- Spain

- /

- Hospitality

- /

- BME:MEL

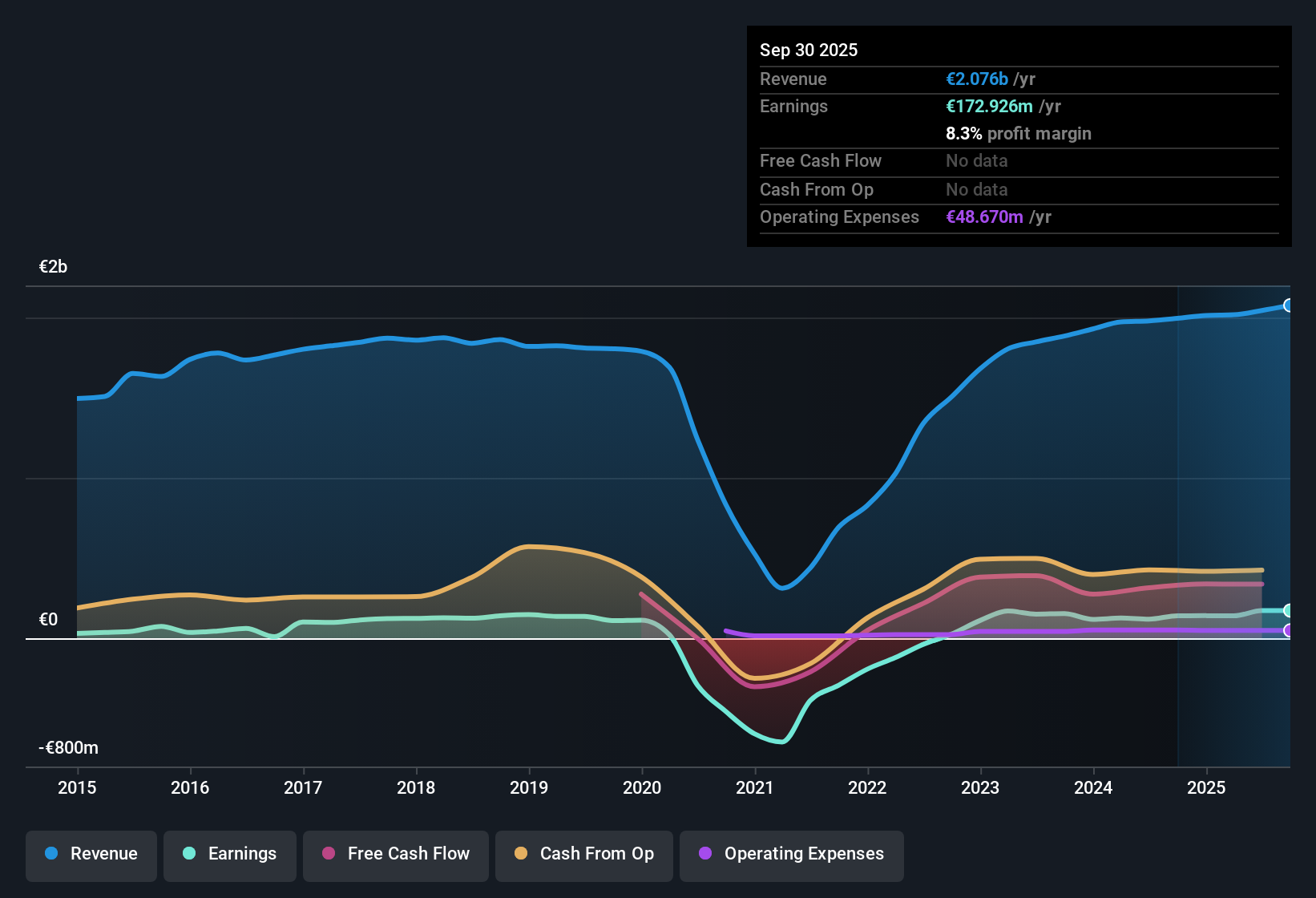

Meliá Hotels (BME:MEL) Net Margin Improvement Reinforces Value Narrative Despite Slower Revenue Growth

Reviewed by Simply Wall St

Meliá Hotels International (BME:MEL) has posted a solid uptick in profitability, reporting net profit margins of 8.4% compared to 6% a year ago. Over the last five years, the company has achieved an average annual earnings growth of 75%, although this year's earnings climbed 44.8%. This is a healthy gain, but slower than its longer-term rate. While revenue is forecast to grow at 2.3% per year, which trails the Spanish market’s 4.2% average, earnings are expected to rise by 7.4% annually, ahead of the broader market’s 5.1% pace.

See our full analysis for Meliá Hotels International.Now that we have the headline results, let's put the latest numbers up against the most widely held narratives to see which stories stand up and which get challenged.

See what the community is saying about Meliá Hotels International

Cost Pressures Offset Margin Gains

- While net profit margins have increased to 8.4%, analysts expect these to narrow to 8.0% within three years. This highlights pressure from rising labor costs and regional wage agreements that are flagged as "slightly worse than expected."

- According to analysts' consensus view, the company’s efforts to improve efficiency and shift to premium offerings could help defend margins despite these pressures.

- Notably, labor cost headwinds in the Balearic and Canary Islands create risk. Investments in asset-light models and direct booking channels are designed to mitigate margin erosion.

- Consensus notes that cost optimization and digitalization investments remain crucial if Meliá aims to protect margins as external pressures rise.

Peer Comparison Reveals Value Gap

- Meliá’s price-to-earnings ratio stands at 9.2x, far below the European hospitality industry’s 17.2x and its peer group average of 63.3x. The shares trade above the DCF fair value of €5.93 at a market price of €7.18.

- Analysts' consensus narrative highlights that, while the low P/E suggests potential undervaluation versus peers, lackluster revenue growth (2.3% per year, lagging the Spanish market’s 4.2%) could explain why shares haven’t re-rated higher.

- Investors must weigh Meliá’s slower sales trajectory against its relative discount, especially with the market pricing in only modest outperformance on earnings growth.

- The consensus sees the company’s premium room mix and asset-light expansion as keys to driving future margin gains required to justify a higher multiple.

What stands out about Meliá’s current position is how closely the analyst consensus price target of €9.12, which is 13% above today’s share price, relies on ongoing profit growth and asset-light expansion keeping margins resilient. 📊 Read the full Meliá Hotels International Consensus Narrative.

Regional Exposure Heightens Risk

- Meliá is heavily exposed to Mediterranean and Spanish resort markets, which increases vulnerability to disruptions from regional economic shifts, extreme climate events, and fluctuating guest demand. These are all flagged as key downside risks by analysts.

- Analysts' consensus view draws attention to underperformance and limited upside in markets like Germany, Cuba, and parts of Asia, emphasizing that lack of geographic diversification may hold back sustainable long-term growth.

- Consensus suggests that while international expansion efforts are underway, future volatility in core regions could weigh on revenue stability and long-term valuation.

- This focus on a few bright spots may put pressure on management to accelerate diversification and offset future regional challenges.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Meliá Hotels International on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do the figures paint a different picture for you? Share your unique take and build your own narrative in just a few minutes. Do it your way

A great starting point for your Meliá Hotels International research is our analysis highlighting 5 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Meliá’s sluggish revenue growth, heavy regional exposure, and reliance on margin gains reveal uncertainty about delivering consistent results through changing market cycles.

If predictable growth appeals more to you, use our stable growth stocks screener (2103 results) to discover companies with a track record of steady expansion and reliable performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:MEL

Meliá Hotels International

Owns, operates, manages, leases, and franchises hotels worldwide.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives