Digitalist Group Plc's (HEL:DIGIGR) P/S Is Still On The Mark Following 45% Share Price Bounce

Digitalist Group Plc (HEL:DIGIGR) shareholders would be excited to see that the share price has had a great month, posting a 45% gain and recovering from prior weakness. The annual gain comes to 269% following the latest surge, making investors sit up and take notice.

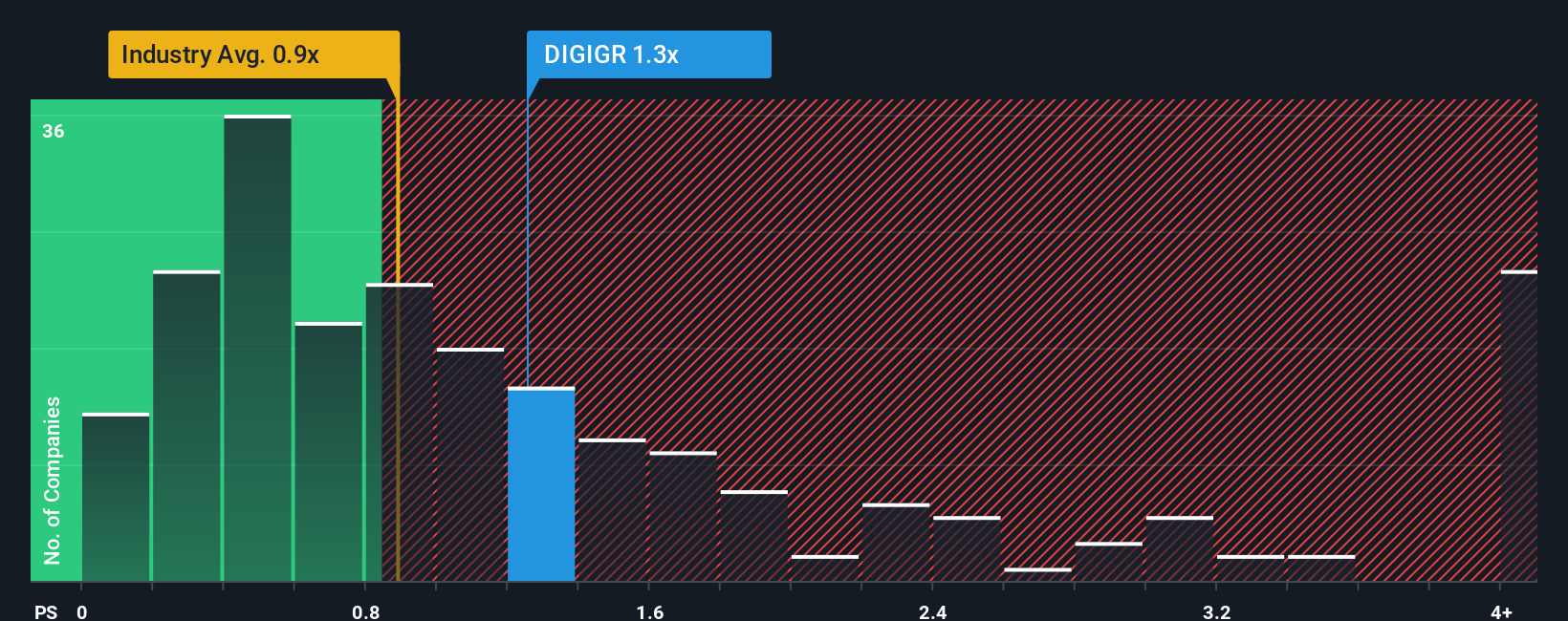

Since its price has surged higher, when almost half of the companies in Finland's IT industry have price-to-sales ratios (or "P/S") below 0.7x, you may consider Digitalist Group as a stock probably not worth researching with its 1.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Digitalist Group

What Does Digitalist Group's Recent Performance Look Like?

For example, consider that Digitalist Group's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Digitalist Group will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Digitalist Group?

In order to justify its P/S ratio, Digitalist Group would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a frustrating 3.2% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 13% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to decline by 23% over the next year, even worse than the company's recent medium-term annualised revenue decline.

In light of this, it's understandable that Digitalist Group's P/S sits above the majority of other companies. Nonetheless, there's no guarantee the P/S has found a floor yet with recent revenue going backwards, despite the industry heading down even harder. There is potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

What We Can Learn From Digitalist Group's P/S?

Digitalist Group's P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Digitalist Group revealed its narrower three-year contraction in revenue is contributing to its higher than industry P/S, given the industry is set to shrink even more. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under any additional threat. We still remain cautious about the company's ability to stay its recent course and avoid revenues slipping in line with the industry. Otherwise, it's hard to see the share price falling strongly in the near future if its outlook remains more positive than the rest of its peers.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Digitalist Group (at least 3 which are a bit concerning), and understanding them should be part of your investment process.

If you're unsure about the strength of Digitalist Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:DIGIGR

Digitalist Group

A technology company, provides consultancy services related to digital solutions in Finland and Sweden.

Slight risk and overvalued.

Similar Companies

Market Insights

Community Narratives