- Finland

- /

- Capital Markets

- /

- HLSE:TAALA

Taaleri (HLSE:TAALA) Margin Downturn Reinforces Cautious Narrative Despite Low Valuation

Reviewed by Simply Wall St

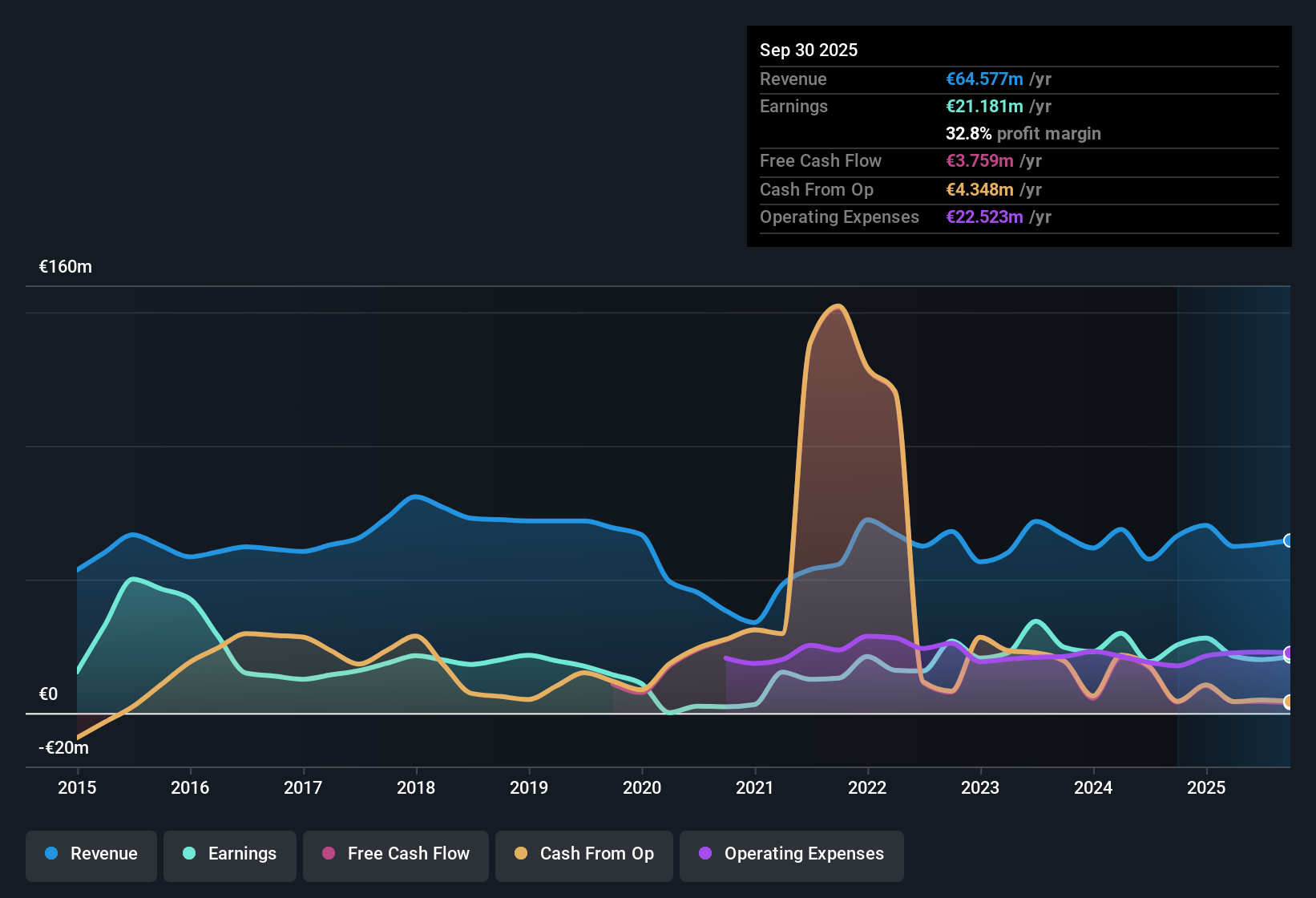

Taaleri Oyj (HLSE:TAALA) posted revenue growth that is forecast at just 0.6% per year, well behind the Finnish market’s 4% annual benchmark. While the company’s net profit margin remains elevated at 32.8%, it is down from 38.5% the year before, and earnings are now projected to fall around 25.1% per year over the coming three years after a period of strong 16.9% annualized growth. Shares currently trade at €7.26, notably below an internally estimated fair value of €16.05, with a price-to-earnings ratio of 9.6x, much lower than its peers and the wider European industry. Investors are taking note of the stock’s attractive valuation and high-quality historical earnings, but the outlook is clouded by shrinking margins and declining profitability ahead.

See our full analysis for Taaleri Oyj.Next, we will see how these earnings figures compare to the widely followed narratives around Taaleri, and whether the fundamentals support or challenge the story investors have been telling.

See what the community is saying about Taaleri Oyj

Management Fees Supported by Renewable Energy Demand

- Strong client appetite for renewable energy and bioindustry assets is boosting Taaleri’s management fee income. The SolarWind III Fund size has grown 42% over the prior vintage, highlighting real expansion opportunities beyond traditional segments.

- According to analysts' consensus view, this fundraising momentum and expansion into green, high-margin verticals

- is expected to accelerate recurring revenues and diversify income streams,

- while broader investor interest, including international inflows and green policy tailwinds, could drive assets under management and set the foundation for future top-line gains.

- Consensus narrative weighs the opportunity from strong fund inflows against potential fundraising headwinds. The current growth in fee-generating assets and investor engagement reinforces management’s strategic focus and the diversified growth outlook.

Profit Margins Seen Rebounding After Dip

- Although net profit margin declined to 32.8% (from 38.5%), forecasts now signal an increase to 34.3% by 2028. This suggests a near-term squeeze could be followed by margin expansion as new segments and insurance products mature.

- Analysts' consensus narrative points out that

- structural changes, international expansion, and product diversification are likely to stabilize and grow margins,

- but continued volatility from sector headwinds and internal restructuring could delay a return to peak profitability and drive earnings variability.

Valuation Deeply Discounted Versus Peers and DCF

- With shares trading at €7.26, Taaleri’s price-to-earnings ratio is just 9.6x compared to 26.5x for peers and 16.6x for the sector. The share price is far below the DCF fair value of €16.05 and also beneath analysts’ price target of €8.50.

- Consensus narrative highlights a tug-of-war:

- investors see high-quality historic earnings and cheap valuation as attractive,

- but are wary of risks around declining revenues, pressure on profitability, and uncertainty about how quickly new business lines can compensate for legacy declines.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Taaleri Oyj on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the story looks different from your perspective? Take just a few minutes to turn your insights into a narrative that reflects your view. Do it your way.

A great starting point for your Taaleri Oyj research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Taaleri’s shrinking margins, volatile earnings outlook, and weak revenue growth stand out. Management continues to pursue new opportunities and high-quality valuation signals.

If you want companies showing consistent expansion and reliable performance instead, focus your search on stable growth stocks screener (2121 results) to find those delivering stability year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taaleri Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:TAALA

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives