The European market recently experienced a modest uptick, with the pan-European STOXX Europe 600 Index closing 1.15% higher amid optimism for potential trade deals, although gains were tempered by tariff concerns. In this context of fluctuating economic conditions and evolving trade policies, investors are increasingly exploring diverse opportunities to uncover value in less conventional areas. While the term "penny stock" might seem outdated, it still signifies smaller or emerging companies that can offer significant potential for growth when backed by robust financials.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Maps (BIT:MAPS) | €3.41 | €45.29M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| IAMBA Arad (BVB:FERO) | RON0.498 | RON16.84M | ✅ 2 ⚠️ 4 View Analysis > |

| Cellularline (BIT:CELL) | €2.83 | €59.69M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.98 | €18.62M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.20 | PLN11.32M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.435 | SEK2.33B | ✅ 4 ⚠️ 1 View Analysis > |

| Euroland Société anonyme (ENXTPA:ALERO) | €3.10 | €9.84M | ✅ 2 ⚠️ 5 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.155 | €297.53M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.968 | €32.64M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 328 stocks from our European Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Vytrus Biotech (BME:VYT)

Simply Wall St Financial Health Rating: ★★★★★★

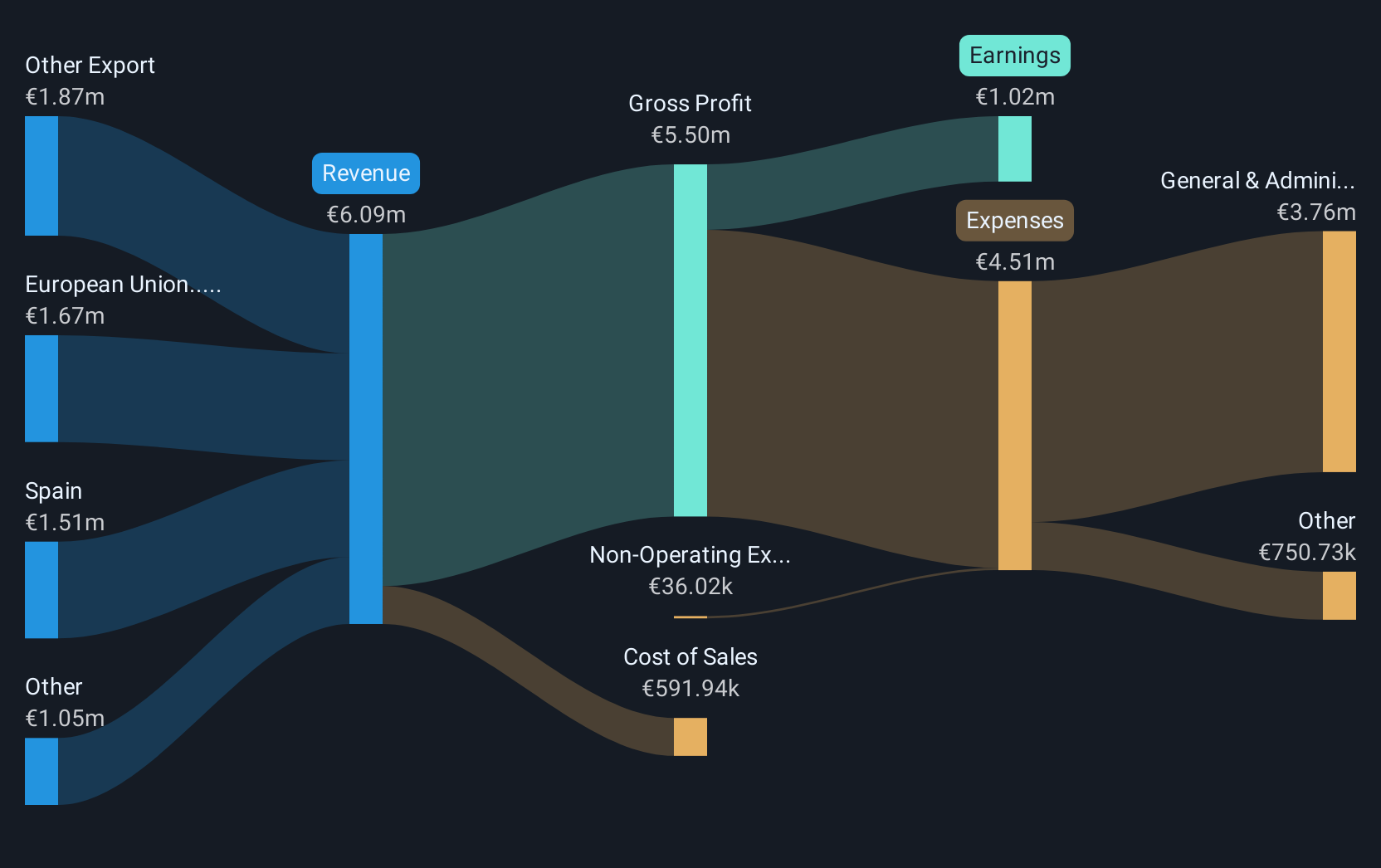

Overview: Vytrus Biotech, S.A. focuses on developing, producing, and selling active ingredients derived from plant stem cells for the cosmetic sector primarily in Spain, with a market cap of €35.36 million.

Operations: The company's revenue is derived entirely from its Personal Products segment, amounting to €6.09 million.

Market Cap: €35.36M

Vytrus Biotech, with a market cap of €35.36 million, has shown significant earnings growth of 87.4% over the past year, surpassing the industry average. The company’s financial health appears robust; its short-term and long-term liabilities are well-covered by assets, and it holds more cash than total debt. Recent private placements raised €1.2 million, bolstering liquidity without meaningful shareholder dilution. However, despite high-quality earnings and a well-covered interest payment on debt (9.7x EBIT coverage), Vytrus faces challenges with a volatile share price and an inexperienced management team averaging just 0.7 years in tenure.

- Dive into the specifics of Vytrus Biotech here with our thorough balance sheet health report.

- Examine Vytrus Biotech's earnings growth report to understand how analysts expect it to perform.

Nordic Iron Ore (OM:NIO)

Simply Wall St Financial Health Rating: ★★★★★☆

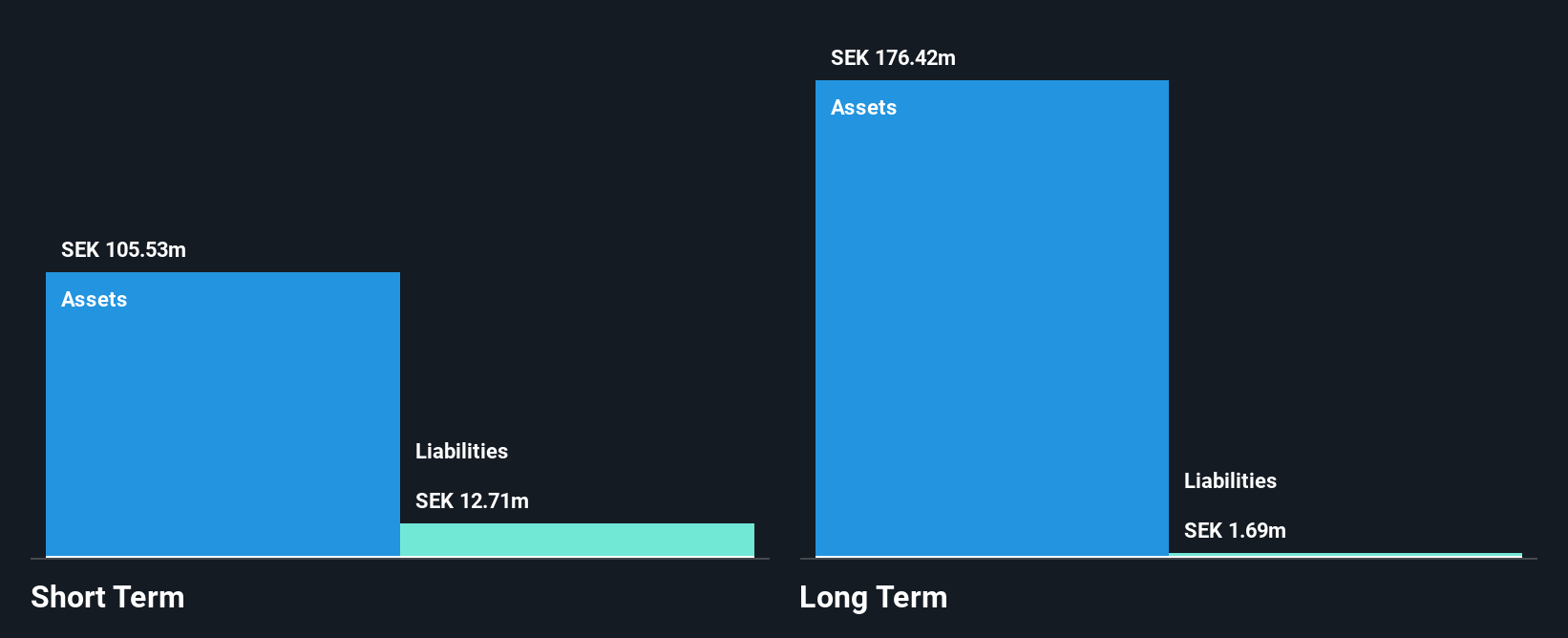

Overview: Nordic Iron Ore AB (publ) focuses on the exploration, development, and mining of iron ore deposits in Västerbergslagen, Sweden, with a market cap of SEK224.12 million.

Operations: Nordic Iron Ore AB (publ) does not report any distinct revenue segments.

Market Cap: SEK224.12M

Nordic Iron Ore, with a market cap of SEK224.12 million, operates pre-revenue and has experienced significant volatility in its share price. Despite being unprofitable with increasing losses over the past five years, the company maintains a strong financial position with more cash than debt and sufficient short-term assets to cover liabilities. Recent developments include relocating to larger premises in Ludvika to support growth and improve logistics for future mining operations. The move is driven by an expanding workforce and increased project activity, positioning Nordic Iron Ore for potential scalability as it progresses its exploration efforts.

- Navigate through the intricacies of Nordic Iron Ore with our comprehensive balance sheet health report here.

- Examine Nordic Iron Ore's past performance report to understand how it has performed in prior years.

BRAIN Biotech (XTRA:BNN)

Simply Wall St Financial Health Rating: ★★★★☆☆

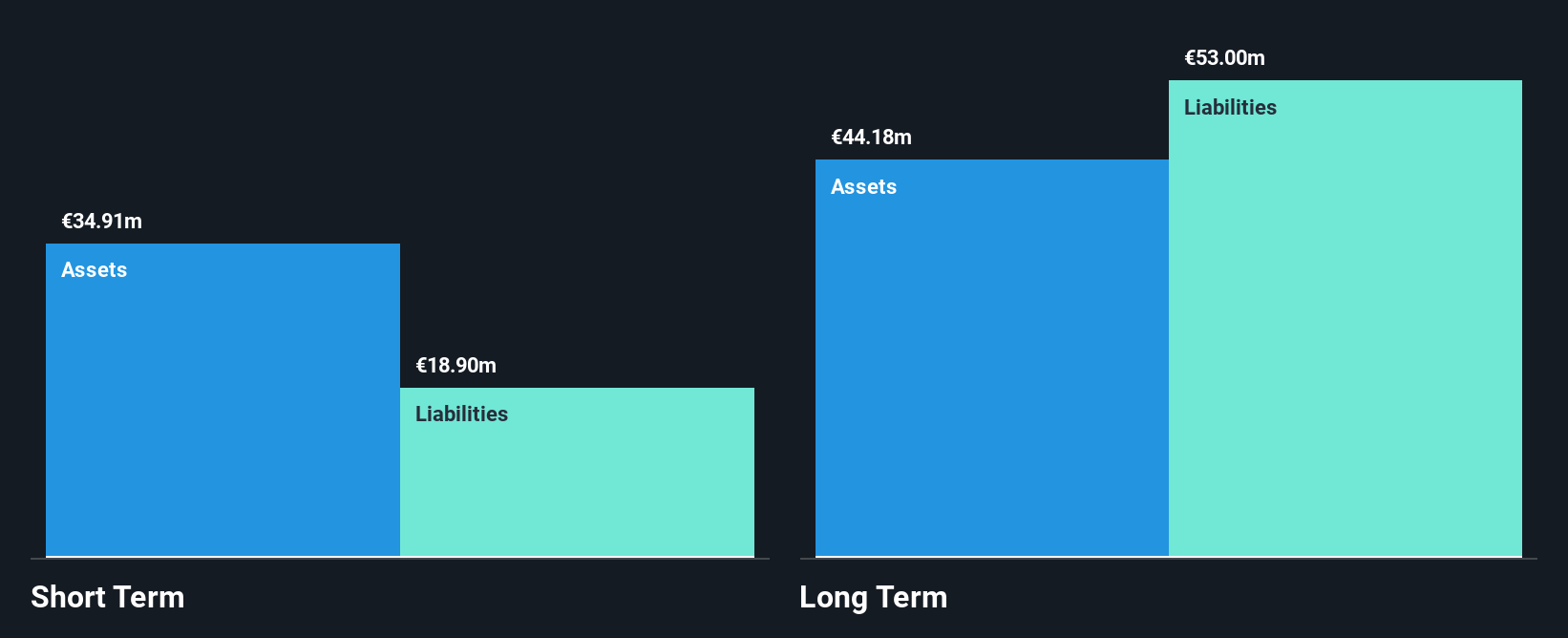

Overview: BRAIN Biotech AG operates in Germany, the United States, France, the Netherlands, and the United Kingdom, offering bio-based products and solutions with a market cap of €41.84 million.

Operations: BRAIN Biotech generates its revenue through the BRAIN Bioincubator segment, which reported -€0.38 million, with a segment adjustment of €53.90 million.

Market Cap: €41.84M

BRAIN Biotech AG, with a market cap of €41.84 million, is navigating its pre-revenue phase while facing financial challenges such as increased net losses and reduced revenue compared to the previous year. Despite these hurdles, the company has sufficient cash runway for over a year and more cash than debt, providing some financial stability. Recent strategic moves include acquiring full ownership of Breatec B.V. and expanding production capabilities in the Netherlands to enhance operational efficiency and product development. However, lowered earnings guidance reflects ongoing challenges in achieving projected growth targets within its core segment.

- Get an in-depth perspective on BRAIN Biotech's performance by reading our balance sheet health report here.

- Assess BRAIN Biotech's future earnings estimates with our detailed growth reports.

Seize The Opportunity

- Investigate our full lineup of 328 European Penny Stocks right here.

- Ready For A Different Approach? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BRAIN Biotech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BNN

BRAIN Biotech

Provides bio-based products and solutions in Germany, the United States, France, the Netherlands, and the United Kingdom.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives