Kalmar Oyj's (HEL:KALMAR) Price Is Out Of Tune With Revenues

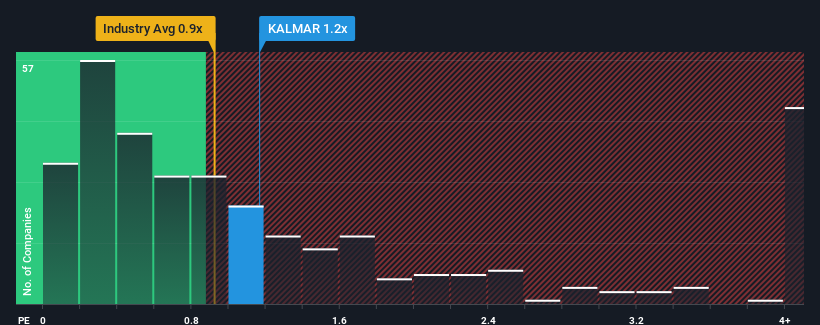

With a median price-to-sales (or "P/S") ratio of close to 0.8x in the Machinery industry in Finland, you could be forgiven for feeling indifferent about Kalmar Oyj's (HEL:KALMAR) P/S ratio of 1.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Kalmar Oyj

What Does Kalmar Oyj's P/S Mean For Shareholders?

Kalmar Oyj could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Kalmar Oyj's future stacks up against the industry? In that case, our free report is a great place to start.How Is Kalmar Oyj's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Kalmar Oyj's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 12%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 18% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 1.3% per annum during the coming three years according to the six analysts following the company. With the industry predicted to deliver 3.8% growth each year, the company is positioned for a weaker revenue result.

In light of this, it's curious that Kalmar Oyj's P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

When you consider that Kalmar Oyj's revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Kalmar Oyj that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Kalmar Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:KALMAR

Kalmar Oyj

Provides heavy material handling equipment and services for ports, terminals, distribution centres, manufacturing, and heavy logistics industries in the Americas, Europe, Asia, the Middle East, and Africa.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives