- Finland

- /

- Metals and Mining

- /

- HLSE:PAMPALO

Endomines Finland Oyj (HEL:PAMPALO) shareholder returns have been notable, earning 54% in 1 year

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But if you pick the right individual stocks, you could make more than that. To wit, the Endomines Finland Oyj (HEL:PAMPALO) share price is 54% higher than it was a year ago, much better than the market return of around 2.5% (not including dividends) in the same period. If it can keep that out-performance up over the long term, investors will do very well! Having said that, the longer term returns aren't so impressive, with stock gaining just 6.1% in three years.

Since the stock has added €19m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

See our latest analysis for Endomines Finland Oyj

Given that Endomines Finland Oyj didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last year Endomines Finland Oyj saw its revenue grow by 19%. We respect that sort of growth, no doubt. Buyers pushed the share price 54% in response, which isn't unreasonable. If the company can maintain the revenue growth, the share price could go higher still. But it's crucial to check profitability and cash flow before forming a view on the future.

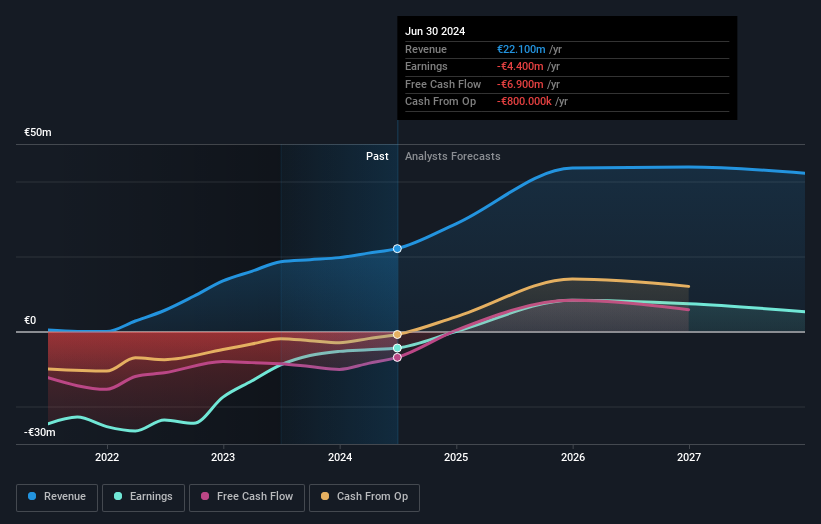

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Take a more thorough look at Endomines Finland Oyj's financial health with this free report on its balance sheet.

A Different Perspective

It's nice to see that Endomines Finland Oyj shareholders have received a total shareholder return of 54% over the last year. Notably the five-year annualised TSR loss of 8% per year compares very unfavourably with the recent share price performance. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Endomines Finland Oyj is showing 1 warning sign in our investment analysis , you should know about...

But note: Endomines Finland Oyj may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Finnish exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Endomines Finland Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:PAMPALO

Endomines Finland Oyj

Engages in the mining and exploration of gold deposits in Finland and the United States.

Reasonable growth potential and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success