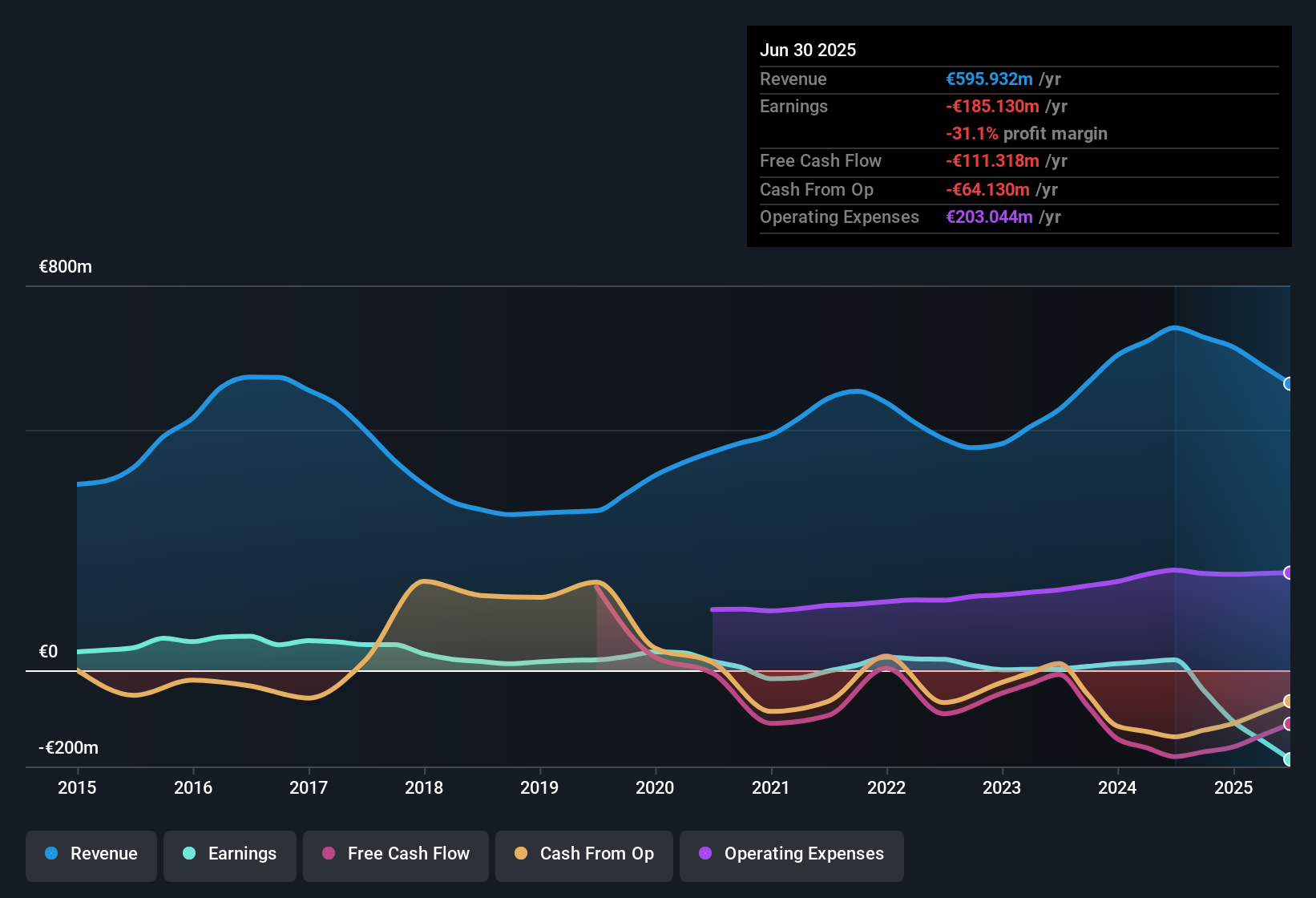

Talgo (BME:TLGO) Losses Deepen 66.4% Annually, Challenging Growth-Focused Investor Narratives

Reviewed by Simply Wall St

Talgo (BME:TLGO) continues its run of unprofitability as losses have accelerated at an average pace of 66.4% per year over the past five years, with no improvement seen in its net profit margin or earnings quality. However, revenue is projected to grow at 7.7% per year, outpacing the broader Spanish market. Analysts anticipate a transition to profitability within the next three years, with earnings expected to surge 116.12% annually over this period. While the company still faces substantial financial risks due to its current standing, the combination of forecasted profit momentum and growth outlook is likely to shape near-term investor expectations.

See our full analysis for Talgo.Next, we will align these headline results with the key narratives driving discussion across the market, highlighting where sentiment might shift and where expectations already reflect the trends in the numbers.

Curious how numbers become stories that shape markets? Explore Community Narratives

Sales Multiple Undercuts Industry Peers

- Talgo's price-to-sales ratio stands at 0.5x, noticeably below the European Machinery industry average of 1x and peer companies at 0.7x. This points to a valuation gap anchored in top-line sales.

- Bulls argue that the discount gives investors a margin of safety because Talgo’s sales growth outlook (7.7% per year forecast) could justify a valuation catch-up if the company executes, especially relative to sector averages.

- When a company is priced significantly under its industry’s norm on a sales basis, bullish investors see room to rerate if revenue grows as projected and margins stabilize.

- However, any rerating depends on reversing persistent losses and demonstrating improved earnings quality, not just growing sales.

Fair Value and Analyst Target Diverge

- The current share price (€2.64) is closely aligned with the DCF fair value estimate (€2.62). However, it remains materially below the analyst price target of €3.58, revealing a split between model-based fair value and the Street’s optimism.

- What is notable is that while DCF models suggest the stock is fairly valued today, some investors trust analyst targets because Talgo’s medium-term profit forecasts (annual earnings growth of 116.12% expected) could drive the price closer to that €3.58 level.

- This gap becomes relevant as analyst targets typically anticipate fundamental improvements that DCF models, which weigh current financial challenges heavily, may understate.

- If profit momentum materializes, it could validate the Street's bullish price target but, as of now, significant execution risk remains in bridging that gap.

Margin Strain Clouds Financial Standing

- Net profit margin has not shown improvement over recent periods, with persistent unprofitability and earnings quality cited as ongoing weaknesses in Talgo’s filings.

- Critics highlight that these margin challenges overshadow headline revenue growth because even as sales accelerate, the company's financial position is described as “not good.” Bears argue this could handicap future investment or contract execution unless profitability quickly improves.

- With losses compounding at 66.4% per year over the last five years, bears see margin restoration as a critical hurdle before any rerating can occur.

- Until real progress is made on sustained profitability, risks to valuation and financial flexibility remain front and center for risk-averse investors.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Talgo's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Talgo’s ongoing unprofitability, strained margins, and balance sheet risks limit its investment appeal compared to peers with stronger financial health.

If you want more resilience in your portfolio, check out solid balance sheet and fundamentals stocks screener to find businesses built on solid fundamentals and a healthier financial footing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Talgo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:TLGO

Talgo

Engages in design, manufacture, and maintenance of railway and auxiliary machinery for the maintenance of railway systems rolling stock worldwide.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives