- Spain

- /

- Construction

- /

- BME:FER

Ferrovial (BME:FER): Evaluating Valuation After Recent Stock Momentum and Market Attention

Reviewed by Simply Wall St

Most Popular Narrative: 1.5% Overvalued

The prevailing narrative sees Ferrovial as slightly overvalued, with broad expectations around the company’s future earnings, revenue growth, and industry position fueling this view.

Significant optimism appears to be embedded around Ferrovial's positioning in the green transition, as seen by the refinancing of the JFK New Terminal One with green bonds and assertive capital allocation. However, increased regulatory complexity, stricter climate policies, and rising costs for sustainable construction could erode margins and slow project approvals, which may negatively impact future profit margins and earnings visibility.

Want to know the real reason analysts call this stock nearly fully priced? The most talked-about scenario is built on ambitious growth forecasts and a profit margin transformation that surpasses industry tradition. Curious what critical assumptions could turn this narrative on its head or push the shares higher than the crowd expects? Find out how these bold projections shape the number everyone’s watching.

Result: Fair Value of €46.99 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, sustained double-digit revenue growth in North America or a surge in project wins could quickly challenge assumptions that are incorporated into the current, cautious valuation.

Find out about the key risks to this Ferrovial narrative.Another View: Is the Market Right?

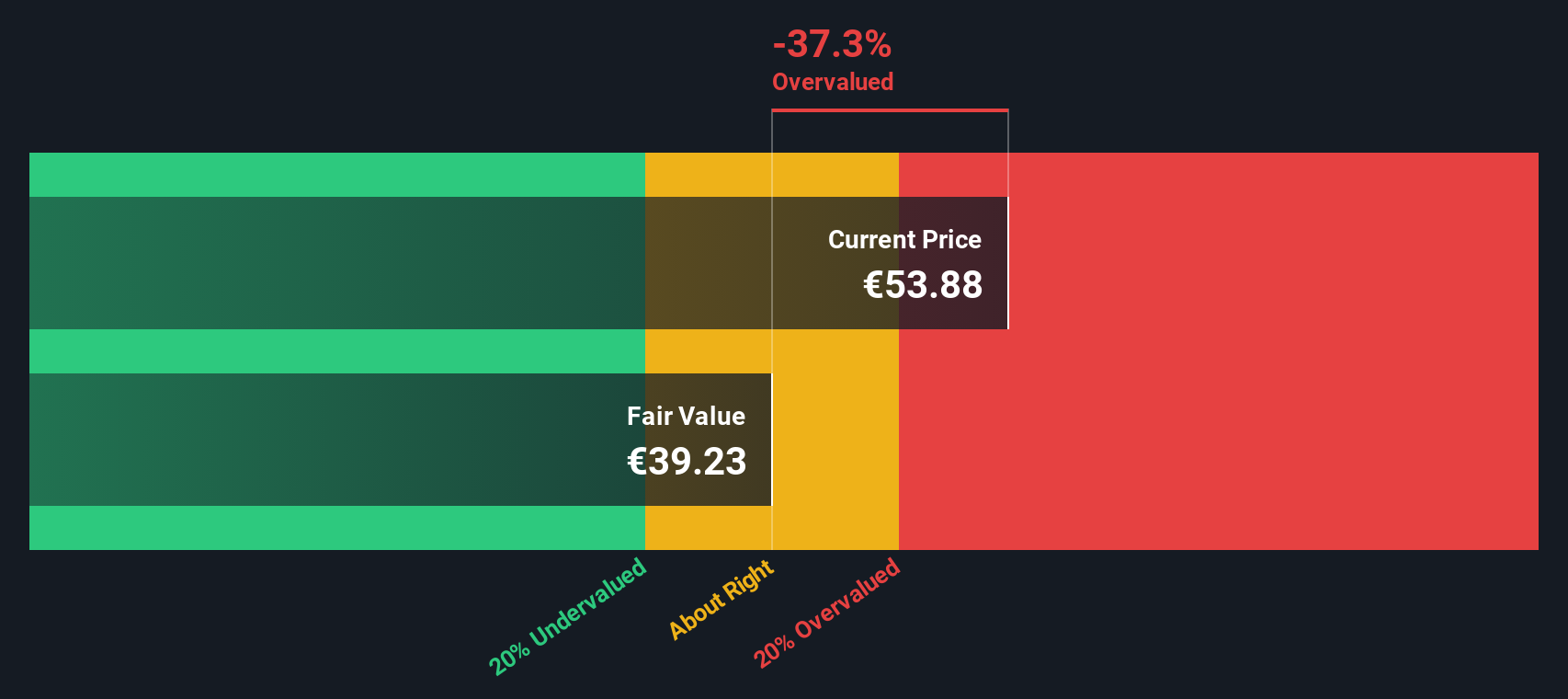

Looking at things differently, our DCF model points to a less optimistic conclusion. This casts doubt on whether the current price is justified by future cash flows. Could the market be missing something deeper?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Ferrovial Narrative

If you have your own perspective or want to check the data firsthand, you are free to dig in and shape your own analysis in just a few minutes. Do it your way

A great starting point for your Ferrovial research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors keep their options open. Give yourself an edge by exploring fresh opportunities in high-potential markets and future-focused sectors using our stock screeners.

- Unlock hidden potential by scanning for businesses with the strongest balance sheets and impressive undervaluation using our undervalued stocks based on cash flows.

- Fuel your portfolio’s growth with up-and-coming tech leaders by tapping into AI penny stocks and uncovering companies harnessing artificial intelligence breakthroughs.

- Boost your income strategy by targeting shares offering reliable yields above 3 percent through our feature-rich dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About BME:FER

Ferrovial

Engages in the design, construction, financing, operation, and maintenance of transport infrastructure and urban services internationally.

Proven track record with low risk.

Similar Companies

Market Insights

Community Narratives