- Finland

- /

- Industrials

- /

- HLSE:ASPO

Aspo Oyj (HLSE:ASPO) Earnings Jump 609%: Margin Rebound Challenges Bearish Narratives on Sustainability

Reviewed by Simply Wall St

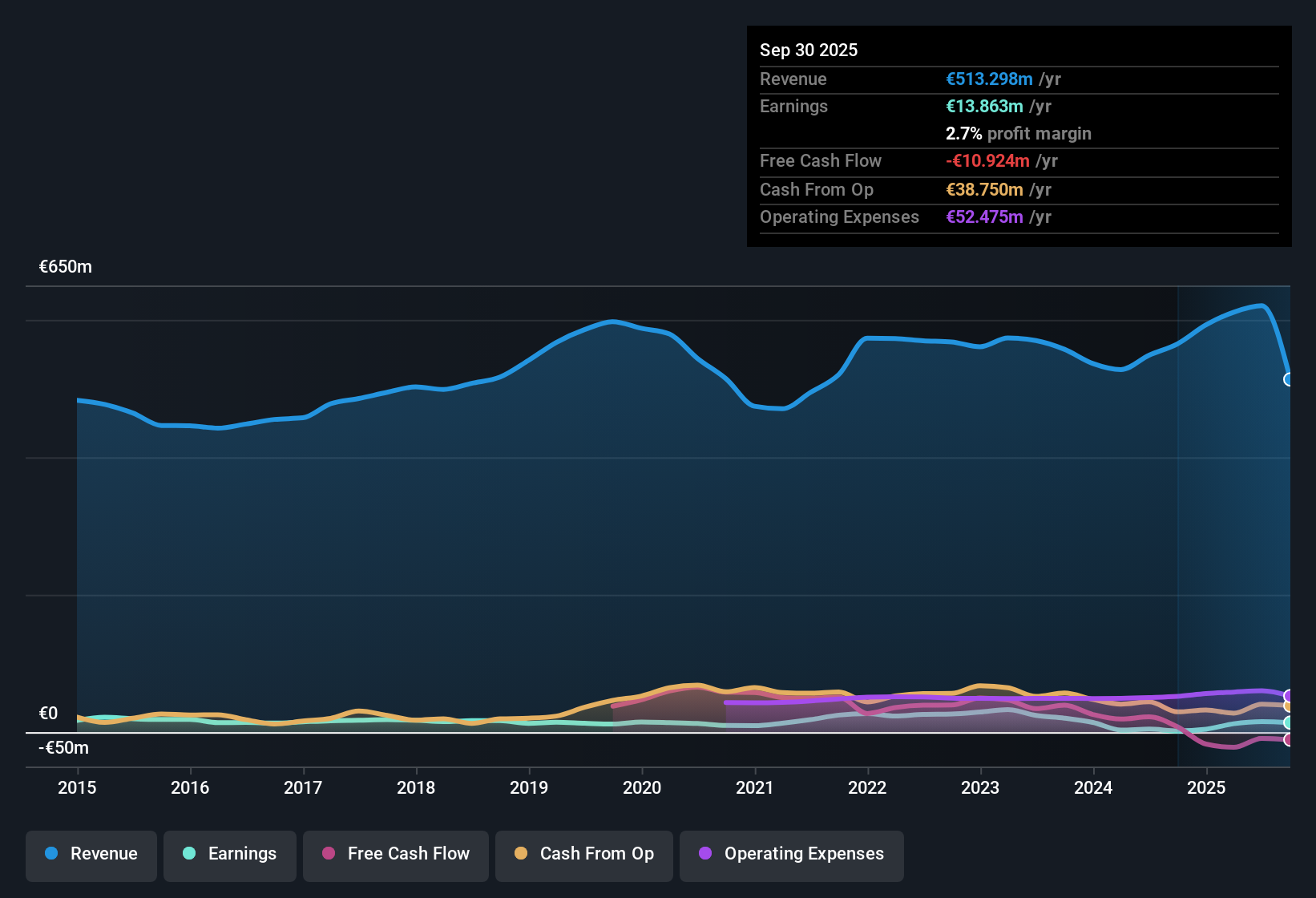

Aspo Oyj (HLSE:ASPO) reported a striking 609.1% surge in earnings over the past year, with net profit margins expanding to 2.7% from just 0.3% a year ago. While this turnaround will catch investors’ attention, average annual earnings have actually declined by 12.1% per year over the last five years, pointing to questions about how durable this rebound really is. On the upside, the share price of €6.5 sits just below the estimated fair value of €6.67, and quality of earnings remains high despite forecasts for slower growth compared to the broader Finnish market.

See our full analysis for Aspo Oyj.Next up, we will see how these headline results compare with some of the most widely held narratives among market watchers and investors. We will also consider whether the new data aligns with the established story or goes against prevailing expectations.

See what the community is saying about Aspo Oyj

Margin Expansion Forecast: 2.5% to 4.0%

- Analysts see profit margins moving from 2.5% today to 4.0% over the next three years, pointing to continued improvements in earnings quality despite modest revenue growth and competition.

- According to analysts' consensus view, expected margin gains reflect management’s cost-saving efforts and investments in operational efficiency. This outlook also highlights a tension against sector headwinds:

- On one hand, ongoing supply chain automation and new "Green Coaster" vessels are highlighted as drivers of lower operating costs and stronger net margins, suggesting further upside if execution continues.

- On the other hand, consensus recognizes risk that weak demand in segments like ESL and overreliance on acquisitions could cap these profitability gains, exposing the company if external market risks worsen.

- For a deeper dive into the balanced perspective shaping Aspo's outlook and how these margin targets are forecasted to play out, check the full analyst and investor consensus. 📊 Read the full Aspo Oyj Consensus Narrative.

Portfolio Shakeup: Leipurin Sale and M&A Ambitions

- The sale of Leipurin, previously a record profit contributor for the group, increases Aspo's reliance on Telko’s inorganic, acquisition-led growth, with recent organic volume described as "low single digits."

- Analysts' consensus view notes this strategic pivot could both unlock value and heighten execution risk:

- By reinvesting proceeds from the sale into higher-margin specialty chemicals and M&A, Aspo may deepen exposure to more profitable business lines and long-term stability.

- However, critics highlight that moving away from stable segments creates higher dependence on volatile trading and the need for flawless integration, with ongoing market softness possibly complicating the transition.

Valuation at 14.7x PE: Peer Discount, Industry Premium

- Aspo trades on a price-to-earnings ratio of 14.7x, making it more expensive than direct peers at 13.5x but considerably cheaper than the broader European Industrials average at 21.7x.

- Analysts' consensus view sees this valuation driven by faith in high-quality earnings and improving margins, but with two perspectives:

- On the positive side, continued EPS growth and strong ESG credentials support the idea that Aspo could rerate closer to industry multiples as structural changes gain traction.

- Yet, with slower forecasted sales growth and ongoing financial risks, bears argue that the premium to peers may not be justified unless execution on portfolio reforms and margin gains stays fully on track.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Aspo Oyj on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the data? Share your perspective and craft your personal narrative in just a few minutes with Do it your way.

A great starting point for your Aspo Oyj research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite signs of margin progress, Aspo faces uncertain sales growth and growing dependence on volatile segments. This raises questions about its ability to deliver steady results.

If consistent performance matters most, use our stable growth stocks screener (2087 results) to zero in on companies with a demonstrated track record of reliable growth and earnings expansion through changing market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:ASPO

Aspo Oyj

Provides shipping services in Finland, Scandinavia, the Baltic countries, other European countries, and internationally.

Proven track record and slightly overvalued.

Market Insights

Community Narratives