- Spain

- /

- Telecom Services and Carriers

- /

- BME:TEF

Telefónica (BME:TEF) Revenue Decline Challenges Recovery Hopes Despite Deep Value Discount

Reviewed by Simply Wall St

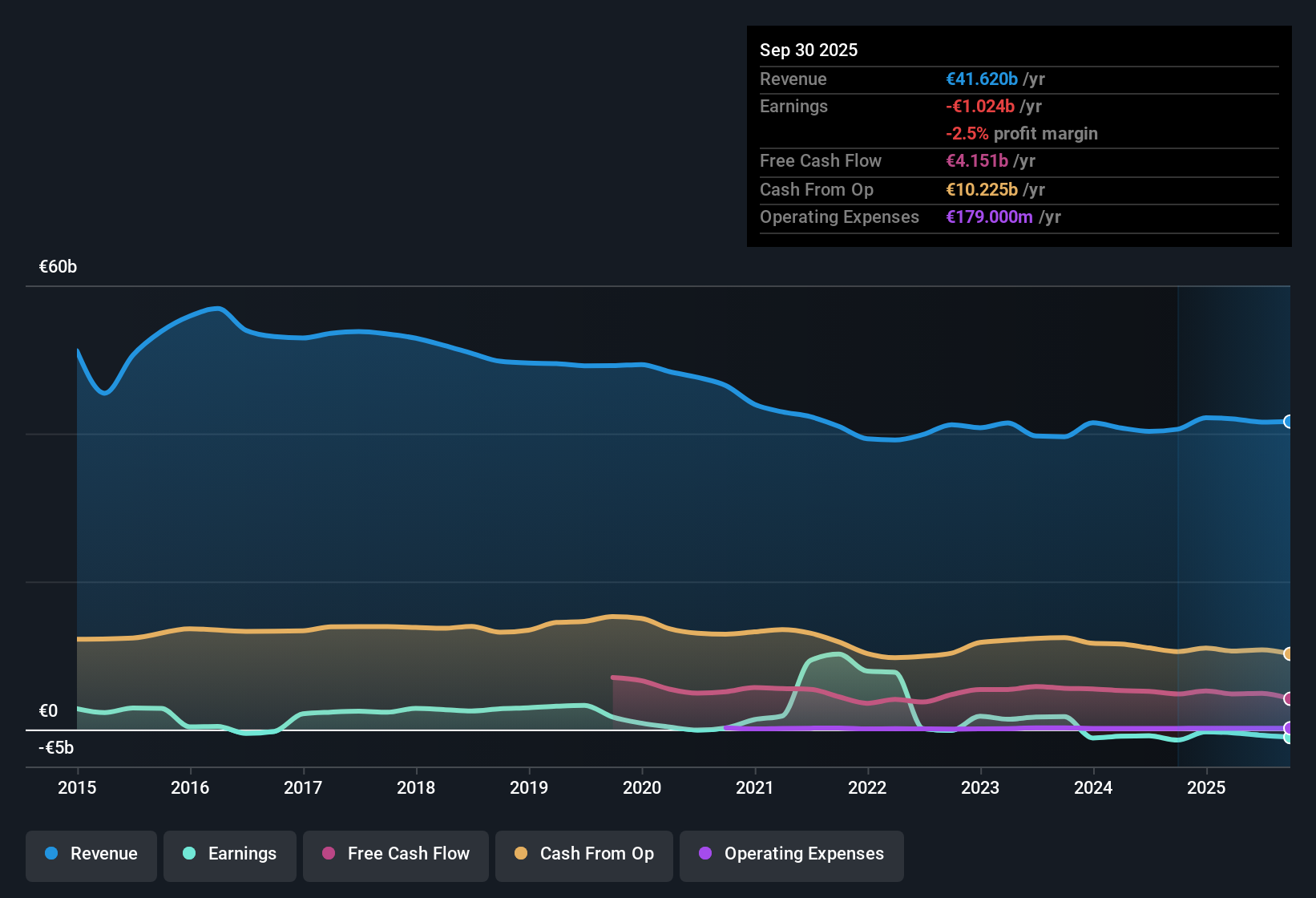

Telefónica (BME:TEF) faces headwinds with revenue forecast to decline at 1.3% per year for the next three years, while losses have widened over the last five years at a rate of 55.4% per year. Analysts, however, are projecting a turnaround with profitability expected within the next three years and earnings growth predicted at a robust 59.92% per year. Despite current unprofitability, Telefónica’s price-to-sales ratio of 0.5x positions the stock well below both peer and industry averages, suggesting solid relative value at its current share price of €3.63 compared to an estimated fair value of €7.57.

See our full analysis for Telefónica.Next, we will see how these headline numbers stack up against the dominant market narratives and whether recent results reinforce or challenge popular perceptions.

See what the community is saying about Telefónica

Profit Margins Projected to Rise from -1.9% to 5.7%

- Analysts expect Telefónica’s profit margin to shift from -1.9% today to 5.7% within the next three years, marking a turnaround from extended losses.

- According to the analysts' consensus view, this margin improvement is tied to aggressive digital expansion and cost savings:

- Accelerated fiber and 5G rollout, along with the shutdown of legacy copper infrastructure, is expected to add at least 1.5 percentage points to Spanish margins over three years. This directly supports forecasts for higher overall profitability.

- Mix improvement from IT, cloud, big data, and cybersecurity in both Spain and Brazil is projected to boost higher-margin services. This underlines why bulls remain confident about the margin rebound even with other headwinds in play.

- Consensus narrative notes these trends lock in better top-line and margin growth, putting focus on execution risks as new digital revenue streams scale up.

- For the in-depth take on how the consensus view stacks up against today’s results and margin forecasts, check the full narrative. 📊 Read the full Telefónica Consensus Narrative.

Balance Sheet: Debt Still Restricts Flexibility

- Telefónica’s high leverage is identified as its ongoing principal risk, with debt levels exceeding the company’s guidance targets despite asset sales totaling over €3 billion.

- Bears emphasize that while improvements are coming, high debt continues to cast a shadow over investment and cash flow flexibility:

- The company’s ability to redeploy capital into high-growth areas is constrained, potentially limiting both margin and revenue growth outside of its four core European and Latin American markets.

- Exposure to currency swings in Latin America and persistent stagnation in core markets like Spain and Germany challenge sustainable margin recovery and heighten the risk in meeting long-term profit forecasts.

Valuation Remains Appealing Against Peers and DCF Fair Value

- Telefónica trades at a price-to-sales ratio of 0.5x, well below both the peer average (2.9x) and the industry average (1.1x). The current share price of €3.63 sits 52% below its DCF fair value of €7.57.

- Consensus narrative highlights that despite sluggish revenue prospects, the discount to DCF fair value and deep pricing versus peers are drawing value-focused investors:

- The analyst consensus price target of €4.44 closely matches the current share price, signaling the market already prices in the risks alongside recovery hopes about future cash flow and margin growth.

- Investors are encouraged to sense check whether the implied profit and margin rebound supporting fair value can realistically be achieved, as low pricing could mask persistence of capital structure and operational risks.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Telefónica on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on Telefónica’s figures? Share your perspective and shape the story in just a few minutes. Do it your way

A great starting point for your Telefónica research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Telefónica’s high debt continues to restrict investment flexibility and leaves its profitability and cash flow recovery at risk, despite planned digital expansion.

If you want to prioritize companies with greater financial strength and less leverage risk, check out solid balance sheet and fundamentals stocks screener (1977 results) built to weather uncertainty and protect your capital.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Telefónica might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:TEF

Telefónica

Provides telecommunications services in Europe and Latin America.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives