What Valmet Oyj (HLSE:VALMT)'s Major Decarbonization Project in Taiwan Means For Shareholders

Reviewed by Sasha Jovanovic

- On November 17, 2025, Valmet Oyj announced it will deliver a CFB boiler, flue gas treatment, and automation system to Cheng Loong Corporation's Houli paper mill in Taiwan, enabling the mill to reduce coal use and cut annual CO2 emissions by 48,000 tonnes.

- The project highlights Valmet's leadership in decarbonization technologies and the company's ability to provide high-efficiency, flexible waste-to-energy solutions for industrial clients.

- We'll examine how this major decarbonization project with Cheng Loong showcases Valmet's expertise and supports its long-term sustainability strategy.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Valmet Oyj Investment Narrative Recap

Investing in Valmet Oyj is based on confidence in the company's ability to lead the global shift toward sustainable industrial solutions and to capture order growth from decarbonization and circularity. While Valmet’s new Taiwan boiler project underscores its market credibility and expertise, this order alone does not materially change near-term catalysts, such as the drive to boost recurring high-margin services, or alleviate the main risk of continued revenue softness and volatility in core industrial segments.

The most relevant recent announcement comes from October 29, when Valmet reaffirmed its full-year net sales guidance, signaling stability amid challenging market conditions. This consistency supports the view that operational improvements and new high-profile contracts may buffer, but not offset, the short-term risks from cyclical demand pressures and the company's reliance on large, capital-heavy projects.

Yet, investors should also keep in mind that, despite the company's advancements in green technologies, recurring service margins are still below target, which could limit...

Read the full narrative on Valmet Oyj (it's free!)

Valmet Oyj's outlook anticipates €5.9 billion in revenue and €557.7 million in earnings by 2028. This scenario requires a 4.1% annual revenue growth rate and an increase in earnings of €302.7 million from the current level of €255.0 million.

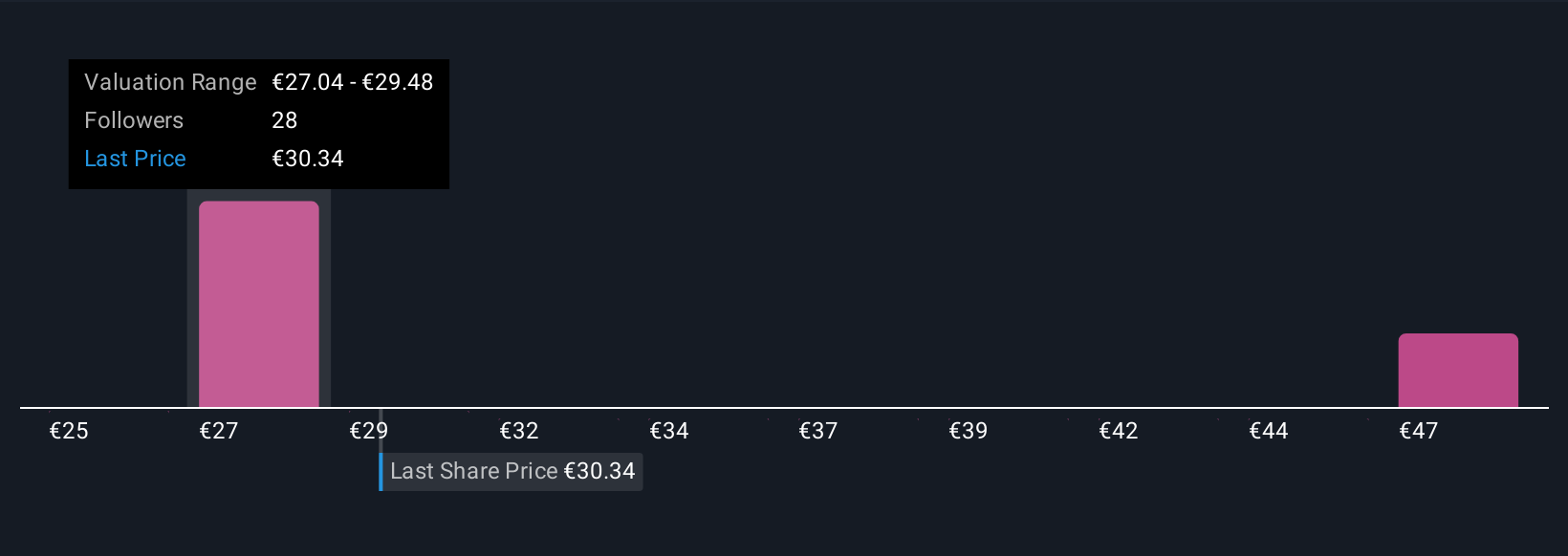

Uncover how Valmet Oyj's forecasts yield a €28.46 fair value, a 4% upside to its current price.

Exploring Other Perspectives

Four individual fair value estimates from the Simply Wall St Community range from €24.60 to €51.61 per share. With variability in these community views, keep in mind that recurring margin weakness in Valmet’s Biomaterial Solutions segment continues to be a watchpoint for overall profitability.

Explore 4 other fair value estimates on Valmet Oyj - why the stock might be worth 10% less than the current price!

Build Your Own Valmet Oyj Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Valmet Oyj research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Valmet Oyj research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Valmet Oyj's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:VALMT

Valmet Oyj

Develops and supplies process technologies, automation, and services for the pulp, paper, and energy industries in North America, South America, China, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives