As European markets navigate the complexities of escalating global trade tensions, investors are keeping a close watch on potential opportunities amid the volatility. Penny stocks, often representing smaller or less-established companies, remain an intriguing area for those seeking value and growth potential outside of traditional blue-chip investments. Despite their outdated moniker, these stocks can offer compelling prospects when backed by strong financials and clear growth strategies.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.085 | SEK2B | ✅ 4 ⚠️ 0 View Analysis > |

| Transferator (NGM:TRAN A) | SEK2.63 | SEK239.12M | ✅ 2 ⚠️ 3 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.49 | SEK261.7M | ✅ 4 ⚠️ 3 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.72 | SEK226.32M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.58 | PLN121.34M | ✅ 3 ⚠️ 2 View Analysis > |

| FAE Technology (BIT:FAE) | €2.27 | €45.46M | ✅ 4 ⚠️ 3 View Analysis > |

| Cellularline (BIT:CELL) | €2.51 | €52.94M | ✅ 4 ⚠️ 2 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.98 | €32.82M | ✅ 3 ⚠️ 3 View Analysis > |

| Arcure (ENXTPA:ALCUR) | €4.0505 | €23.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.16 | €298.22M | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 431 stocks from our European Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Ercros (BME:ECR)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ercros, S.A. is a Spanish company that manufactures and sells basic chemicals, intermediate chemicals, and pharmaceuticals with a market cap of €267.91 million.

Operations: Ercros generates its revenue from three main segments: Chlorine Derivatives (€386.20 million), Intermediate Chemicals (€194.58 million), and Pharmaceuticals (€62.64 million).

Market Cap: €267.91M

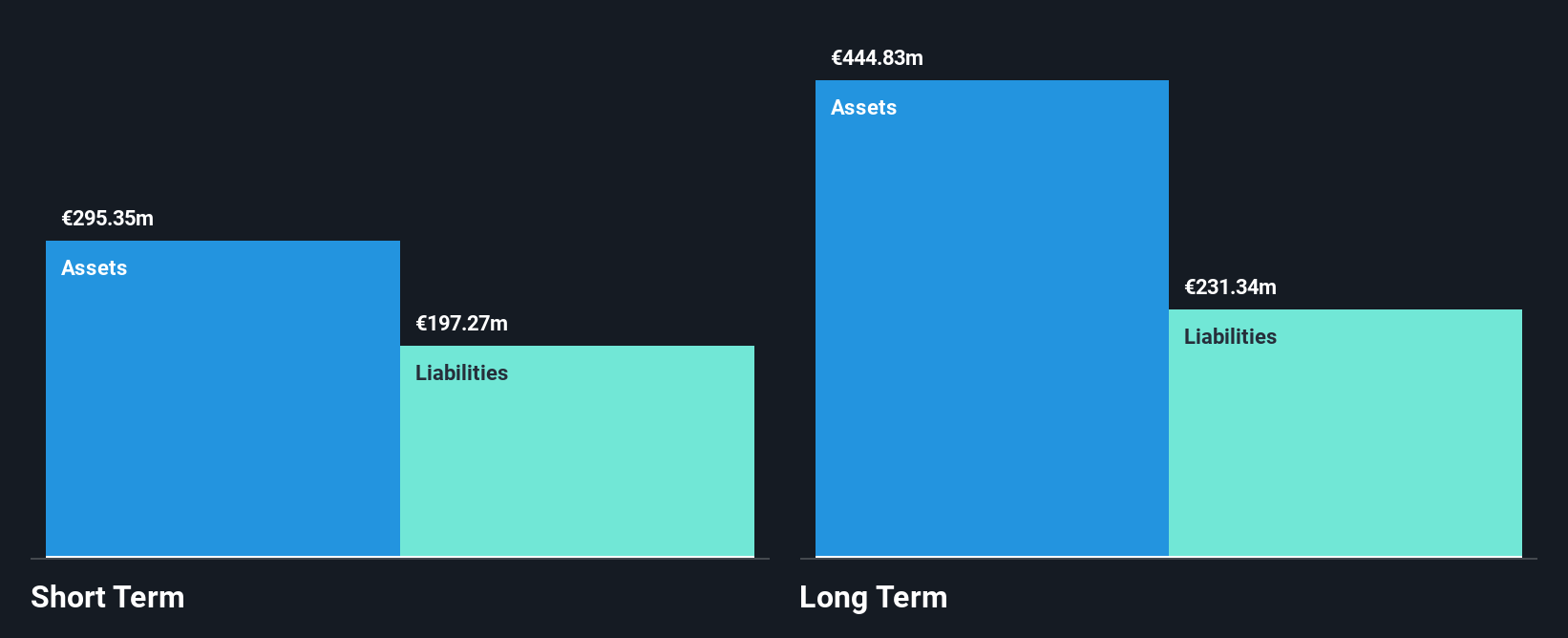

Ercros, S.A., with a market cap of €267.91 million, operates in the chemicals sector and has faced financial challenges recently. Despite generating significant revenue from its Chlorine Derivatives, Intermediate Chemicals, and Pharmaceuticals segments, the company reported a net loss of €11.66 million for 2024 compared to a net income of €27.59 million the previous year. Ercros' negative return on equity indicates unprofitability; however, its short-term assets exceed both short-term and long-term liabilities. The company's debt levels have improved over time but remain inadequately covered by operating cash flow. Stability in weekly volatility suggests some consistency amidst financial struggles.

- Jump into the full analysis health report here for a deeper understanding of Ercros.

- Assess Ercros' previous results with our detailed historical performance reports.

Oriola Oyj (HLSE:ORIOLA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Oriola Oyj operates in the wholesale distribution of pharmaceuticals and health products across Sweden, Finland, and internationally, with a market cap of €182.50 million.

Operations: The company's revenue is primarily derived from its Distribution segment, which accounts for €1.36 billion, followed by the Wholesale segment at €315.6 million.

Market Cap: €182.5M

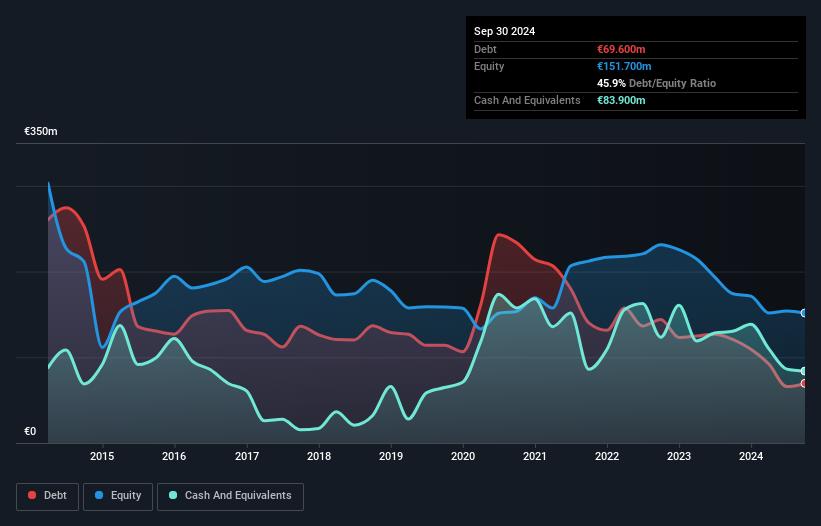

Oriola Oyj, with a market cap of €182.50 million, is navigating financial difficulties despite its substantial revenue streams from the Distribution (€1.36 billion) and Wholesale (€315.6 million) segments. Recent changes include the consolidation of share classes and board restructuring, with Harri Pärssinen appointed as Vice Chairman. The company reported a net loss of €20.1 million for 2024, reflecting ongoing unprofitability and negative return on equity (-15.07%). While trading at good value relative to peers and having more cash than debt, Oriola's short-term assets fall short of covering its liabilities, posing liquidity challenges amidst efforts to stabilize operations.

- Click here and access our complete financial health analysis report to understand the dynamics of Oriola Oyj.

- Examine Oriola Oyj's earnings growth report to understand how analysts expect it to perform.

H&R GmbH KGaA (XTRA:2HRA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: H&R GmbH & Co. KGaA manufactures and sells chemical-pharmaceutical raw materials and injection molded precision plastic parts across Europe, Africa, Asia, and internationally with a market cap of €139.21 million.

Operations: No specific revenue segments have been reported for H&R GmbH & Co. KGaA.

