- Spain

- /

- Entertainment

- /

- BME:SQRL

Vértice Trescientos Sesenta Grados'(BME:VER) Share Price Is Down 12% Over The Past Year.

It's easy to match the overall market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. That downside risk was realized by Vértice Trescientos Sesenta Grados, S.A. (BME:VER) shareholders over the last year, as the share price declined 12%. That's well below the market decline of 7.8%. We wouldn't rush to judgement on Vértice Trescientos Sesenta Grados because we don't have a long term history to look at.

Check out our latest analysis for Vértice Trescientos Sesenta Grados

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Even though the Vértice Trescientos Sesenta Grados share price is down over the year, its EPS actually improved. It's quite possible that growth expectations may have been unreasonable in the past.

The divergence between the EPS and the share price is quite notable, during the year. So it's easy to justify a look at some other metrics.

Vértice Trescientos Sesenta Grados' revenue is actually up 80% over the last year. Since the fundamental metrics don't readily explain the share price drop, there might be an opportunity if the market has overreacted.

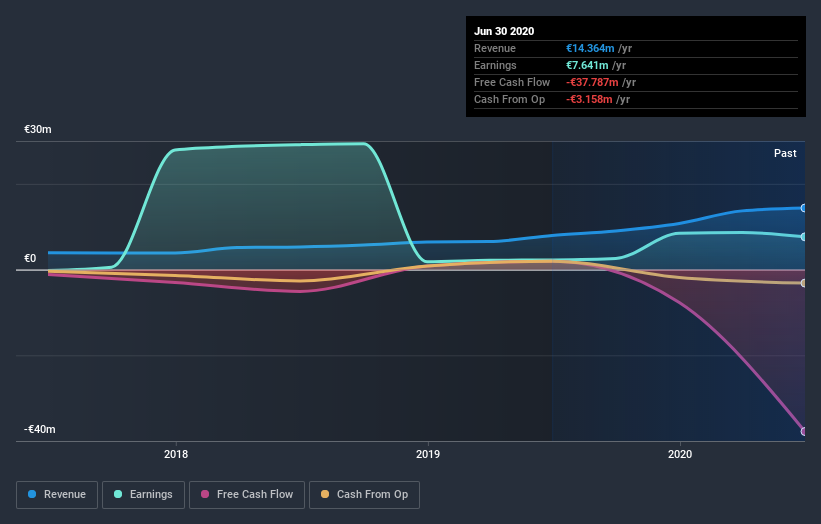

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Vértice Trescientos Sesenta Grados' balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Vértice Trescientos Sesenta Grados shareholders are down 12% for the year, even worse than the market loss of 7.8%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 6.3% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Vértice Trescientos Sesenta Grados has 3 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

We will like Vértice Trescientos Sesenta Grados better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on ES exchanges.

If you’re looking to trade Vértice Trescientos Sesenta Grados, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About BME:SQRL

Squirrel Media

Produces and distributes audiovisual contents in Spain and internationally.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success