Stock Analysis

The simplest way to invest in stocks is to buy exchange traded funds. But investors can boost returns by picking market-beating companies to own shares in. For example, the Digital Workforce Services Oyj (HEL:DWF) share price is up 23% in the last 1 year, clearly besting the market decline of around 16% (not including dividends). So that should have shareholders smiling. Digital Workforce Services Oyj hasn't been listed for long, so it's still not clear if it is a long term winner.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

Check out our latest analysis for Digital Workforce Services Oyj

Digital Workforce Services Oyj isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Digital Workforce Services Oyj grew its revenue by 14% last year. We respect that sort of growth, no doubt. While the share price performed well, gaining 23% over twelve months, you could argue the revenue growth warranted it. If the company can maintain the revenue growth, the share price could go higher still. But before deciding this growth stock is underappreciated, you might want to check out profitability trends (and cash flow)

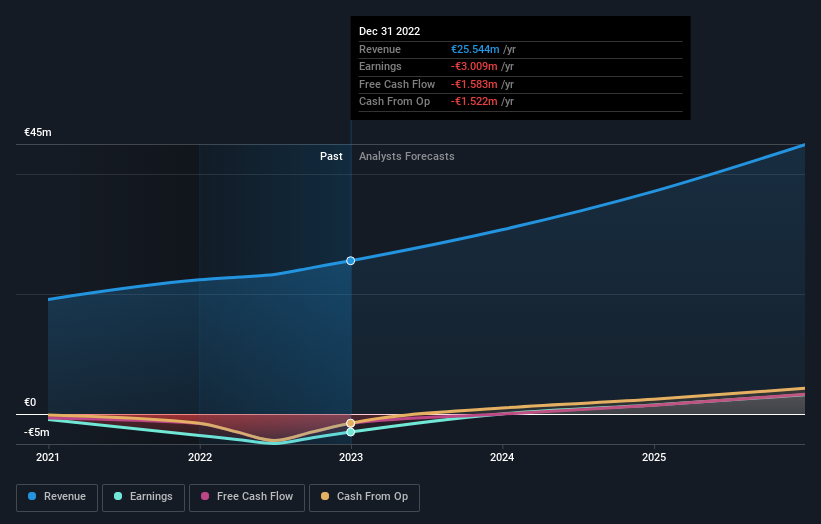

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Digital Workforce Services Oyj boasts a total shareholder return of 23% for the last year. And the share price momentum remains respectable, with a gain of 13% in the last three months. This suggests the company is continuing to win over new investors. It's always interesting to track share price performance over the longer term. But to understand Digital Workforce Services Oyj better, we need to consider many other factors. Even so, be aware that Digital Workforce Services Oyj is showing 2 warning signs in our investment analysis , and 1 of those is significant...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Finnish exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Digital Workforce Services Oyj is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:DWF

Digital Workforce Services Oyj

Digital Workforce Services Oyj. provides robotic process automation services (RPA) and intelligent automation (IA) solutions worldwide.

Reasonable growth potential with adequate balance sheet.