Don't Sell NBI Bearings Europe, S.A. (BME:NBI) Before You Read This

Today, we'll introduce the concept of the P/E ratio for those who are learning about investing. To keep it practical, we'll show how NBI Bearings Europe, S.A.'s (BME:NBI) P/E ratio could help you assess the value on offer. Looking at earnings over the last twelve months, NBI Bearings Europe has a P/E ratio of 15.84. That corresponds to an earnings yield of approximately 6.3%.

Check out our latest analysis for NBI Bearings Europe

How Do You Calculate A P/E Ratio?

The formula for price to earnings is:

Price to Earnings Ratio = Price per Share ÷ Earnings per Share (EPS)

Or for NBI Bearings Europe:

P/E of 15.84 = €3.660 ÷ €0.231 (Based on the trailing twelve months to December 2019.)

(Note: the above calculation results may not be precise due to rounding.)

Is A High Price-to-Earnings Ratio Good?

The higher the P/E ratio, the higher the price tag of a business, relative to its trailing earnings. That is not a good or a bad thing per se, but a high P/E does imply buyers are optimistic about the future.

Does NBI Bearings Europe Have A Relatively High Or Low P/E For Its Industry?

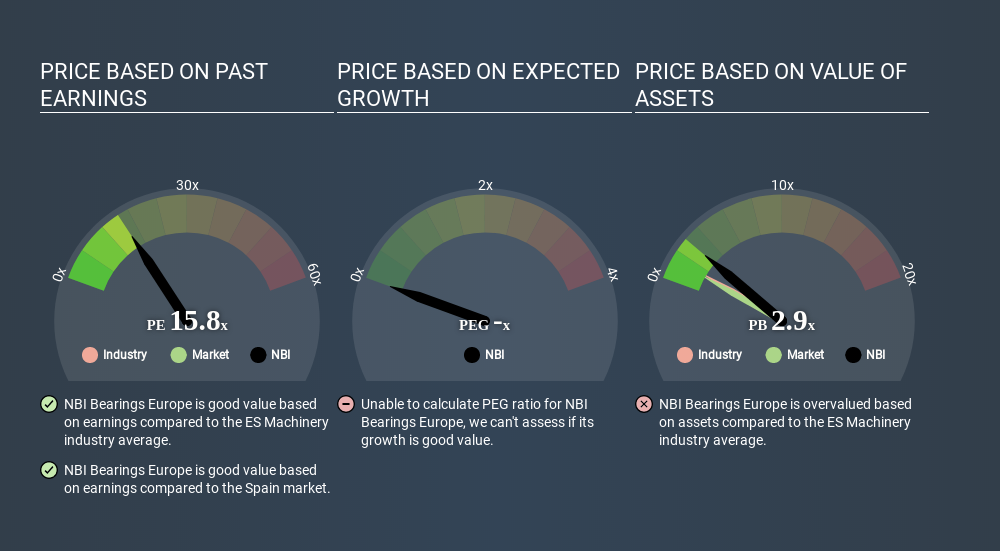

The P/E ratio essentially measures market expectations of a company. You can see in the image below that the average P/E (15.8) for companies in the machinery industry is roughly the same as NBI Bearings Europe's P/E.

That indicates that the market expects NBI Bearings Europe will perform roughly in line with other companies in its industry. So if NBI Bearings Europe actually outperforms its peers going forward, that should be a positive for the share price. Further research into factors such as insider buying and selling, could help you form your own view on whether that is likely.

How Growth Rates Impact P/E Ratios

Generally speaking the rate of earnings growth has a profound impact on a company's P/E multiple. That's because companies that grow earnings per share quickly will rapidly increase the 'E' in the equation. That means even if the current P/E is high, it will reduce over time if the share price stays flat. A lower P/E should indicate the stock is cheap relative to others -- and that may attract buyers.

In the last year, NBI Bearings Europe grew EPS like Taylor Swift grew her fan base back in 2010; the 52% gain was both fast and well deserved. And earnings per share have improved by 57% annually, over the last three years. So you might say it really deserves to have an above-average P/E ratio.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

The 'Price' in P/E reflects the market capitalization of the company. Thus, the metric does not reflect cash or debt held by the company. The exact same company would hypothetically deserve a higher P/E ratio if it had a strong balance sheet, than if it had a weak one with lots of debt, because a cashed up company can spend on growth.

Spending on growth might be good or bad a few years later, but the point is that the P/E ratio does not account for the option (or lack thereof).

Is Debt Impacting NBI Bearings Europe's P/E?

Net debt totals 23% of NBI Bearings Europe's market cap. It would probably deserve a higher P/E ratio if it was net cash, since it would have more options for growth.

The Bottom Line On NBI Bearings Europe's P/E Ratio

NBI Bearings Europe's P/E is 15.8 which is about average (15.8) in the ES market. When you consider the impressive EPS growth last year (along with some debt), it seems the market has questions about whether rapid EPS growth will be sustained.

Investors should be looking to buy stocks that the market is wrong about. If the reality for a company is better than it expects, you can make money by buying and holding for the long term. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

But note: NBI Bearings Europe may not be the best stock to buy. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20).

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About BME:NBI

NBI Bearings Europe

Engages in the design, production, and sale of bearings worldwide.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives