Stock Analysis

- Finland

- /

- Capital Markets

- /

- HLSE:CAPMAN

CapMan Oyj's (HEL:CAPMAN) Upcoming Dividend Will Be Larger Than Last Year's

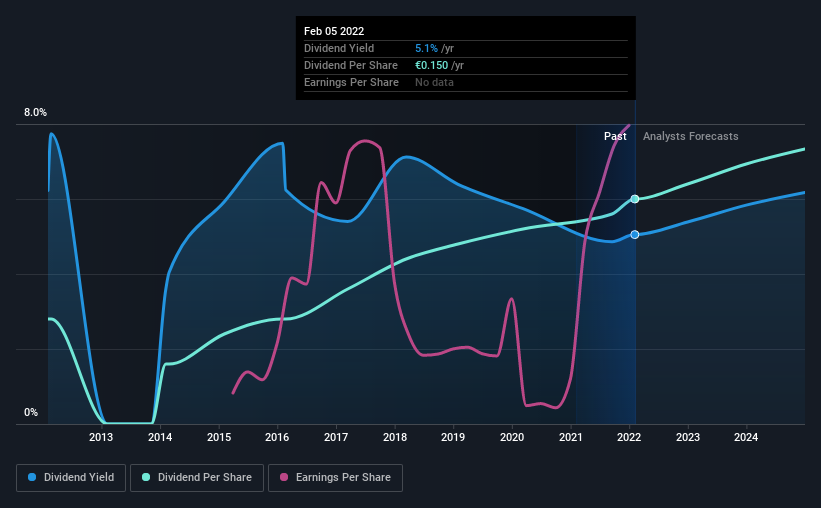

The board of CapMan Oyj (HEL:CAPMAN) has announced that it will be increasing its dividend on the 25th of March to €0.08. The announced payment will take the dividend yield to 5.1%, which is in line with the average for the industry.

View our latest analysis for CapMan Oyj

CapMan Oyj's Earnings Easily Cover the Distributions

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. The last payment was quite easily covered by earnings, but it made up 216% of cash flows. While the company may be more focused on returning cash to shareholders than growing the business at this time, we think that a cash payout ratio this high might expose the dividend to being cut if the business ran into some challenges.

Looking forward, earnings per share is forecast to rise by 17.4% over the next year. If the dividend continues on this path, the payout ratio could be 66% by next year, which we think can be pretty sustainable going forward.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. Since 2012, the first annual payment was €0.07, compared to the most recent full-year payment of €0.15. This implies that the company grew its distributions at a yearly rate of about 7.9% over that duration. We have seen cuts in the past, so while the growth looks promising we would be a little bit cautious about its track record.

The Dividend Has Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. CapMan Oyj has seen EPS rising for the last five years, at 6.2% per annum. The company is paying out a lot of its cash as a dividend, but it looks okay based on the payout ratio.

In Summary

Overall, we always like to see the dividend being raised, but we don't think CapMan Oyj will make a great income stock. While the low payout ratio is redeeming feature, this is offset by the minimal cash to cover the payments. Overall, we don't think this company has the makings of a good income stock.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 2 warning signs for CapMan Oyj that investors need to be conscious of moving forward. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

Valuation is complex, but we're helping make it simple.

Find out whether CapMan Oyj is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:CAPMAN

CapMan Oyj

A leading Nordic private assets management and investment firm with an active approach to value creation and private equity and venture capital firm specializing in growth capital investments, industry consolidation, turnaround, recapitalization, middle market buyouts, credit and mezzanine financing in unquoted companies, investments in value-add and income focused real estate, and investments in energy, transportation, and telecommunications infrastructure.

High growth potential with mediocre balance sheet.