- Spain

- /

- Hospitality

- /

- BME:EDR

Take Care Before Jumping Onto eDreams ODIGEO S.A. (BME:EDR) Even Though It's 46% Cheaper

eDreams ODIGEO S.A. (BME:EDR) shareholders that were waiting for something to happen have been dealt a blow with a 46% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 41% share price drop.

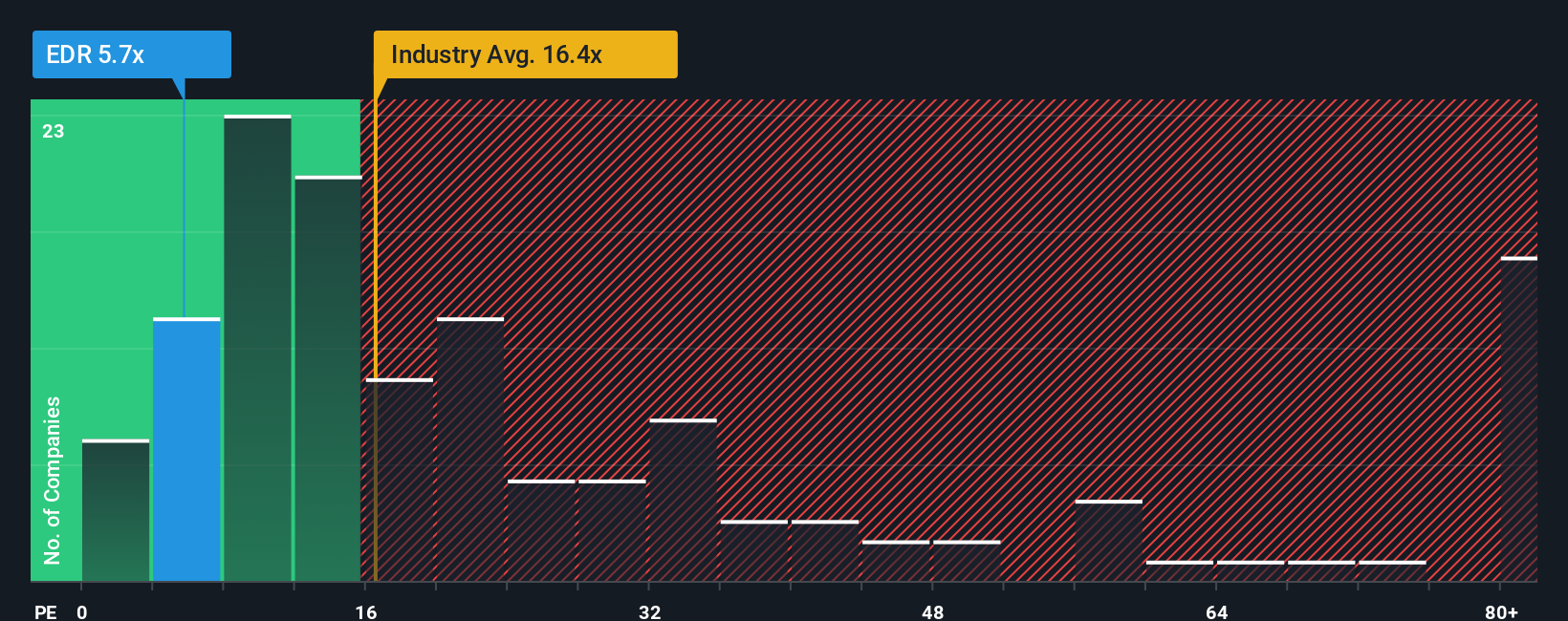

Although its price has dipped substantially, eDreams ODIGEO's price-to-earnings (or "P/E") ratio of 5.7x might still make it look like a strong buy right now compared to the market in Spain, where around half of the companies have P/E ratios above 17x and even P/E's above 31x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for eDreams ODIGEO as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for eDreams ODIGEO

Is There Any Growth For eDreams ODIGEO?

There's an inherent assumption that a company should far underperform the market for P/E ratios like eDreams ODIGEO's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 124%. Although, its longer-term performance hasn't been as strong with three-year EPS growth being relatively non-existent overall. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 9.4% per annum during the coming three years according to the five analysts following the company. Meanwhile, the rest of the market is forecast to expand by 11% per annum, which is not materially different.

With this information, we find it odd that eDreams ODIGEO is trading at a P/E lower than the market. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From eDreams ODIGEO's P/E?

eDreams ODIGEO's P/E looks about as weak as its stock price lately. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of eDreams ODIGEO's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with eDreams ODIGEO (including 1 which shouldn't be ignored).

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:EDR

eDreams ODIGEO

Operates as an online travel company in France, Southern Europe, Northern Europe, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives