Marimekko (HLSE:MEKKO) Profit Margin Rises, Testing Market Views on Earnings Quality

Reviewed by Simply Wall St

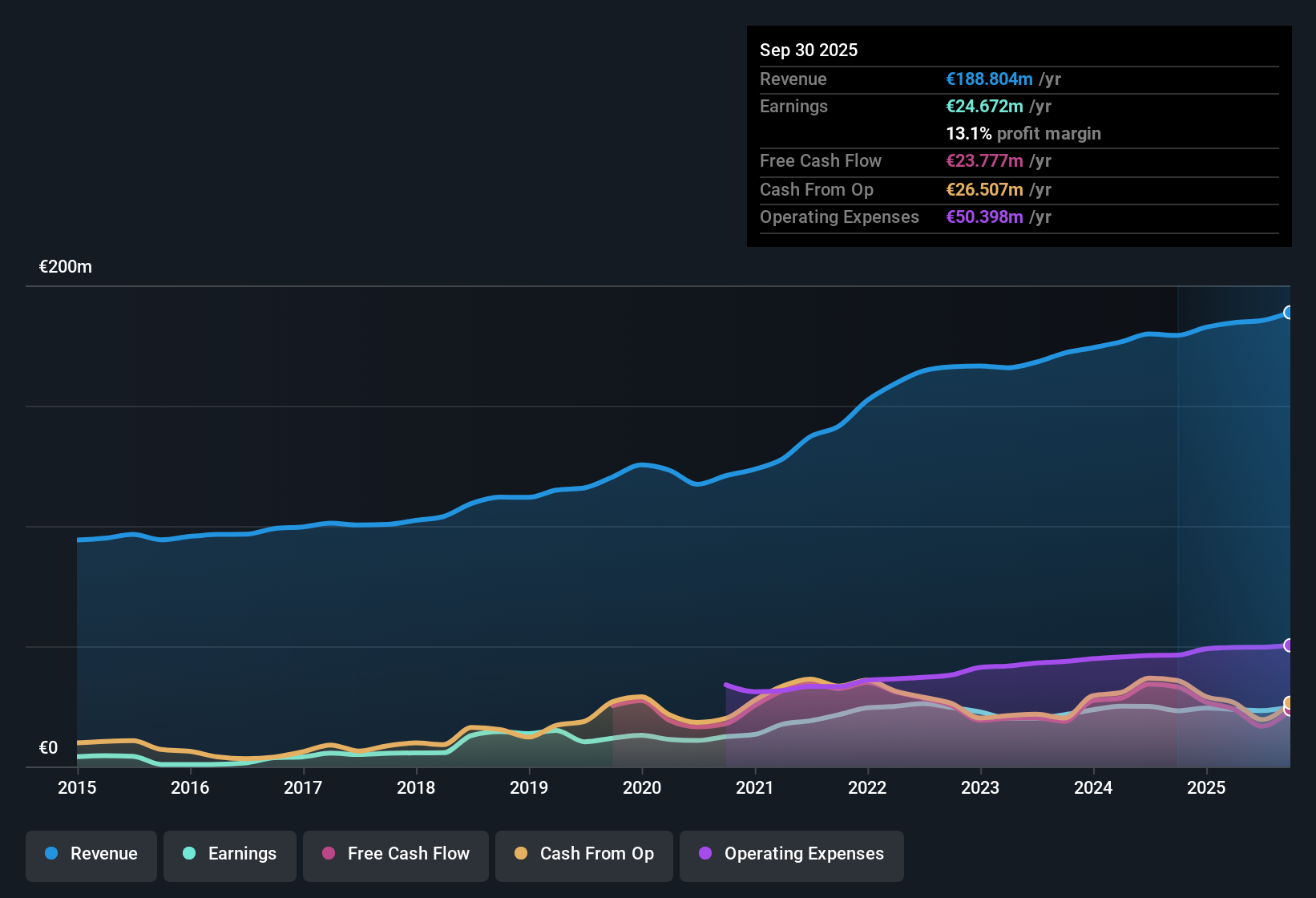

Marimekko (HLSE:MEKKO) reported revenue growth projected at 5.7% per year, overtaking the Finnish market average of 4.2%. EPS is forecast to climb 11.9% annually, though this pace trails the market’s expected 16.7% gain. A net profit margin of 13.1% puts Marimekko slightly ahead of last year’s 12.9%, and five-year annualized earnings growth stands at 7%, with the most recent year reaching 7.1%. Investors may see ongoing profit growth and a recent margin uptick as positive signals, especially given the attractive rewards and absence of flagged risks.

See our full analysis for Marimekko Oyj.Next up, we will see how the latest figures measure against the most talked-about market narratives. Sometimes the numbers confirm the story, while other times they call it into question.

See what the community is saying about Marimekko Oyj

Global Expansion Delivers 14% International Sales Growth

- International sales jumped 14% in the most recent period, building on Marimekko’s global retail and omnichannel investments and highlighting growing demand outside Finland.

- Analysts' consensus view sees this as confirmation that Marimekko’s bet on new flagship stores in Paris and Asia-Pacific, digital launches in New Zealand and Canada, and global brand tie-ups is paying off.

- This expansion is expected to set the foundation for stronger, more geographically diversified revenue streams in upcoming years.

- International direct-to-consumer channels are widely viewed as crucial to improving gross margins and protecting earnings quality over time.

- Consensus narrative points to Marimekko’s ability to capture new customer bases and increase brand visibility abroad as central pillars of its long-term growth strategy. 📊 Read the full Marimekko Oyj Consensus Narrative.

Profit Margin Rises to 13.1% Despite Fixed Cost Pressures

- Net profit margin edged up to 13.1% from 12.9% year over year, outpacing the Finnish market despite an uptick in fixed costs tied to expansion, new store launches, higher personnel expenses, and digital investments.

- Consensus narrative highlights that, while rising costs can compress margins, Marimekko’s ongoing focus on sustainability and ethical supply chains underpins brand loyalty and pricing power.

- The steady margin improvement reassures analysts about Marimekko’s resilience, offsetting concerns about increased spending and short-term cost pressures.

- Continued investment in transparency resonates with consumers, potentially supporting further profitability gains if brand loyalty and premium positioning endure.

Valuation: Trading Below DCF Fair Value, But Premium to Peers

- While Marimekko’s share price of €12.78 reflects a price-to-earnings ratio of 20.9x, making it look more expensive than both peers and the European luxury industry average of 20.3x, it is still trading below its DCF fair value of €17.53.

- According to analysts' consensus, this valuation gap presents a unique tension:

- Investors may be willing to accept the current premium if ongoing profit growth and robust margin trends persist.

- However, with no major risks flagged and sustained growth already factored into current multiples, upside from here may depend on Marimekko exceeding consensus expectations or accelerating international gains further.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Marimekko Oyj on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you interpret the figures from a different angle? Share your perspective and craft your unique narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Marimekko Oyj.

See What Else Is Out There

Marimekko’s valuation appears elevated compared to peers, and further upside may be limited if profit growth and international expansion do not exceed expectations.

If you’re seeking better value for your investment, consider these 839 undervalued stocks based on cash flows, where you can find stocks trading at more attractive valuations based on cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:MEKKO

Marimekko Oyj

A lifestyle design company, designs, manufactures, and sells clothing, bags and accessories, and interior decoration products worldwide.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives