- Spain

- /

- Personal Products

- /

- BME:PUIG

Puig (BME:PUIG) Is Up 6.3% After Raising Guidance on Makeup Momentum and U.S. Online Strength

Reviewed by Sasha Jovanovic

- Puig Brands reported a 6.1 percent increase in like-for-like sales in its third quarter, driven by strong makeup and skincare segment performance, as softness continued in the fragrance division.

- Momentum in premium brands such as Charlotte Tilbury, particularly in the U.S. online market, prompted the company to raise its full-year revenue growth guidance to the midpoint of its previously stated range.

- We’ll explore how Puig’s raised outlook, supported by the success of its makeup segment, shapes its current investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Puig Brands' Investment Narrative?

If you’re eyeing Puig Brands, the biggest bet is on continued demand for premium beauty and a successful blend of powerhouse makeup brands, like Charlotte Tilbury, with its historic fragrances. The Q3 update that prompted higher full-year revenue guidance spotlights makeup as Puig’s short-term growth pillar, easing concern around recent fragrance softness. This tilt toward digital and the U.S. market could influence near-term momentum and help sustain recent sales gains, but it doesn’t erase bigger risks. With its board still relatively fresh and recent share price underperformance, the main question is whether robust makeup trends can fully offset ongoing pressure in fragrances and any potential volatility as the lock-up period nears an end. Intrigue remains around the board's limited experience and how sustained shifts in brand demand might sway 2025’s trajectory. In contrast, a board with short tenure may present distinct uncertainties that investors should be aware of.

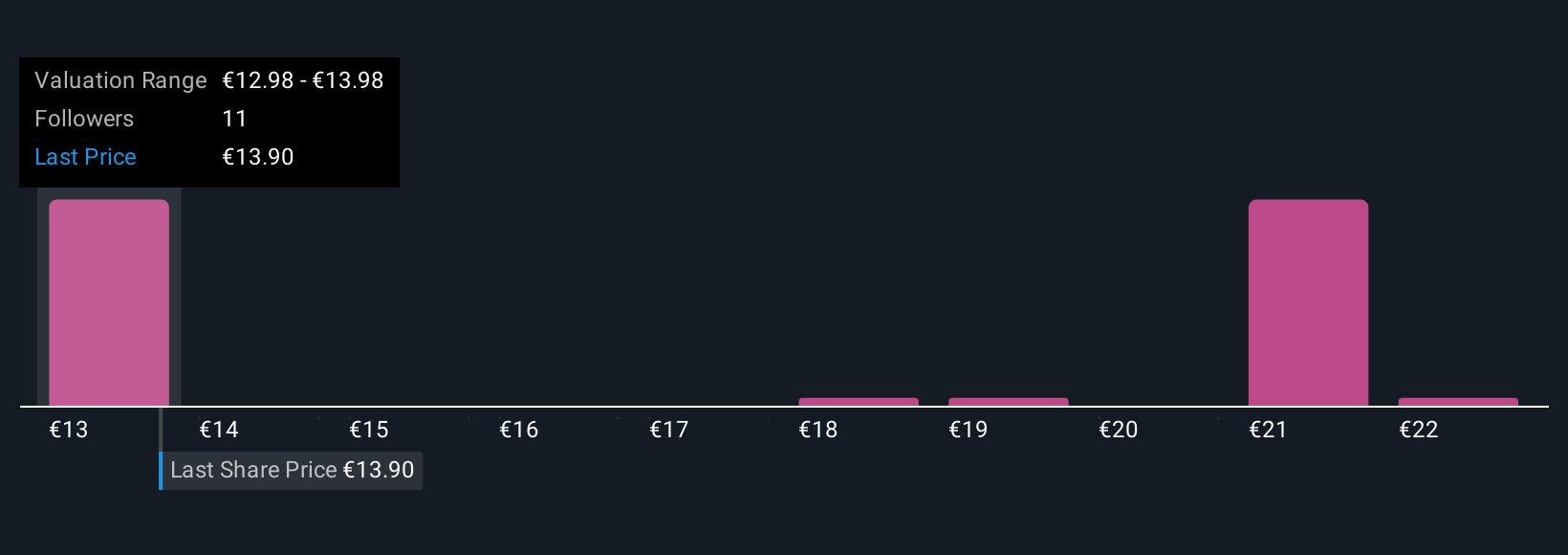

Puig Brands' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 6 other fair value estimates on Puig Brands - why the stock might be worth 13% less than the current price!

Build Your Own Puig Brands Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Puig Brands research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Puig Brands research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Puig Brands' overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:PUIG

Puig Brands

Operates in the beauty and fashion industry in Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives