Global markets have experienced a mixed week, with major indices like the Nasdaq Composite and S&P MidCap 400 reaching record highs before retreating, while small-cap stocks showed resilience. In such an environment, investors often look for opportunities that might not be immediately apparent in larger, more established companies. Though the term 'penny stock' might sound like a relic of past trading days, the opportunity it points to is still relevant. These smaller or newer companies can offer significant potential when built on solid financials. We'll explore several penny stocks that could pair balance sheet strength with long-term potential for growth.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.565 | MYR2.81B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.72 | MYR124.72M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.81 | HK$507.83M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$141.28M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.25 | MYR351.85M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.55 | £360.49M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.54 | MYR766.84M | ★★★★★★ |

| Kelington Group Berhad (KLSE:KGB) | MYR3.04 | MYR2.09B | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £4.025 | £391.86M | ★★★★☆☆ |

Click here to see the full list of 5,823 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Raisio (HLSE:RAIVV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Raisio plc, with a market cap of €366.21 million, operates in the production and sale of food and food ingredients across Finland, the Netherlands, Belgium, and other parts of Europe.

Operations: The company's revenue is primarily derived from its Healthy Food segment at €146.8 million and Healthy Ingredients segment at €112.1 million.

Market Cap: €366.21M

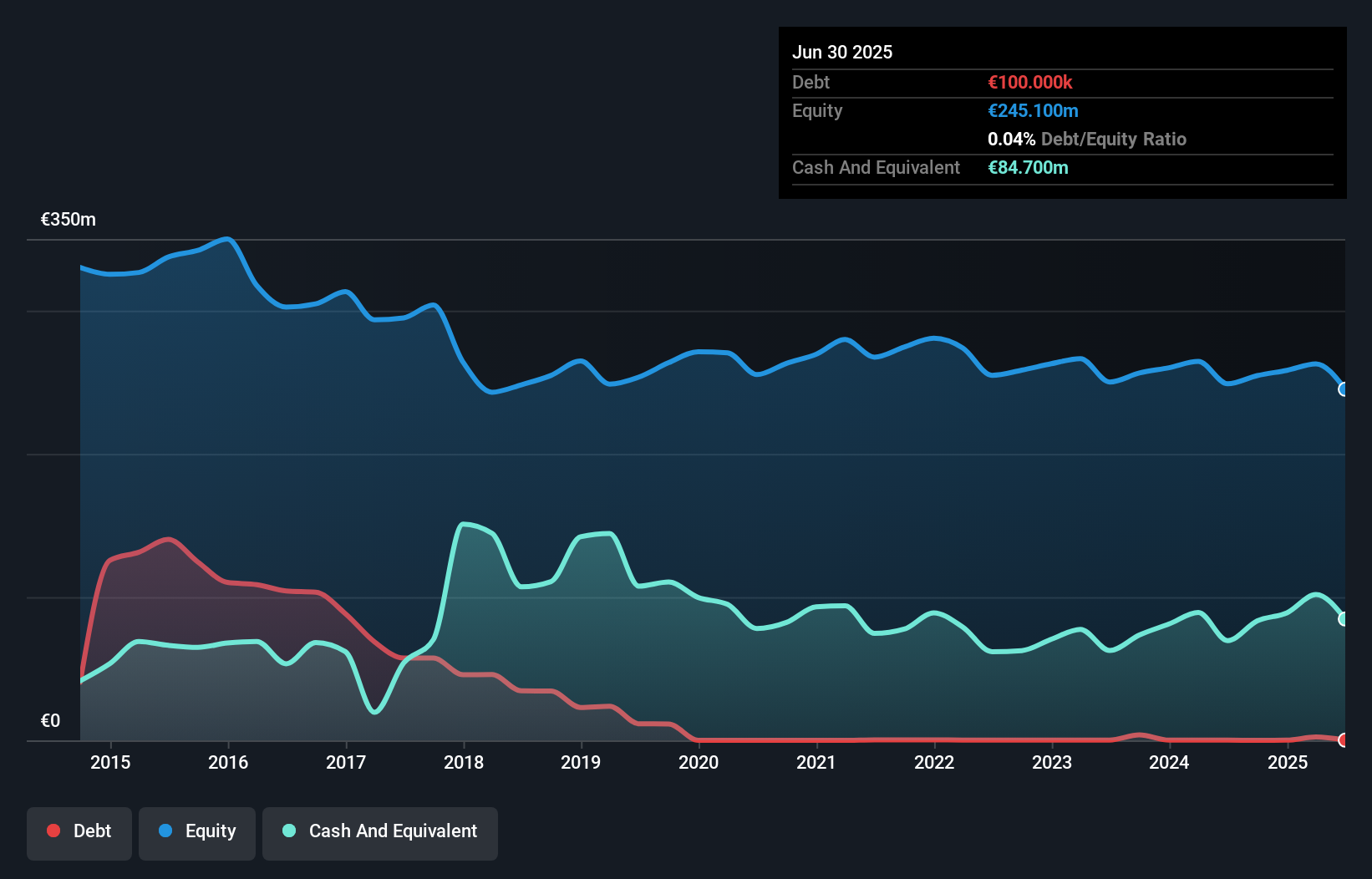

Raisio plc, with a market cap of €366.21 million, shows potential in the penny stock realm due to its experienced board and strong financial position, having more cash than debt and well-covered liabilities. However, its management team is relatively new, which may impact strategic consistency. The company trades significantly below estimated fair value and has demonstrated stable earnings growth recently, although it lags behind industry averages. Raisio's inclusion in the S&P Global BMI Index highlights increased recognition. Despite low return on equity and a dividend not fully covered by earnings, its financial health remains robust with improved profit margins over the past year.

- Jump into the full analysis health report here for a deeper understanding of Raisio.

- Review our growth performance report to gain insights into Raisio's future.

Al-Baha Investment and Development (SASE:4130)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Al-Baha Investment and Development Company, along with its subsidiaries, focuses on managing and leasing residential and non-residential real estate in Saudi Arabia, with a market cap of SAR831.60 million.

Operations: The company's revenue is entirely generated from its operations in Saudi Arabia, amounting to SAR17.84 million.

Market Cap: SAR831.6M

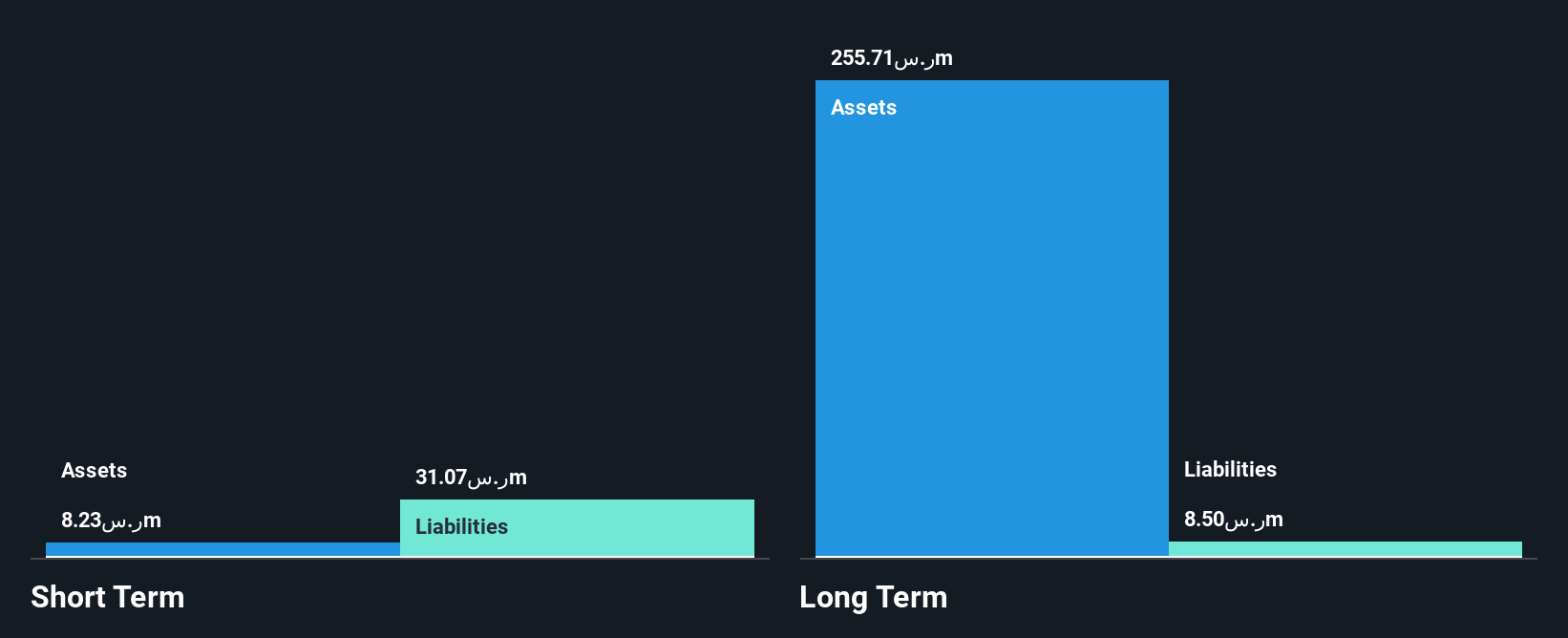

Al-Baha Investment and Development Company, with a market cap of SAR831.60 million, has shown some financial volatility recently. Despite becoming profitable over the past five years, its recent earnings have been impacted by a large one-off gain of SAR3.2 million. The company reported a net loss in the third quarter but achieved net income for the nine months ending September 30, 2024. Al-Baha is debt-free with seasoned board members averaging 11.8 years in tenure; however, it faces challenges covering short-term liabilities with current assets and experiences high share price volatility compared to most Saudi stocks.

- Unlock comprehensive insights into our analysis of Al-Baha Investment and Development stock in this financial health report.

- Examine Al-Baha Investment and Development's past performance report to understand how it has performed in prior years.

JBM (Healthcare) (SEHK:2161)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: JBM (Healthcare) Limited is an investment holding company involved in the manufacture, marketing, distribution, and sale of branded healthcare and wellness products across Hong Kong, Macau, Mainland China, and international markets with a market cap of HK$958.35 million.

Operations: The company's revenue is derived from three main segments: Branded Medicines (HK$190.11 million), Health and Wellness Products (HK$72.19 million), and Proprietary Chinese Medicines (HK$386.12 million).

Market Cap: HK$958.35M

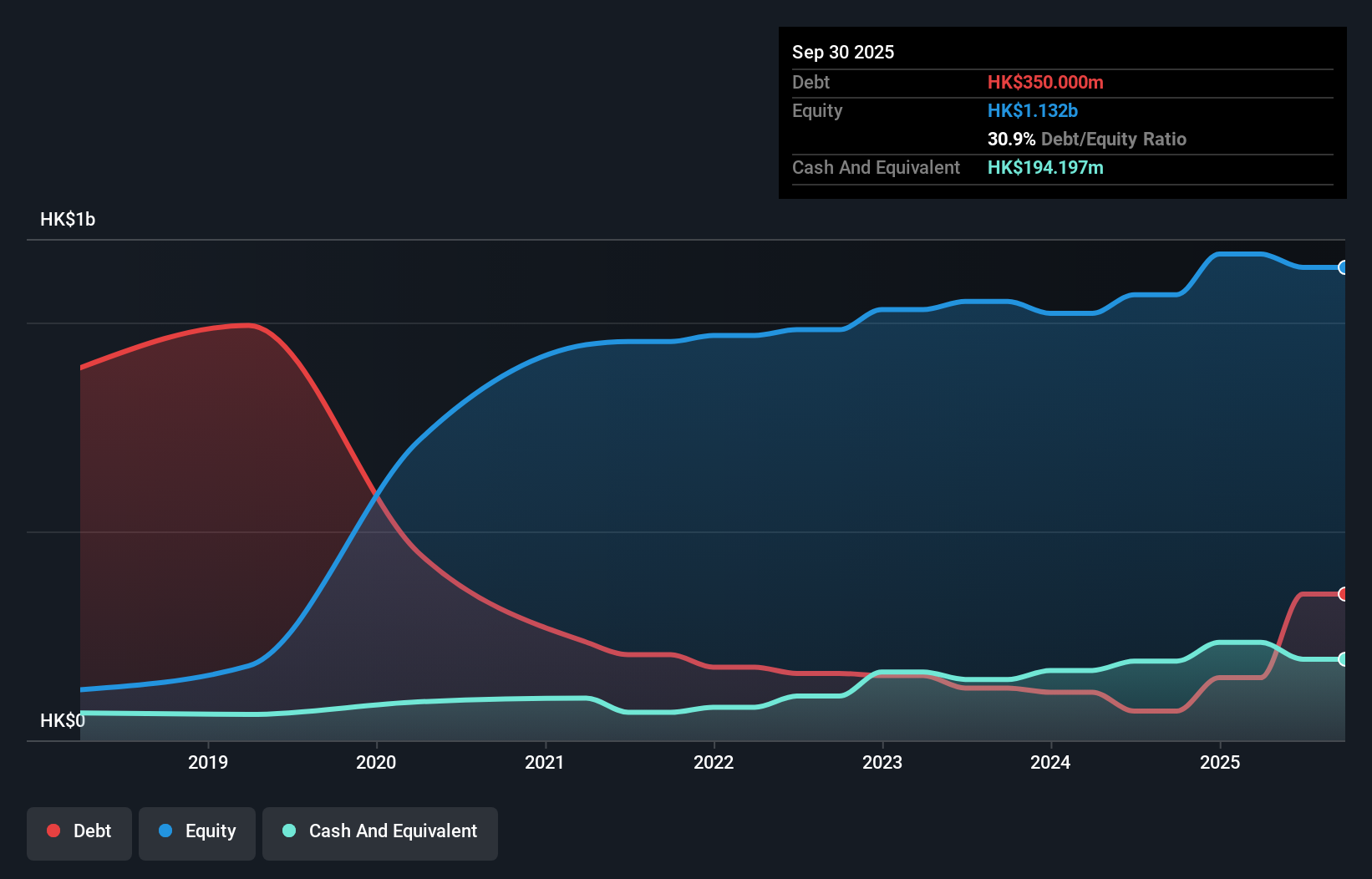

JBM (Healthcare) Limited, with a market cap of HK$958.35 million, has demonstrated financial resilience and growth potential. The company benefits from high-quality earnings and a strong balance sheet, with more cash than total debt and short-term assets exceeding both short- and long-term liabilities. Its net profit margins have improved significantly over the past year, reaching 20.1%, while earnings growth of 128.5% outpaced the industry average. Recent share buybacks aim to enhance shareholder value by improving net asset value per share, although its dividend track record remains unstable despite recent increases approved in August 2024.

- Get an in-depth perspective on JBM (Healthcare)'s performance by reading our balance sheet health report here.

- Gain insights into JBM (Healthcare)'s past trends and performance with our report on the company's historical track record.

Key Takeaways

- Discover the full array of 5,823 Penny Stocks right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2161

JBM (Healthcare)

An investment holding company, engages in the manufacture, marketing, distribution, and sale of branded healthcare and wellness products in Hong Kong, Macau, Mainland China, and internationally.

Flawless balance sheet with solid track record.