The Rapala VMC (HEL:RAP1V) Share Price Is Down 43% So Some Shareholders Are Getting Worried

For many, the main point of investing is to generate higher returns than the overall market. But even the best stock picker will only win with some selections. So we wouldn't blame long term Rapala VMC Corporation (HEL:RAP1V) shareholders for doubting their decision to hold, with the stock down 43% over a half decade.

Check out our latest analysis for Rapala VMC

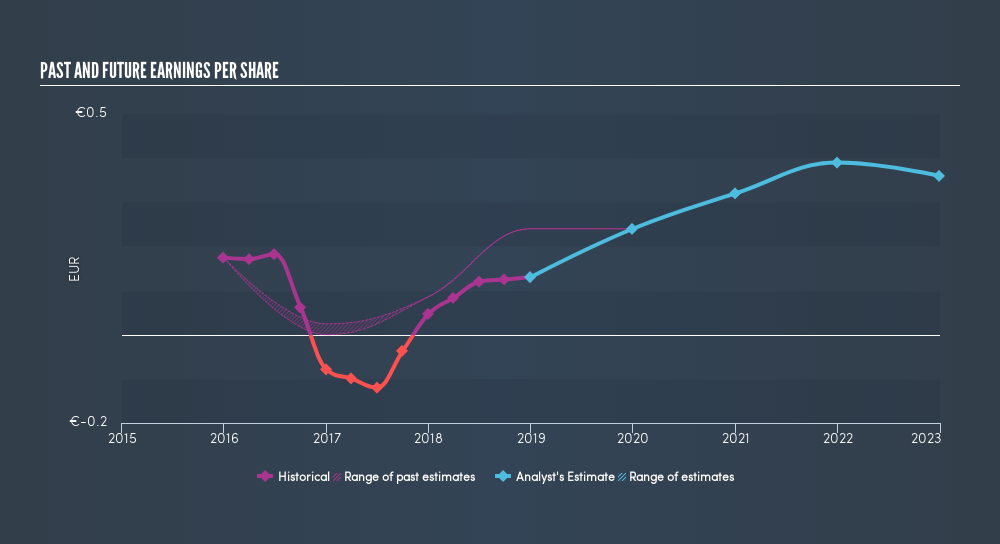

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the five years over which the share price declined, Rapala VMC's earnings per share (EPS) dropped by 17% each year. The share price decline of 11% per year isn't as bad as the EPS decline. The relatively muted share price reaction might be because the market expects the business to turn around.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Rapala VMC has improved its bottom line lately, but is it going to grow revenue? You could check out this freereport showing analyst revenue forecasts.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for Rapala VMC the TSR over the last 5 years was -34%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

Investors in Rapala VMC had a tough year, with a total loss of 10% (including dividends), against a market gain of about 3.6%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 7.9% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Before deciding if you like the current share price, check how Rapala VMC scores on these 3 valuation metrics.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this freelist of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FI exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About HLSE:RAP1V

Undervalued with excellent balance sheet.

Market Insights

Community Narratives