- Spain

- /

- Hospitality

- /

- BME:NHH

A Look at Minor Hotels Europe & Americas (BME:NHH) Valuation Following Expansion to 60 Italian Properties

Reviewed by Simply Wall St

Minor Hotels Europe & Americas (BME:NHH) recently revealed that the Tivoli Palazzo Risorgimento Lecce will open in April 2026, marking its 60th property in Italy. This move underscores the company’s commitment to capturing value in the expanding European luxury hotel segment.

See our latest analysis for Minor Hotels Europe & Americas.

Minor Hotels Europe & Americas has seen its strategy pay off this year, with strong RevPAR growth and a steady focus on premium property upgrades helping it cement its spot in the luxury hotel space. This momentum is reflected in the impressive 54.8% total shareholder return over the past 12 months. The long-term picture appears even brighter, with a remarkable 172.8% total return over five years.

If news of Minor Hotels' expansion caught your attention, it might be the perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

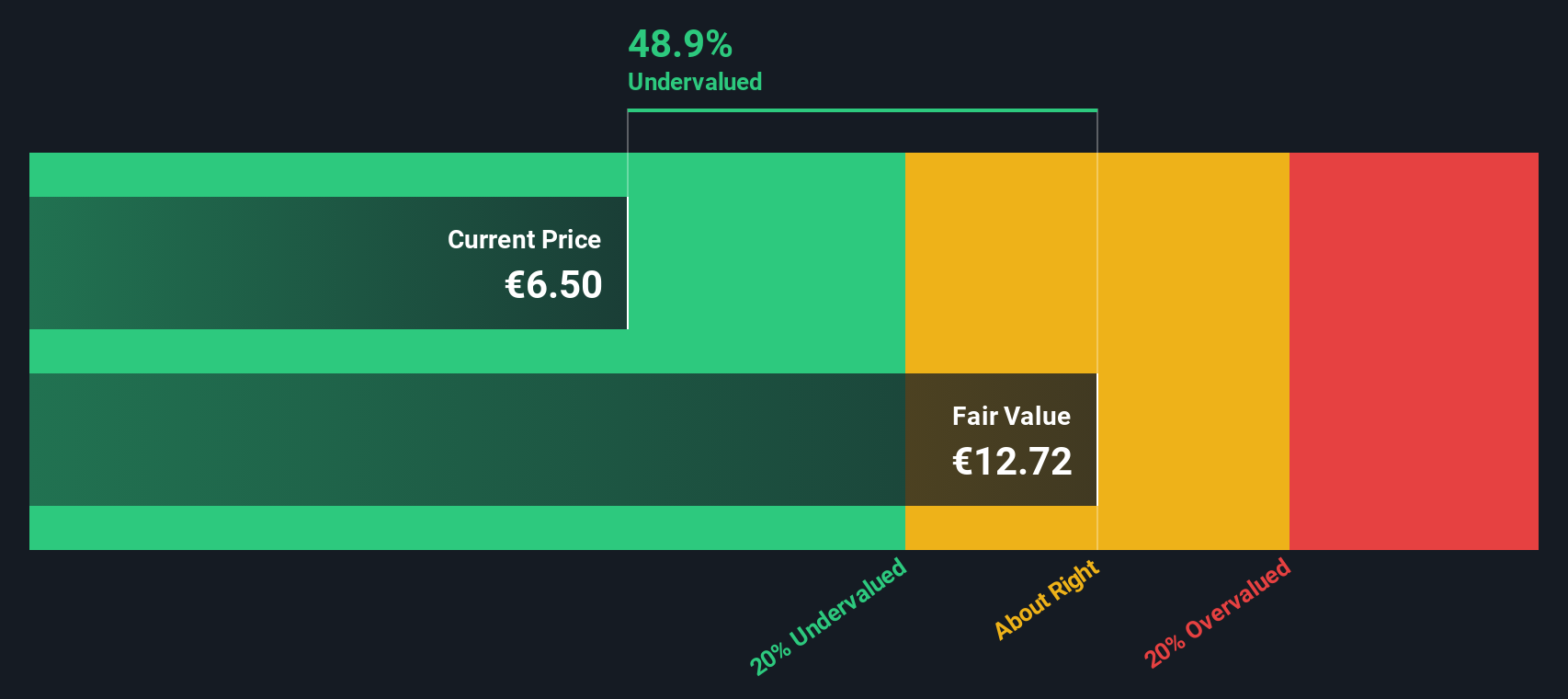

With such notable returns and ongoing expansion, investors may wonder whether Minor Hotels Europe & Americas is still trading below its true value or whether the market has already factored in expectations for future growth.

Price-to-Earnings of 11.2x: Is it justified?

Minor Hotels Europe & Americas' stock trades at a price-to-earnings (P/E) ratio of 11.2x, which places it far below both industry and peer benchmarks. With a closing price of €6.5, investors are getting a significant discount compared to typical hospitality sector multiples.

The price-to-earnings ratio measures how much investors are currently paying for each euro of earnings a company generates. It is especially relevant here since Minor Hotels Europe & Americas has enjoyed rapid earnings growth and improved profitability, making earnings-based valuation meaningful.

This P/E ratio is notably attractive compared to both the European Hospitality industry average of 18.6x and the peer group average of 25.7x. Such a gap suggests the market is underpricing the company’s strong earnings momentum and operational execution.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 11.2x (UNDERVALUED)

However, investors should note that a significant discount to the analyst price target and a lack of reported annual growth could indicate underlying challenges.

Find out about the key risks to this Minor Hotels Europe & Americas narrative.

Another View: What Does the SWS DCF Model Say?

Taking a different angle, our SWS DCF model estimates Minor Hotels Europe & Americas has a fair value of €12.72 per share, nearly double the current market price of €6.5. That indicates the stock is significantly undervalued. But do all roads really lead to hidden value, or could the market know something the numbers do not?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Minor Hotels Europe & Americas for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Minor Hotels Europe & Americas Narrative

If you think there is more to the story or want to dig deeper into the numbers, you can build your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Minor Hotels Europe & Americas.

Looking for more investment ideas?

Smart moves start with broad horizons. Don't miss out on fresh opportunities. These handpicked strategies can help you identify the market's next big winners before everyone else.

- Capture new possibilities with these 28 quantum computing stocks and find companies at the forefront of high-speed computation and disruptive technology breakthroughs.

- Tap into resilient income streams by checking out these 20 dividend stocks with yields > 3%, highlighting stocks with attractive yields and solid long-term fundamentals.

- Seize the moment with these 840 undervalued stocks based on cash flows as you pinpoint shares the market may be mispricing right now based on strong company cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:NHH

Minor Hotels Europe & Americas

Operates hotels in Spain, Italy, Southern Europe, the United States, Central Europe, Benelux, Latin America, and Central Services.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives