Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And in our experience, buying the right stocks can give your wealth a significant boost. For example, the eDreams ODIGEO S.A. (BME:EDR) share price is up 88% in the last 5 years, clearly besting the market decline of around 13% (ignoring dividends).

View our latest analysis for eDreams ODIGEO

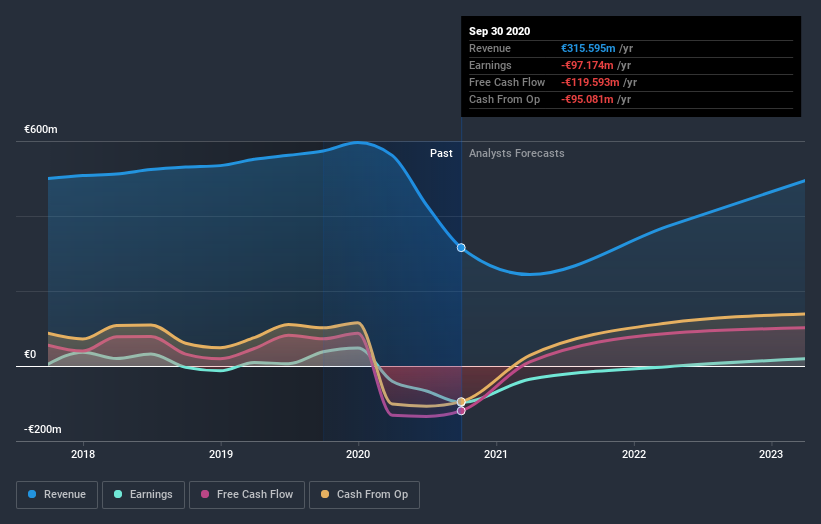

eDreams ODIGEO isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

For the last half decade, eDreams ODIGEO can boast revenue growth at a rate of 0.6% per year. Put simply, that growth rate fails to impress. The modest growth is probably broadly reflected in the share price, which is up 13%, per year over 5 years. We'd be looking for the underlying business to grow revenue a bit faster.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on eDreams ODIGEO's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While it's certainly disappointing to see that eDreams ODIGEO shares lost 4.8% throughout the year, that wasn't as bad as the market loss of 11%. Longer term investors wouldn't be so upset, since they would have made 13%, each year, over five years. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for eDreams ODIGEO you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ES exchanges.

If you decide to trade eDreams ODIGEO, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BME:EDR

eDreams ODIGEO

Operates as an online travel company in France, Southern Europe, Northern Europe, and internationally.

Solid track record and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

PRME remains a long shot but publication in the New England Journal of Medicine helps.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026