The European market has shown mixed signals recently, with the pan-European STOXX Europe 600 Index experiencing a slight decline as expectations for further interest rate cuts from the European Central Bank waned. Despite these fluctuations, opportunities still exist within niche areas of the market. Penny stocks—often smaller or newer companies—remain relevant as they can offer unique growth potential and value that larger firms might overlook. In this article, we explore three penny stocks that stand out for their financial strength and potential to provide compelling investment opportunities.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Lucisano Media Group (BIT:LMG) | €1.08 | €16.04M | ✅ 4 ⚠️ 5 View Analysis > |

| Maps (BIT:MAPS) | €3.30 | €43.83M | ✅ 4 ⚠️ 1 View Analysis > |

| DigiTouch (BIT:DGT) | €2.05 | €28.33M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €224.21M | ✅ 2 ⚠️ 2 View Analysis > |

| Altri SGPS (ENXTLS:ALTR) | €4.88 | €1B | ✅ 3 ⚠️ 2 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.934 | €75.37M | ✅ 2 ⚠️ 4 View Analysis > |

| High (ENXTPA:HCO) | €4.02 | €78.64M | ✅ 1 ⚠️ 5 View Analysis > |

| Faes Farma (BME:FAE) | €4.42 | €1.38B | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.045 | €282.66M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 280 stocks from our European Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

DigiTouch (BIT:DGT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: DigiTouch S.p.A. offers digital marketing and transformation services in Italy, with a market capitalization of €28.33 million.

Operations: The company's revenue is derived from three main segments: Technology Services (€24.65 million), Marketing Services (€10.89 million), and E-Commerce Services (€3.16 million).

Market Cap: €28.33M

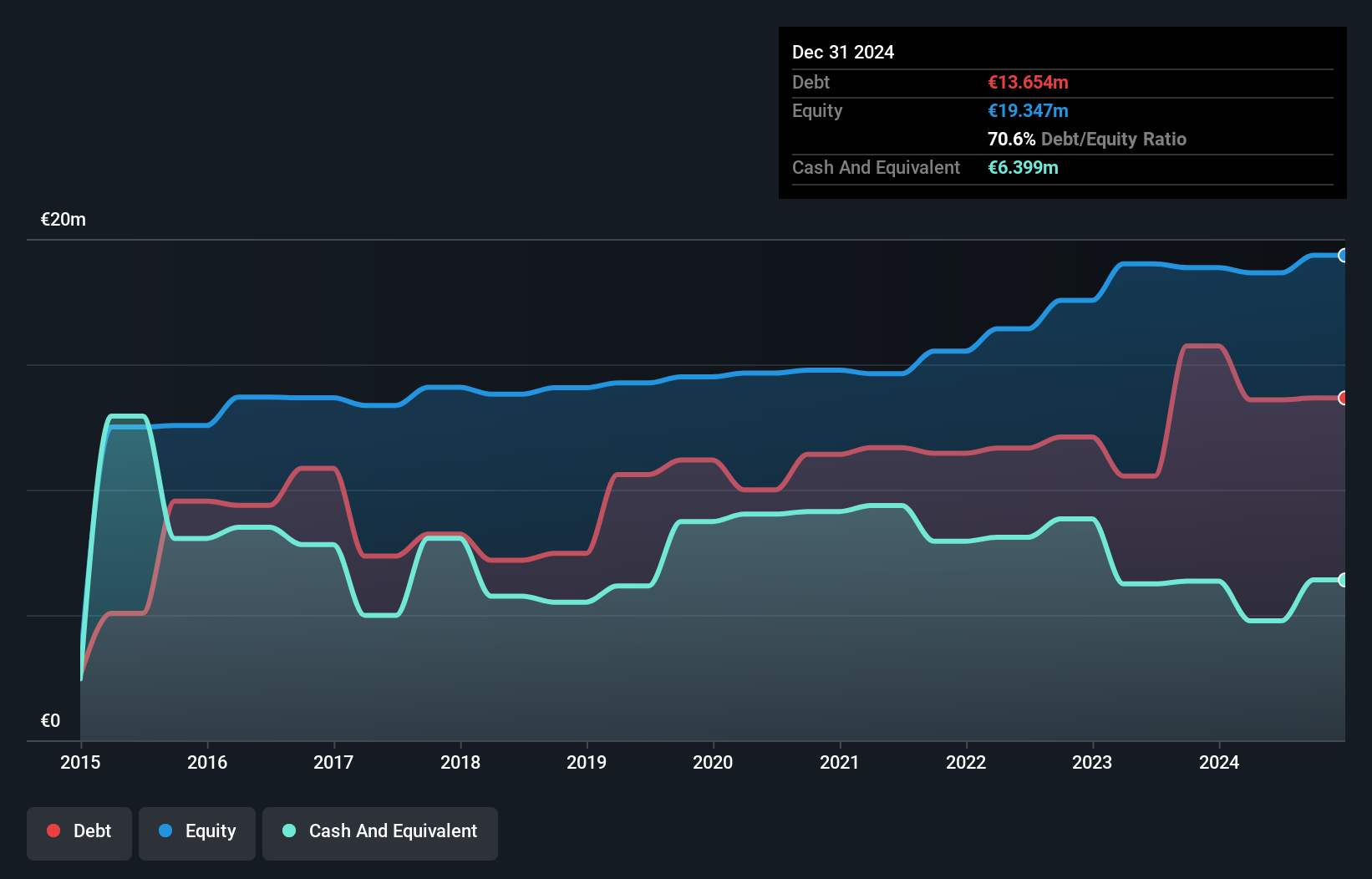

DigiTouch S.p.A., with a market cap of €28.33 million, has demonstrated financial stability and growth potential within the penny stock category. The company reported half-year revenue of €19.8 million, slightly up from the previous year, and net income of €0.82 million remains steady. DigiTouch's short-term assets exceed both its short- and long-term liabilities, indicating solid liquidity management. Although earnings growth slowed to 6.6% last year compared to its five-year average of 22.5%, it still outpaced the broader media industry decline, highlighting resilience in challenging conditions while maintaining high-quality earnings and satisfactory debt levels.

- Dive into the specifics of DigiTouch here with our thorough balance sheet health report.

- Assess DigiTouch's future earnings estimates with our detailed growth reports.

Fondia Oyj (HLSE:FONDIA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Fondia Oyj is a legal services provider operating mainly in Finland, Sweden, Estonia, and Lithuania with a market cap of €17.01 million.

Operations: The company generates its revenue primarily from Business Services, amounting to €24.51 million.

Market Cap: €17.01M

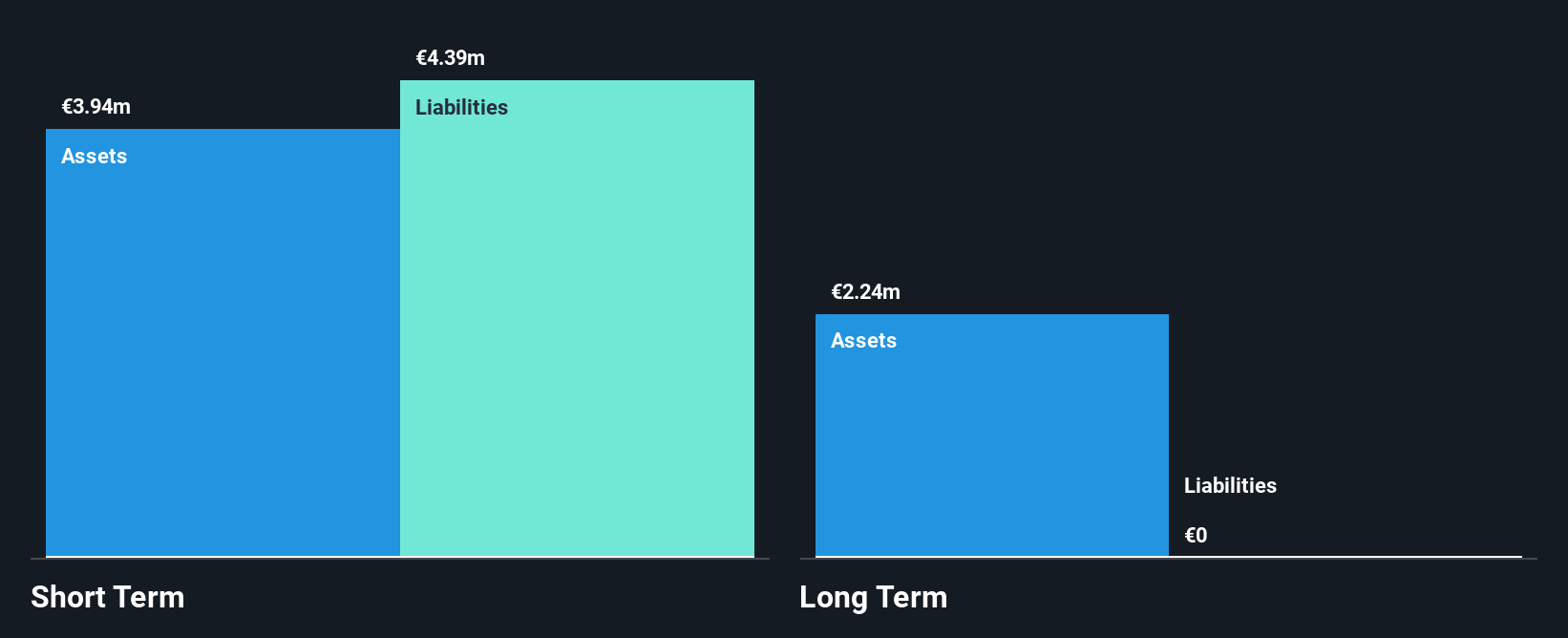

Fondia Oyj, with a market cap of €17.01 million, operates without debt and has no long-term liabilities, providing a stable financial foundation despite current unprofitability. Recent half-year results show a dip in sales to €12.67 million from the previous year, alongside a net loss of €0.061 million compared to prior net income. The company forecasts earnings growth of 48.08% annually but faces challenges as short-term assets (€3.9M) fall short of covering liabilities (€4.4M). Despite these hurdles, Fondia's shares trade at 50.1% below estimated fair value, suggesting potential investment appeal within the penny stock segment.

- Click here to discover the nuances of Fondia Oyj with our detailed analytical financial health report.

- Gain insights into Fondia Oyj's future direction by reviewing our growth report.

Merus Power Oyj (HLSE:MERUS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Merus Power Oyj designs, manufactures, and sells battery energy storage systems and power quality solutions in Finland and internationally, with a market cap of €38.96 million.

Operations: The company generates revenue of €56.25 million from its electric equipment segment.

Market Cap: €38.96M

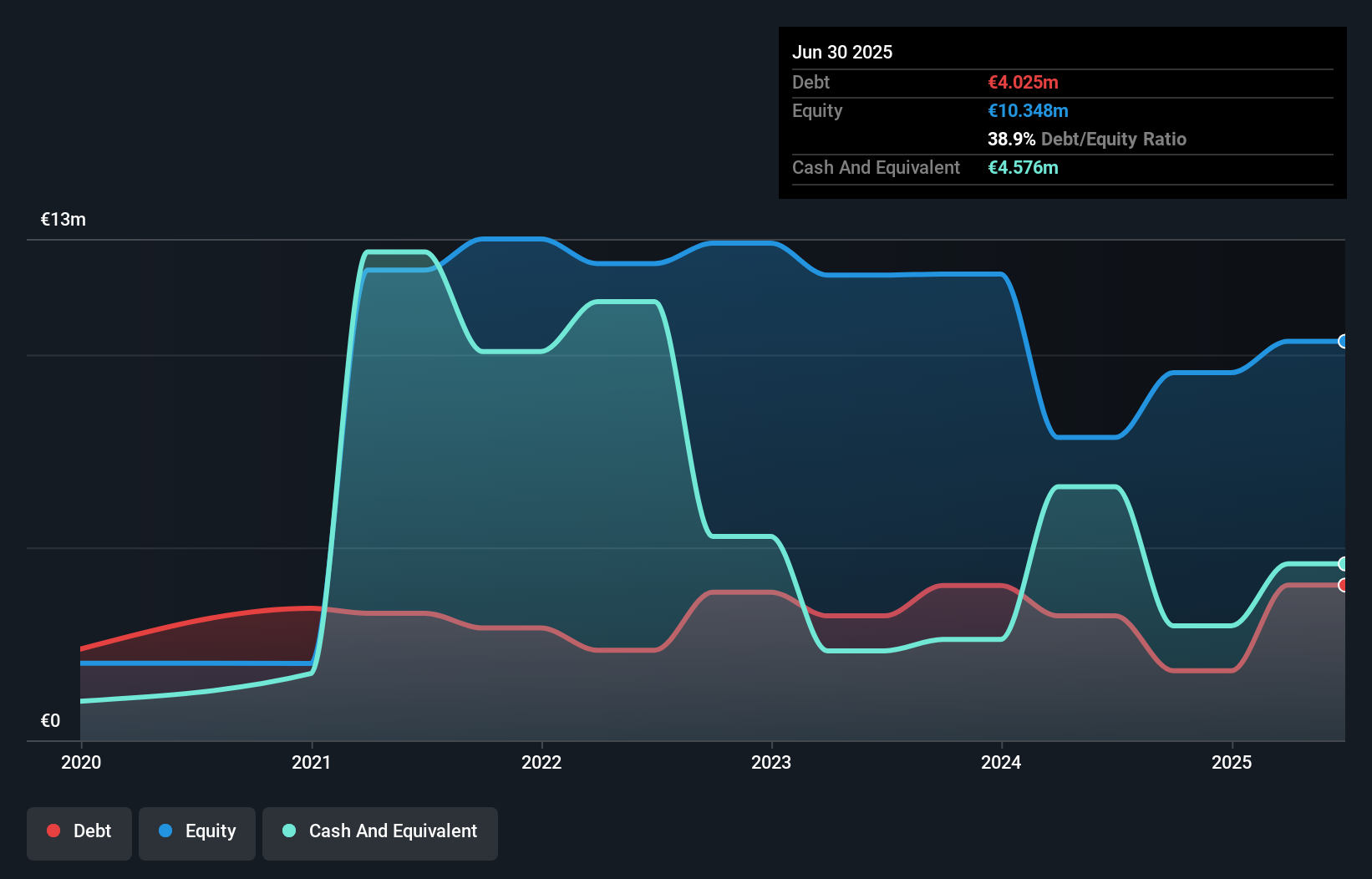

Merus Power Oyj, with a market cap of €38.96 million, has shown significant revenue growth, reporting €25.65 million for the first half of 2025 compared to €7.72 million the previous year. Despite a net loss reduction to €1.18 million from €4.32 million, Merus Power's entry into Poland's energy storage market marks a strategic milestone with an 8 MW/8 MWh project valued at approximately €2.5 million. The company's financial health is bolstered by more cash than debt and short-term assets exceeding liabilities, although its high non-cash earnings and volatile share price present ongoing challenges in this penny stock landscape.

- Get an in-depth perspective on Merus Power Oyj's performance by reading our balance sheet health report here.

- Explore Merus Power Oyj's analyst forecasts in our growth report.

Summing It All Up

- Dive into all 280 of the European Penny Stocks we have identified here.

- Curious About Other Options? AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:DGT

DigiTouch

Provides digital marketing and transformation services in Italy.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives