Ebro Foods (BME:EBRO) Margin Dip Challenges Bullish Value Narrative Despite Discounted Shares

Reviewed by Simply Wall St

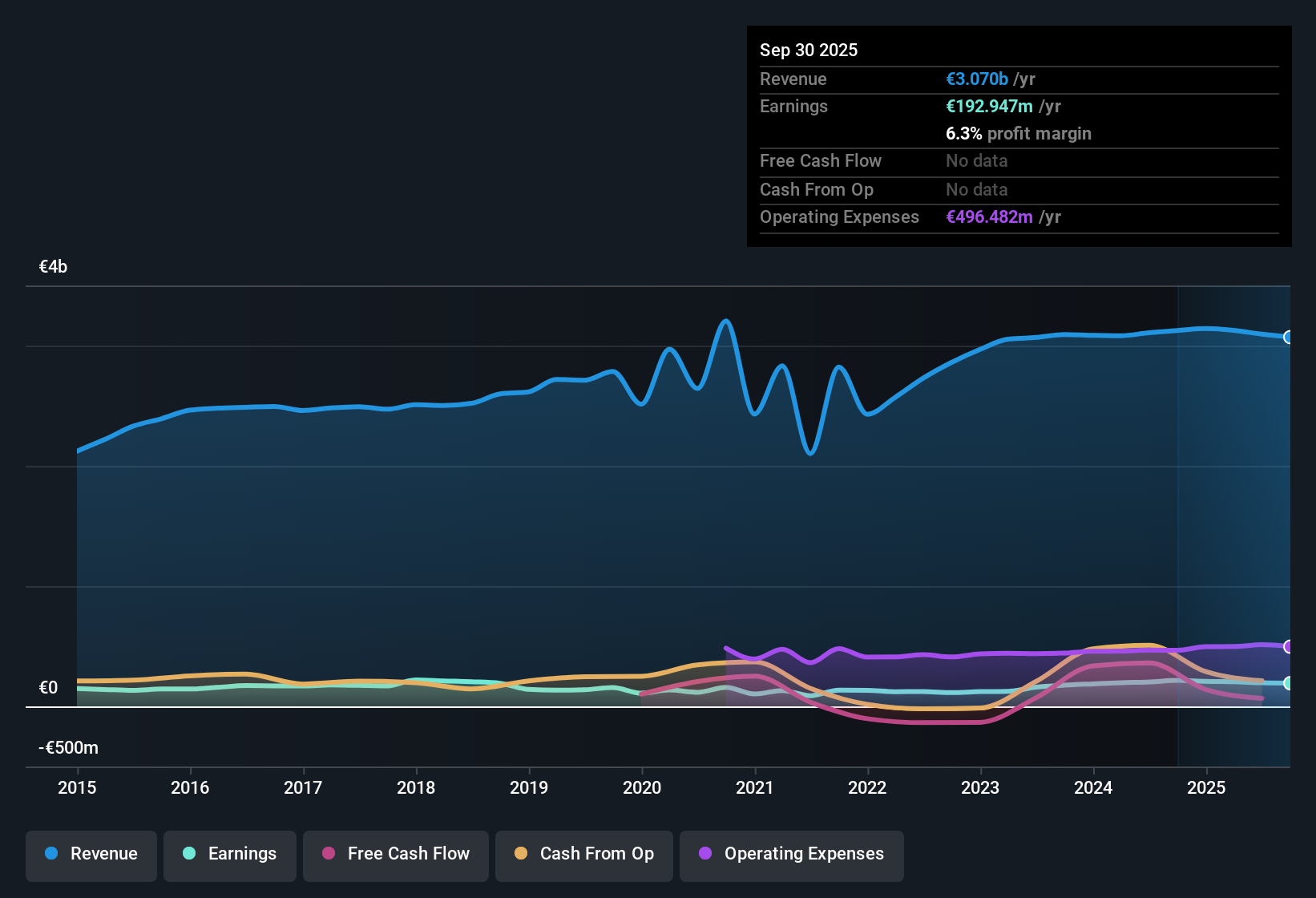

Ebro Foods (BME:EBRO) is forecasting modest growth, with revenue expected to rise by 1.8% per year and earnings projected to increase at 1.5% annually. Both figures are lagging the broader Spanish market’s pace. The company’s net profit margin currently stands at 6.3%, just below last year’s 6.5%, and its average annual earnings growth over the past five years is 14.4%. However, recent periods show a dip in both margins and earnings. For investors, the combination of below-market growth forecasts and a lower share valuation compared to industry benchmarks will shape the discussion around the stock’s value proposition.

See our full analysis for Ebro Foods.Next up, we’ll see how these results compare to the narratives shaping market sentiment. Some stories may get reaffirmed, while others could be up for debate.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margin Trends Below Prior Year

- The current net profit margin of 6.3% is modestly down from last year’s 6.5%. This reflects a small decline in profitability on each euro of sales.

- Even with broader market growth outpacing Ebro, the prevailing market view emphasizes that the company’s average annual earnings growth of 14.4% over five years stands out as a strength.

- This multi-year record of solid profit growth provides support for investors focused on consistency, even if the most recent margin softened.

- However, with near-term margin trends weakening, some may wonder if the firm can maintain its strong long-term track record going forward.

Shares Trade at a Discount to Peers and Industry

- Ebro Foods trades at a price-to-earnings ratio of 13.9x. This is below both the European food industry average of 15.6x and its peer average of 18.7x, offering a clear discount valuation versus alternatives.

- Prevailing market discussion often highlights this relative undervaluation, especially with the current share price of €17.72 sitting well below the DCF fair value of €28.91.

- This gap between price and estimated value suggests a potential opportunity for value-oriented investors prepared for more modest growth.

- At the same time, slower forecasted growth rates could limit how quickly this valuation disconnect closes. This means patience may be required.

Dividend Sustainability Flags Caution

- While not quantified in the latest data, a minor risk is flagged around the sustainability of Ebro’s dividend. This signals investors should keep an eye on future payout ratios and coverage.

- The prevailing market view considers dividend durability especially important now, since near-term earnings growth is forecast at just 1.5% per year.

- If earnings growth lags and margins remain under pressure, the ability to maintain dividends at current levels could become a greater point of concern for cautious investors.

- Still, the past record of earnings quality helps offset some near-term unease, though it does not guarantee future payout stability.

For a balanced breakdown of the key themes shaping the investment case, check out the full Ebro Foods Consensus Narrative for the most up-to-date perspectives.📊 Read the full Ebro Foods Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Ebro Foods's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

With Ebro Foods facing questions around near-term earnings growth, softening margins, and a potential risk to dividend stability, investors may prefer stronger dividend dependability.

If reliable income matters most, use these 1999 dividend stocks with yields > 3% to focus on companies with robust yields and proven track records of maintaining healthy payouts even as market conditions shift.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ebro Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:EBRO

Ebro Foods

Operates as a food company in Spain, rest of Europe, the United States, Canada, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives