- Spain

- /

- Construction

- /

- BME:ACS

Why Investors Shouldn't Be Surprised By ACS, Actividades de Construcción y Servicios, S.A.'s (BME:ACS) P/S

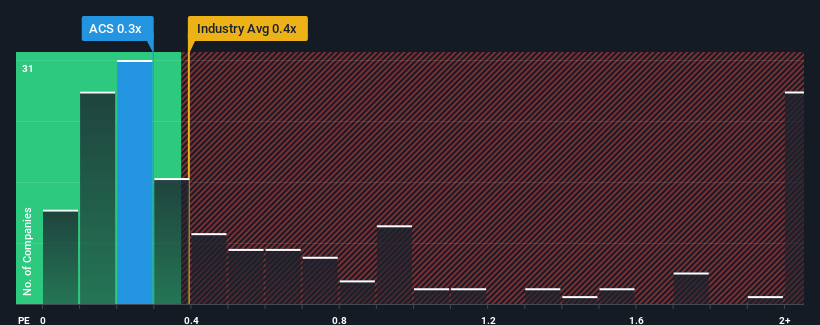

There wouldn't be many who think ACS, Actividades de Construcción y Servicios, S.A.'s (BME:ACS) price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S for the Construction industry in Spain is similar at about 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for ACS Actividades de Construcción y Servicios

What Does ACS Actividades de Construcción y Servicios' Recent Performance Look Like?

ACS Actividades de Construcción y Servicios' revenue growth of late has been pretty similar to most other companies. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

Keen to find out how analysts think ACS Actividades de Construcción y Servicios' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

ACS Actividades de Construcción y Servicios' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. Revenue has also lifted 14% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 2.1% per annum during the coming three years according to the eleven analysts following the company. With the industry predicted to deliver 3.4% growth per annum, the company is positioned for a comparable revenue result.

In light of this, it's understandable that ACS Actividades de Construcción y Servicios' P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What Does ACS Actividades de Construcción y Servicios' P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look at ACS Actividades de Construcción y Servicios' revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

We don't want to rain on the parade too much, but we did also find 3 warning signs for ACS Actividades de Construcción y Servicios that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BME:ACS

ACS Actividades de Construcción y Servicios

ACS, Actividades de Construcción y Servicios, S.A.

Average dividend payer and fair value.