industry have price-to-sales ratios (or "P/S") above 1.2x, you may still consider Boreo Oyj as an enticing stock to check out with its 0.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Boreo Oyj

What Does Boreo Oyj's Recent Performance Look Like?

Boreo Oyj hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Boreo Oyj.Is There Any Revenue Growth Forecasted For Boreo Oyj?

The only time you'd be truly comfortable seeing a P/S as low as Boreo Oyj's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered a frustrating 17% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 9.8% overall rise in revenue. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next three years should generate growth of 3.0% per year as estimated by the lone analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 7.9% each year, which is noticeably more attractive.

In light of this, it's understandable that Boreo Oyj's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Despite Boreo Oyj's share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As expected, our analysis of Boreo Oyj's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 3 warning signs for Boreo Oyj you should be aware of, and 1 of them can't be ignored.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Boreo Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:BOREO

Boreo Oyj

Owns, acquires, and develops small and medium sized companies in Finland, Sweden, Baltic Countries, and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives