Tecnotree Oyj (HEL:TEM1V) Shares Fly 41% But Investors Aren't Buying For Growth

Tecnotree Oyj (HEL:TEM1V) shares have had a really impressive month, gaining 41% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 17% over that time.

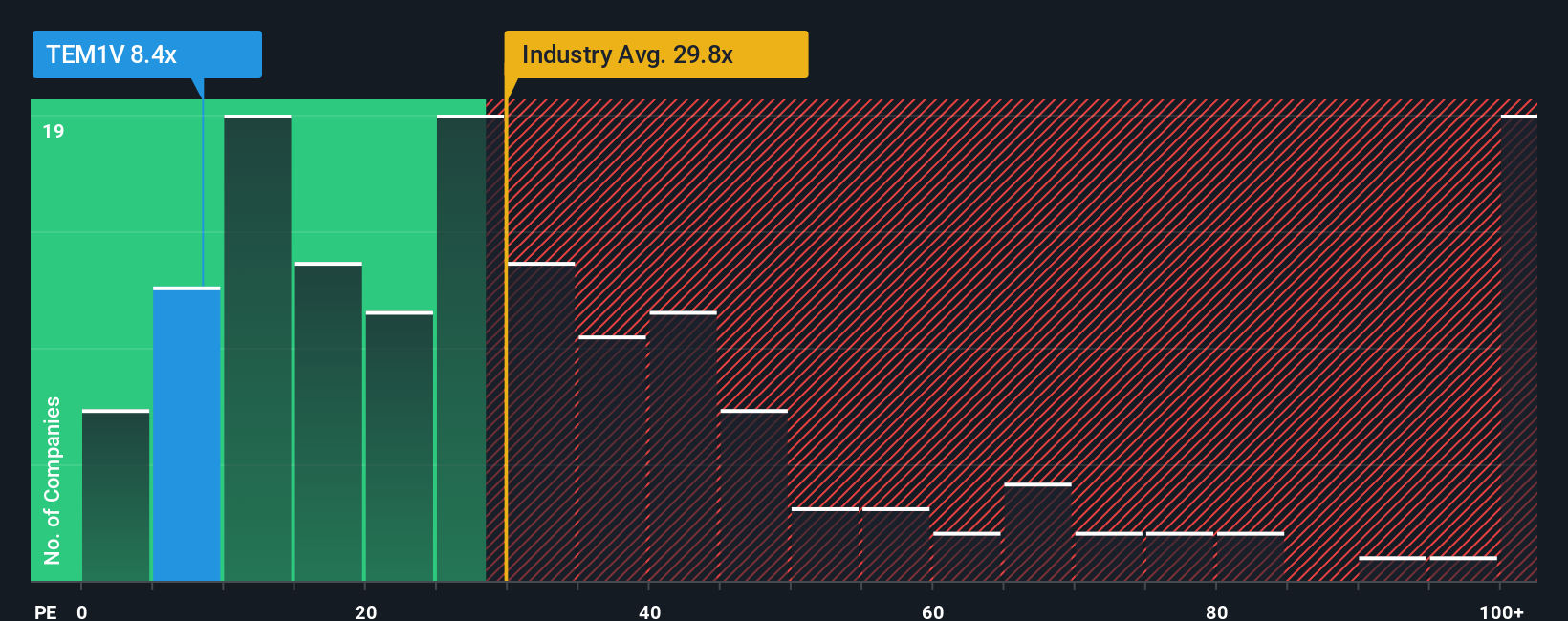

Although its price has surged higher, Tecnotree Oyj may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 8.4x, since almost half of all companies in Finland have P/E ratios greater than 21x and even P/E's higher than 37x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Tecnotree Oyj has been struggling lately as its earnings have declined faster than most other companies. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Check out our latest analysis for Tecnotree Oyj

Is There Any Growth For Tecnotree Oyj?

Tecnotree Oyj's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 38%. The last three years don't look nice either as the company has shrunk EPS by 54% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 6.7% per annum as estimated by the one analyst watching the company. That's shaping up to be materially lower than the 14% per year growth forecast for the broader market.

With this information, we can see why Tecnotree Oyj is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Tecnotree Oyj's P/E?

Shares in Tecnotree Oyj are going to need a lot more upward momentum to get the company's P/E out of its slump. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Tecnotree Oyj maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Tecnotree Oyj (1 is potentially serious!) that you need to be mindful of.

You might be able to find a better investment than Tecnotree Oyj. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Tecnotree Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:TEM1V

Tecnotree Oyj

Provides telecommunication IT solutions for charging, billing, customer care, and messaging and content services in Europe, the Americas, the Middle East, Africa, and the Asia Pacific.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives