Huhtamäki (HLSE:HUH1V) Margin Decline Challenges Bull Case Despite Strong Value and Dividend

Reviewed by Simply Wall St

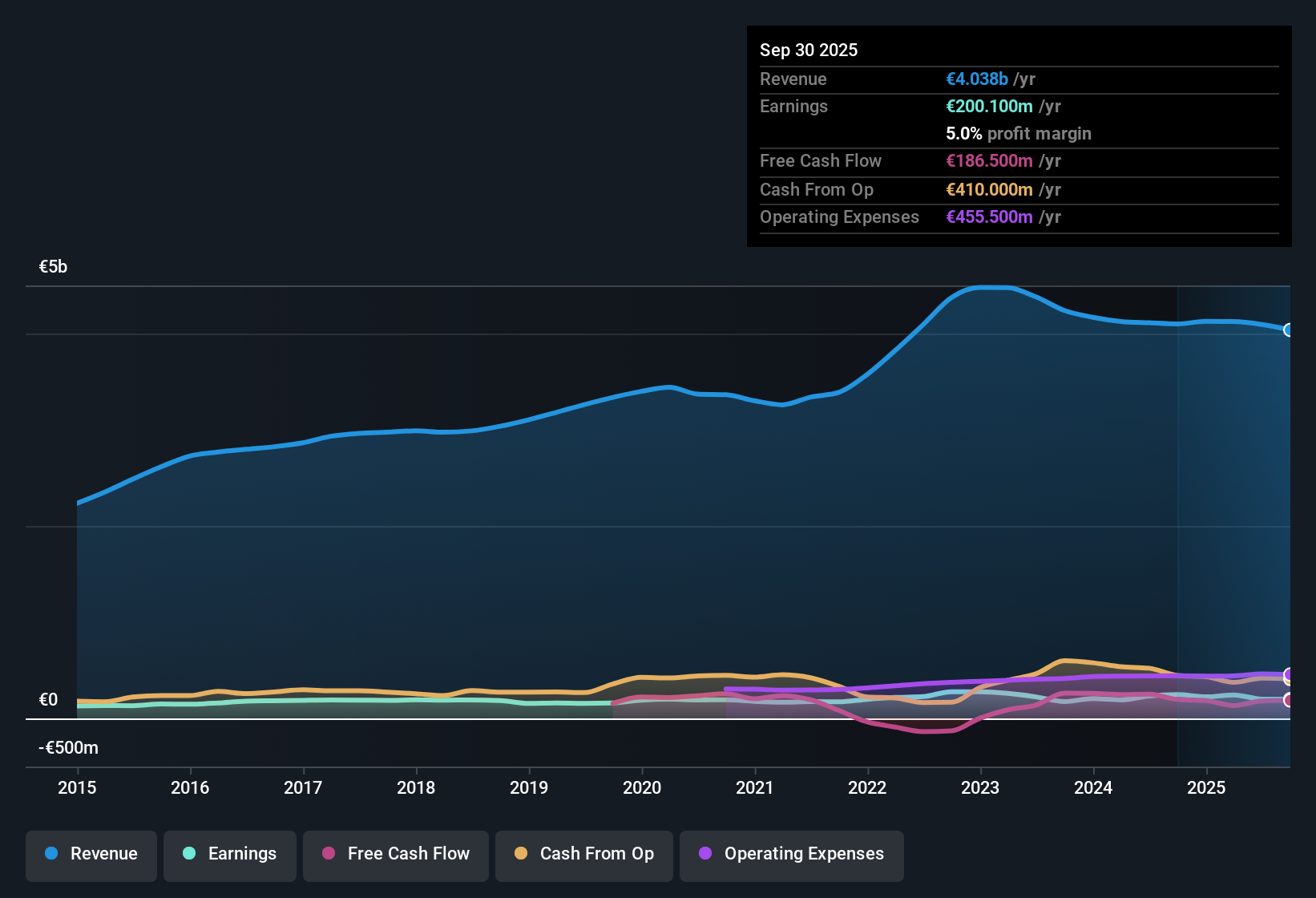

Huhtamäki Oyj (HLSE:HUH1V) reported earnings growth of 4.4% per year over the past five years, with its current net profit margin at 4.9%, down from 5.7% a year ago. Despite a challenging growth outlook, with earnings forecast to grow 12.9% per year and revenue 2.8% per year, both slower than the Finnish market, the stock trades at a price-to-earnings ratio of 15.4x. This is below its peer group and the global packaging sector. For investors, the company’s below-market valuation, solid dividend, and history of high-quality earnings highlight the rewards, but a softer profit margin and concerns about Huhtamäki’s financial position remain in focus.

See our full analysis for Huhtamäki Oyj.We are now setting these results alongside the current market narratives for Huhtamäki to see where consensus holds up and where expectations might shift.

See what the community is saying about Huhtamäki Oyj

Margin Expansion Goals Face Challenging Reality

- Analysts project net profit margins to rise from 4.9% to 6.8% over the next three years, aiming for a meaningful improvement despite current softness.

- Analysts' consensus view expects Huhtamäki's ongoing efficiency programs and investments in fiber-based, compostable packaging will drive this margin expansion, but there is a notable contrast:

- Consensus notes aggressive cost-cutting delivered €100 million in savings ahead of schedule, heavily supporting the margin case if efficiencies are sustained.

- However, critics within the consensus warn that persistent market weakness, especially in Foodservice, could limit upside. Margin targets will depend on recovering demand as well as cost discipline.

See the full consensus narrative for detailed scenario analysis and what could shift these expectations. 📊 Read the full Huhtamäki Oyj Consensus Narrative.

Peer Valuation Gap Widens

- Huhtamäki trades at a 15.4x price-to-earnings ratio, a discount to both sector peers at 18.8x and the global packaging industry at 16x. The share price is €29.52 versus the consensus analyst target of €36.90.

- According to analysts' consensus view, this sizable gap is driven by concerns over Huhtamäki’s slower forecasted growth rates for both earnings (12.9% per year) and revenue (2.8% per year), suggesting that investors see less upside than in faster-growing peers.

- Even with analyst target pricing at a 25% premium to today’s market value, consensus stresses the importance of strong future execution and margin delivery to close this discount.

- The presence of a solid dividend and past high-quality earnings gives some offset, but sentiment hinges on whether value factors compensate for below-market growth outlooks.

Financial Position Adds Uncertainty

- The only material risk flagged is Huhtamäki’s financial position, which is considered not strong based on current metrics. This raises questions about its ability to fund investments and strategic shifts without strain.

- Analysts' consensus view highlights that reliance on sustained cost-cutting and restructuring rather than robust top-line growth places pressure on the balance sheet, heightening risks if inflationary costs or end-market weakness persist.

- Consensus specifically points to currency volatility and competitive pressures, particularly price cuts in North America, as critical factors that could further test Huhtamäki’s financial resilience in coming years.

- The only material flagged risk is not about current performance, but the firm's ability to keep margins and growth on track while absorbing shocks. This makes its financial health a key watchpoint for future quarters.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Huhtamäki Oyj on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the results? Share your perspective and shape your own narrative in just a few minutes: Do it your way.

A great starting point for your Huhtamäki Oyj research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Huhtamäki’s progress on efficiency and valuation is overshadowed by questions about its financial strength and the resilience of its balance sheet.

If you want companies with a stronger foundation, explore solid balance sheet and fundamentals stocks screener (1984 results) that can better withstand uncertainty and financial shocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Huhtamäki Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:HUH1V

Huhtamäki Oyj

Provides packaging solutions in the United States, Germany, the United Kingdom, India, Turkey, Australia, Thailand, Poland, South Africa, Spain, Finland, and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives