Stock Analysis

- Finland

- /

- Capital Markets

- /

- HLSE:CAPMAN

CapMan Oyj's (HEL:CAPMAN) CEO Will Probably Have Their Compensation Approved By Shareholders

The performance at CapMan Oyj (HEL:CAPMAN) has been quite strong recently and CEO Joakim Frimodig has played a role in it. Shareholders will have this at the front of their minds in the upcoming AGM on 16 March 2022. This would also be a chance for them to hear the board review the financial results, discuss future company strategy and vote on any resolutions such as executive remuneration. In light of the great performance, we discuss the case why we think CEO compensation is not excessive.

View our latest analysis for CapMan Oyj

How Does Total Compensation For Joakim Frimodig Compare With Other Companies In The Industry?

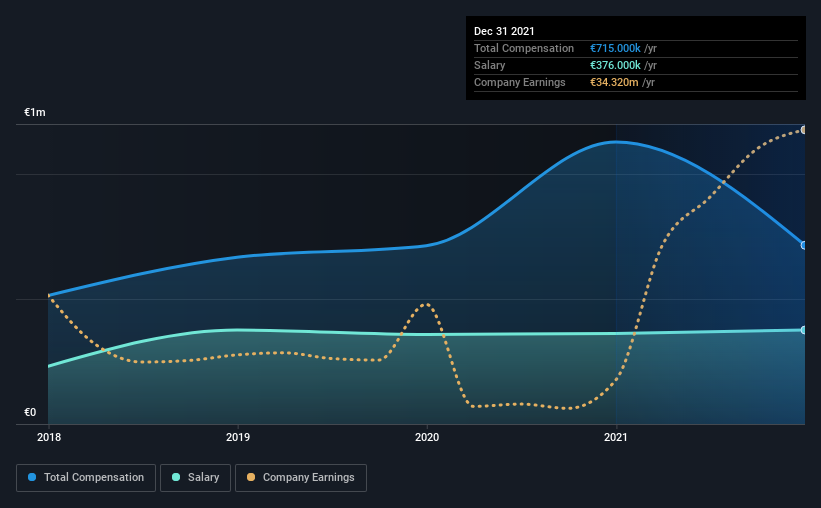

According to our data, CapMan Oyj has a market capitalization of €402m, and paid its CEO total annual compensation worth €715k over the year to December 2021. That's a notable decrease of 37% on last year. Notably, the salary which is €376.0k, represents a considerable chunk of the total compensation being paid.

On examining similar-sized companies in the industry with market capitalizations between €181m and €722m, we discovered that the median CEO total compensation of that group was €901k. This suggests that CapMan Oyj remunerates its CEO largely in line with the industry average. Moreover, Joakim Frimodig also holds €2.6m worth of CapMan Oyj stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | €376k | €362k | 53% |

| Other | €339k | €766k | 47% |

| Total Compensation | €715k | €1.1m | 100% |

On an industry level, total compensation is equally proportioned between salary and other compensation, that is, they each represent approximately 50% of the total compensation. CapMan Oyj is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

CapMan Oyj's Growth

CapMan Oyj has seen its earnings per share (EPS) increase by 58% a year over the past three years. In the last year, its revenue is up 23%.

This demonstrates that the company has been improving recently and is good news for the shareholders. This sort of respectable year-on-year revenue growth is often seen at a healthy, growing business. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has CapMan Oyj Been A Good Investment?

Boasting a total shareholder return of 74% over three years, CapMan Oyj has done well by shareholders. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Seeing that the company has put in a relatively good performance, the CEO remuneration policy may not be the focus at the AGM. Instead, investors might be more interested in discussions that would help manage their longer-term growth expectations such as company business strategies and future growth potential.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 2 warning signs for CapMan Oyj that you should be aware of before investing.

Switching gears from CapMan Oyj, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Valuation is complex, but we're helping make it simple.

Find out whether CapMan Oyj is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:CAPMAN

CapMan Oyj

A leading Nordic private assets management and investment firm with an active approach to value creation and private equity and venture capital firm specializing in growth capital investments, industry consolidation, turnaround, recapitalization, middle market buyouts, credit and mezzanine financing in unquoted companies, investments in value-add and income focused real estate, and investments in energy, transportation, and telecommunications infrastructure.

High growth potential with mediocre balance sheet.