Here's Why Heeros Oyj (HEL:HEEROS) Can Manage Its Debt Responsibly

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Heeros Oyj (HEL:HEEROS) does use debt in its business. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Heeros Oyj

What Is Heeros Oyj's Debt?

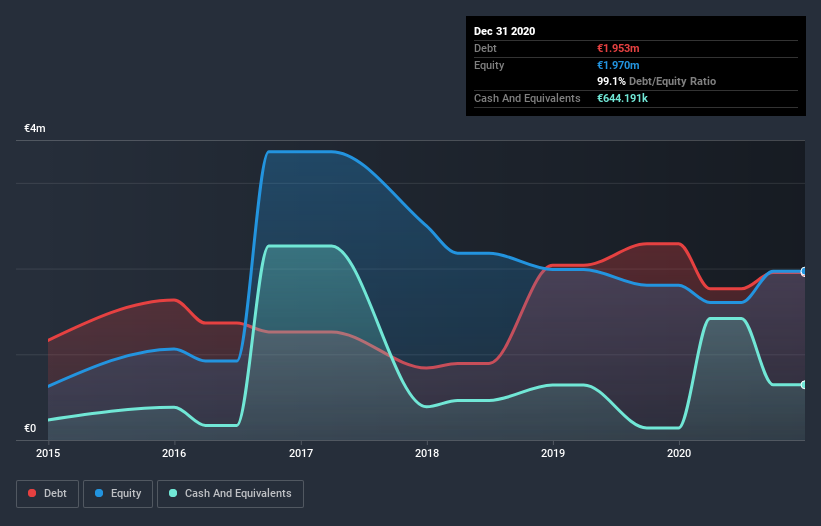

You can click the graphic below for the historical numbers, but it shows that Heeros Oyj had €1.95m of debt in December 2020, down from €2.29m, one year before. However, it does have €644.2k in cash offsetting this, leading to net debt of about €1.31m.

A Look At Heeros Oyj's Liabilities

According to the last reported balance sheet, Heeros Oyj had liabilities of €2.35m due within 12 months, and liabilities of €1.47m due beyond 12 months. Offsetting this, it had €644.2k in cash and €739.2k in receivables that were due within 12 months. So it has liabilities totalling €2.44m more than its cash and near-term receivables, combined.

Since publicly traded Heeros Oyj shares are worth a total of €30.8m, it seems unlikely that this level of liabilities would be a major threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Weak interest cover of 2.0 times and a disturbingly high net debt to EBITDA ratio of 5.5 hit our confidence in Heeros Oyj like a one-two punch to the gut. This means we'd consider it to have a heavy debt load. However, the silver lining was that Heeros Oyj achieved a positive EBIT of €202k in the last twelve months, an improvement on the prior year's loss. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Heeros Oyj's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Happily for any shareholders, Heeros Oyj actually produced more free cash flow than EBIT over the last year. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

When it comes to the balance sheet, the standout positive for Heeros Oyj was the fact that it seems able to convert EBIT to free cash flow confidently. However, our other observations weren't so heartening. To be specific, it seems about as good at managing its debt, based on its EBITDA, as wet socks are at keeping your feet warm. Considering this range of data points, we think Heeros Oyj is in a good position to manage its debt levels. But a word of caution: we think debt levels are high enough to justify ongoing monitoring. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Be aware that Heeros Oyj is showing 2 warning signs in our investment analysis , and 1 of those is potentially serious...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you decide to trade Heeros Oyj, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Heeros Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About HLSE:HEEROS

Solid track record with excellent balance sheet.

Market Insights

Community Narratives