- Finland

- /

- Auto Components

- /

- HLSE:TYRES

Is Nokian Renkaat Set for a Recovery After This Week’s 2.7% Share Price Gain?

Reviewed by Bailey Pemberton

Thinking about buying or holding Nokian Renkaat Oyj stock? You are not alone. This Finnish tire maker has been on many investors’ watchlists lately, especially after its rollercoaster ride on the stock market. Just this week, the price ticked up by 2.7%, which grabbed some attention. If you zoom out, the picture is more nuanced. Over the past month the stock is down by just 0.7%, and the year-to-date return sits at a modest 5.7%. Looking back even farther, there is a clear hangover from years past, with a one-year decline of 0.6%, three-year slide of 11.7%, and an eye-catching five-year drop of 59.4%.

A lot of investors attribute this turbulent performance to broader market shifts and sector-specific pressures. Nokian Renkaat has been navigating challenging international dynamics, particularly after reevaluating its position in Russia. This significantly altered its growth trajectory and risk profile. These moves have changed how analysts and market players think about potential upside and downside risks, leading some to believe that there is fresh growth potential if the company can execute its new strategy.

But the heart of the matter for most investors is simple: is Nokian Renkaat undervalued or not? On our value score, the company notches a 3 out of 6, meaning it is undervalued by half the checks we use. This is a mixed but encouraging signal. Next, let us break down what those valuation methods actually tell us, and why there might be an even more powerful way to think about value lurking around the corner.

Why Nokian Renkaat Oyj is lagging behind its peers

Approach 1: Nokian Renkaat Oyj Discounted Cash Flow (DCF) Analysis

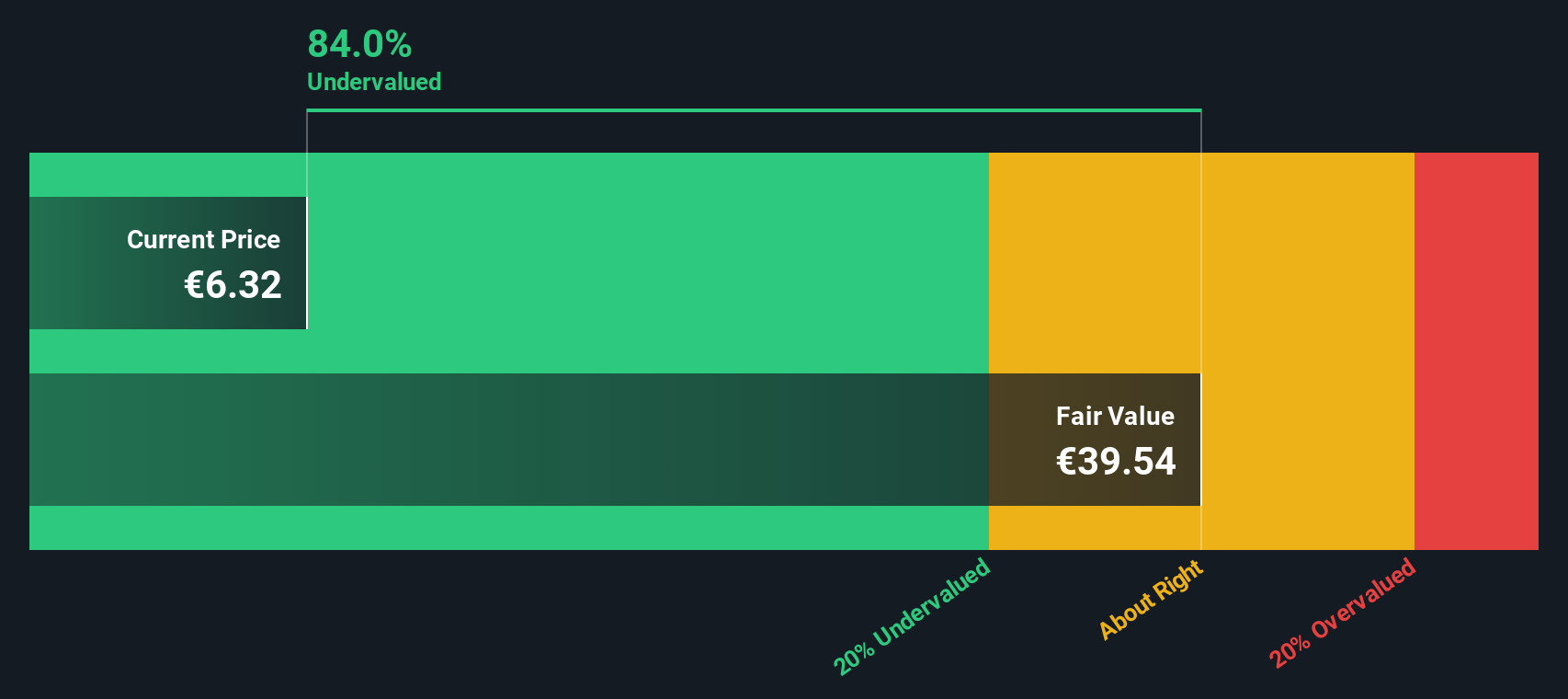

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to the present using an appropriate rate. This helps investors gauge whether a stock is undervalued or overvalued compared to its current market price.

For Nokian Renkaat Oyj, the most recent twelve months saw a negative Free Cash Flow (FCF) of -€161.7 million. However, analyst projections suggest a dramatic expected turnaround. By 2027, FCF is forecasted to climb to €79.9 million, and further extrapolations indicate a potential rise to over €550 million by 2035. These projections reflect both a recovery phase and later stages of steady growth, with Simply Wall St extending estimates beyond analyst forecasts to provide a longer-term view.

Based on these cash flow projections, the DCF model calculates an intrinsic value of €37.23 per share. Notably, this implies the stock is currently trading at a 78.8% discount to its estimated fair value, suggesting considerable potential upside for long-term investors.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Nokian Renkaat Oyj is undervalued by 78.8%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

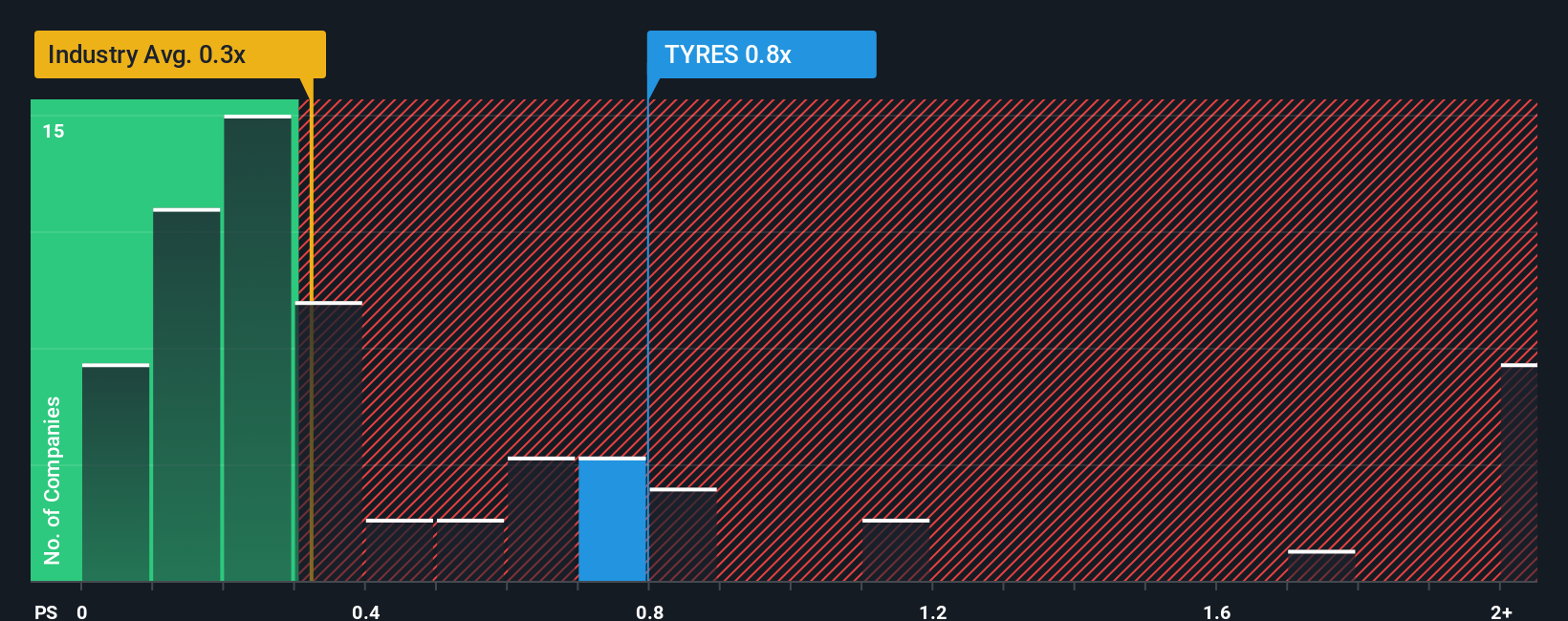

Approach 2: Nokian Renkaat Oyj Price vs Sales

The Price-to-Sales (P/S) ratio is often seen as the most useful valuation metric for companies like Nokian Renkaat Oyj, especially when profitability is variable due to sector challenges or company transitions. The P/S ratio sidesteps the earnings fluctuations and focuses more directly on the relationship between a company’s stock price and its top-line revenue. This makes it a valuable tool for assessing valuation in tough operating environments.

Growth prospects and risk play a significant role in where a fair P/S ratio should fall. Higher expected growth and lower risk typically warrant a higher P/S, while slower-growing or riskier firms usually command lower multiples. For Nokian Renkaat, the current P/S ratio is 0.81x. This is below both the industry average of 0.91x and its peer group average of 0.93x. This signals the market may be applying a discount to the company’s sales compared to others in the Auto Components sector.

Simply Wall St’s proprietary “Fair Ratio” metric takes the analysis further. Unlike plain averages, the Fair Ratio incorporates not just sales growth and profitability, but also company-specific features such as risk profile, market capitalization, and profit margins, as well as broader industry factors. This tailored approach aims to arrive at a more realistic benchmark of what Nokian Renkaat’s multiple should be in the current climate, rather than relying solely on historical peer or industry comparisons.

In this case, since the Fair Ratio and actual P/S multiple are within 0.10 of each other, the stock’s valuation appears to be about right based on its current sales, growth outlook, and risk profile.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Nokian Renkaat Oyj Narrative

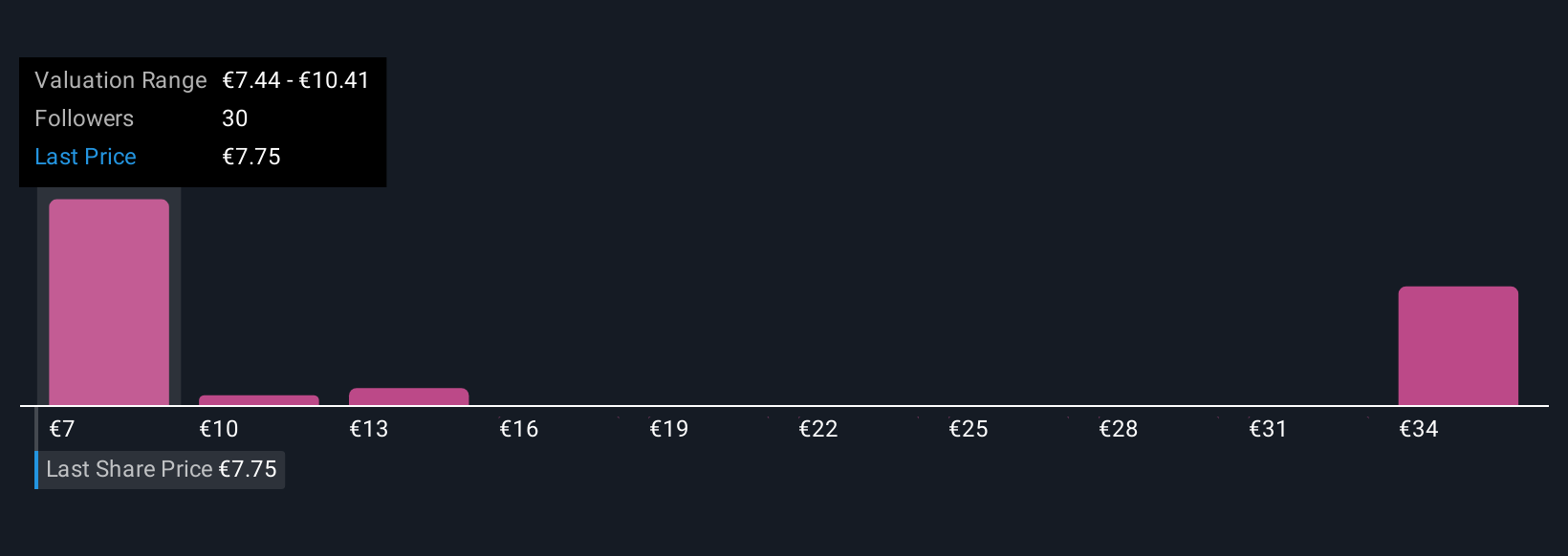

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story about a company—how you see its future, what you expect for revenue, earnings, and profit margins, and what you think a fair share price should be. Rather than only relying on financial ratios or models, Narratives help you connect the company's bigger picture—its strategy, recent news, and industry trends—with your own forecast and valuation.

On Simply Wall St, Narratives are a powerful yet easy-to-use tool available on the Community page, where millions of investors share perspectives. You can create your own Narrative, or browse others’, and see how each one links a company’s story directly to a financial forecast and a calculated fair value. When new information becomes available, such as a quarterly result or major announcement, Narratives update automatically, keeping your insights current.

This approach helps investors decide when to buy or sell by comparing fair value to the current share price. For instance, some Nokian Renkaat Oyj Narratives see a strong recovery ahead and a high fair value, while others remain cautious and set much lower targets, giving every investor a chance to act on what they believe.

Do you think there's more to the story for Nokian Renkaat Oyj? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nokian Renkaat Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:TYRES

Nokian Renkaat Oyj

Develops and manufactures tires for passenger cars, trucks, and heavy machineries in Nordics, the rest of Europe, the Americas, and internationally.

Reasonable growth potential and fair value.

Market Insights

Community Narratives