Why It Might Not Make Sense To Buy PunaMusta Media Oyj (HEL:PUMU) For Its Upcoming Dividend

Readers hoping to buy PunaMusta Media Oyj (HEL:PUMU) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. If you purchase the stock on or after the 26th of March, you won't be eligible to receive this dividend, when it is paid on the 7th of April.

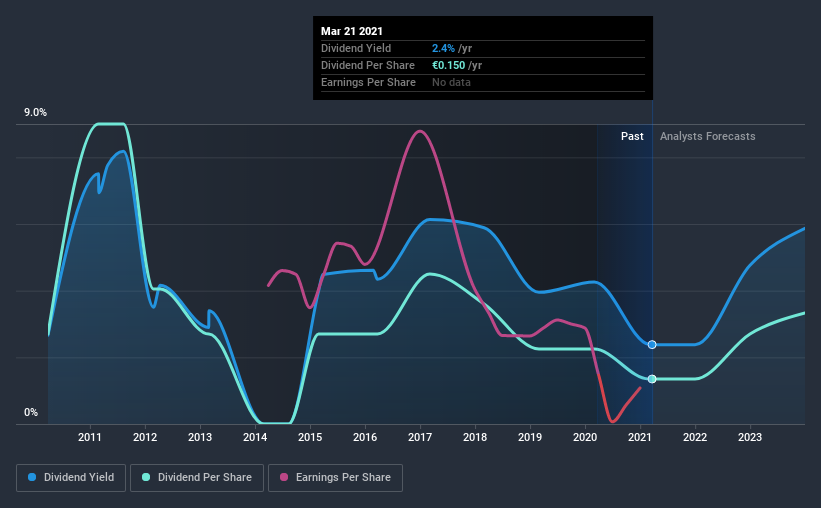

PunaMusta Media Oyj's upcoming dividend is €0.15 a share, following on from the last 12 months, when the company distributed a total of €0.15 per share to shareholders. Last year's total dividend payments show that PunaMusta Media Oyj has a trailing yield of 2.4% on the current share price of €6.3. If you buy this business for its dividend, you should have an idea of whether PunaMusta Media Oyj's dividend is reliable and sustainable. So we need to investigate whether PunaMusta Media Oyj can afford its dividend, and if the dividend could grow.

See our latest analysis for PunaMusta Media Oyj

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. PunaMusta Media Oyj reported a loss after tax last year, which means it's paying a dividend despite being unprofitable. While this might be a one-off event, this is unlikely to be sustainable in the long term. Given that the company reported a loss last year, we now need to see if it generated enough free cash flow to fund the dividend. If PunaMusta Media Oyj didn't generate enough cash to pay the dividend, then it must have either paid from cash in the bank or by borrowing money, neither of which is sustainable in the long term. Thankfully its dividend payments took up just 34% of the free cash flow it generated, which is a comfortable payout ratio.

Click here to see how much of its profit PunaMusta Media Oyj paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings fall far enough, the company could be forced to cut its dividend. PunaMusta Media Oyj was unprofitable last year and, unfortunately, the general trend suggests its earnings have been in decline over the last five years, making us wonder if the dividend is sustainable at all.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. PunaMusta Media Oyj's dividend payments per share have declined at 6.7% per year on average over the past 10 years, which is uninspiring. It's never nice to see earnings and dividends falling, but at least management has cut the dividend rather than potentially risk the company's health in an attempt to maintain it.

We update our analysis on PunaMusta Media Oyj every 24 hours, so you can always get the latest insights on its financial health, here.

To Sum It Up

Has PunaMusta Media Oyj got what it takes to maintain its dividend payments? It's hard to get used to PunaMusta Media Oyj paying a dividend despite reporting a loss over the past year. At least the dividend was covered by free cash flow, however. It's not an attractive combination from a dividend perspective, and we're inclined to pass on this one for the time being.

So if you're still interested in PunaMusta Media Oyj despite it's poor dividend qualities, you should be well informed on some of the risks facing this stock. To that end, you should learn about the 2 warning signs we've spotted with PunaMusta Media Oyj (including 1 which doesn't sit too well with us).

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade PunaMusta Media Oyj, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About HLSE:REBL

Rebl Group Oyj

Primarily engages in printing and designing of magazines and newspapers business in Finland.

Undervalued with mediocre balance sheet.

Market Insights

Community Narratives