Market Cap: €139.21M

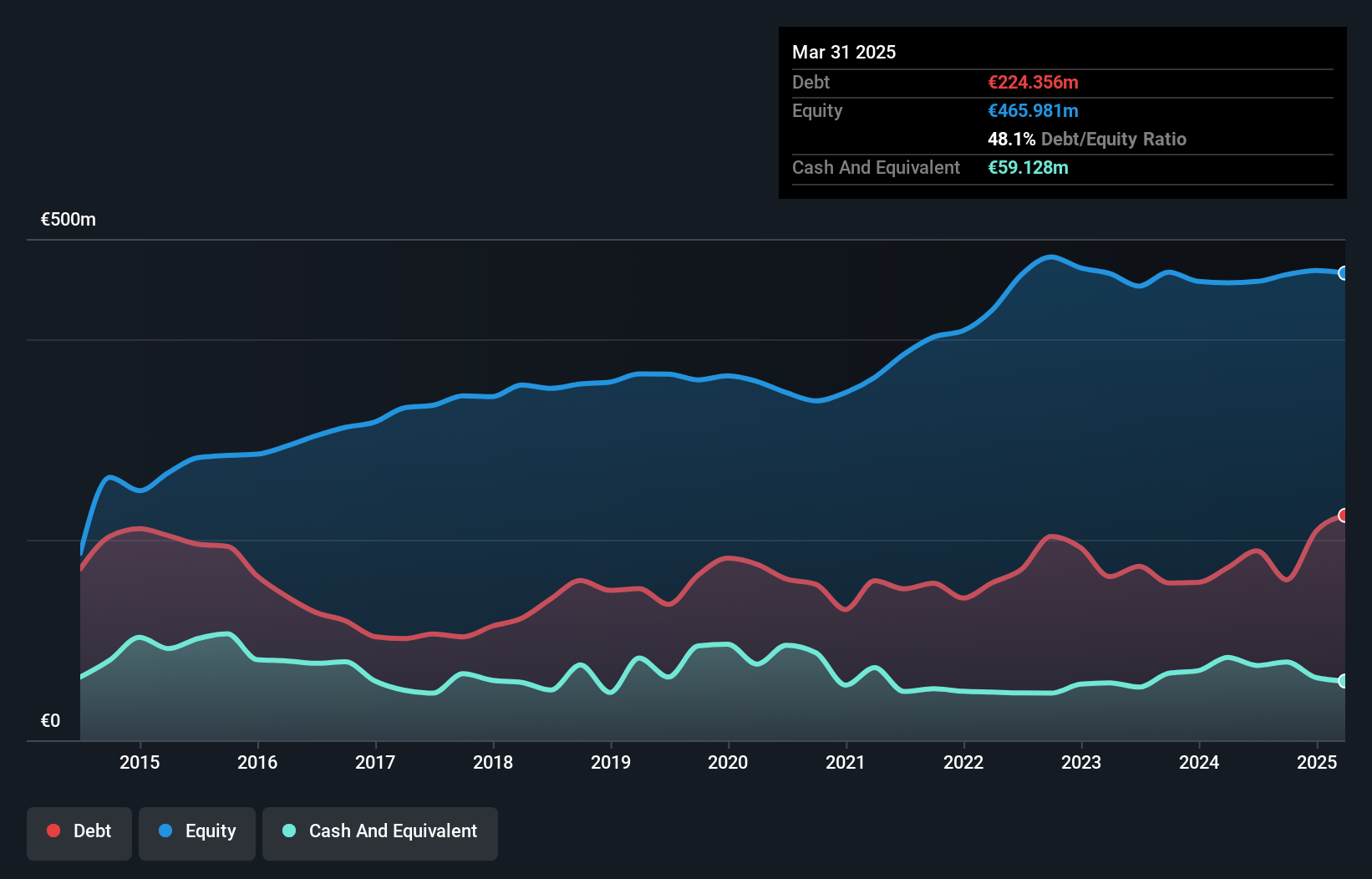

H&R GmbH & Co. KGaA, with a market cap of €139.21 million, reported stable earnings for 2024 despite a slight dip in sales to €1,338.24 million from the previous year. The company maintains a satisfactory net debt to equity ratio of 31.2% and has short-term assets exceeding both short and long-term liabilities, indicating solid liquidity management. Although its return on equity is low at 2.7%, the board's experience averages over 13 years, providing seasoned oversight amidst volatile weekly stock movements (7%). While trading below the German market P/E ratio at 13.1x, its dividend history remains unstable.

- Dive into the specifics of H&R GmbH KGaA here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into H&R GmbH KGaA's future.

Turning Ideas Into Actions

- Embark on your investment journey to our 431 European Penny Stocks selection here.

- Want To Explore Some Alternatives? AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ercros might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:ECR

Ercros

Manufactures and sells basic chemicals, intermediate chemicals, and pharmaceuticals in Spain.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives