A.P. Møller - Mærsk And 2 European Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

Amid renewed uncertainty about U.S. trade policy and escalating geopolitical tensions in the Middle East, European markets have experienced notable declines, with the STOXX Europe 600 Index ending 1.57% lower recently. In such a volatile environment, dividend stocks can offer a measure of stability and income potential for investors seeking to enhance their portfolios amidst market fluctuations.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.48% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.00% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 6.91% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.64% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.96% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.86% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.34% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.22% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.92% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.51% | ★★★★★★ |

Click here to see the full list of 232 stocks from our Top European Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

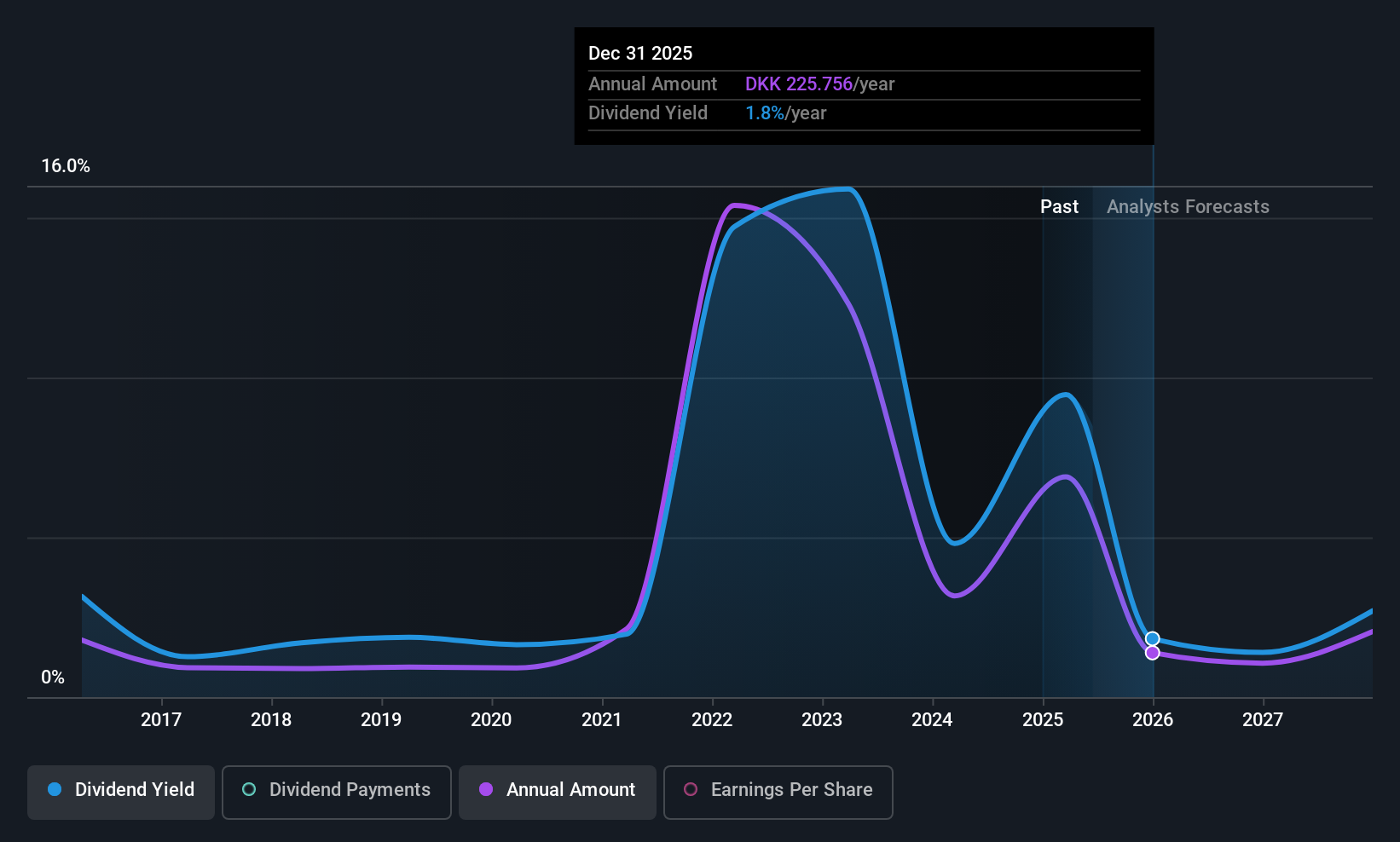

A.P. Møller - Mærsk (CPSE:MAERSK B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: A.P. Møller - Mærsk A/S operates as an integrated logistics company both in Denmark and internationally, with a market cap of DKK191.86 billion.

Operations: A.P. Møller - Mærsk A/S generates revenue through its Ocean segment ($38.29 billion), Logistics & Services segment ($14.90 billion), and Terminals segment ($4.70 billion).

Dividend Yield: 7.9%

A.P. Møller - Mærsk's dividend profile is characterized by a high yield of 7.92%, placing it in the top quartile of Danish dividend payers, yet its dividends have been volatile over the past decade. Despite this instability, dividends are well-covered by earnings and cash flows, with payout ratios at 34.4% and 28.9%, respectively. Recent financials show significant earnings growth; however, future forecasts suggest a potential decline in profitability, impacting long-term dividend sustainability considerations.

- Navigate through the intricacies of A.P. Møller - Mærsk with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that A.P. Møller - Mærsk is priced lower than what may be justified by its financials.

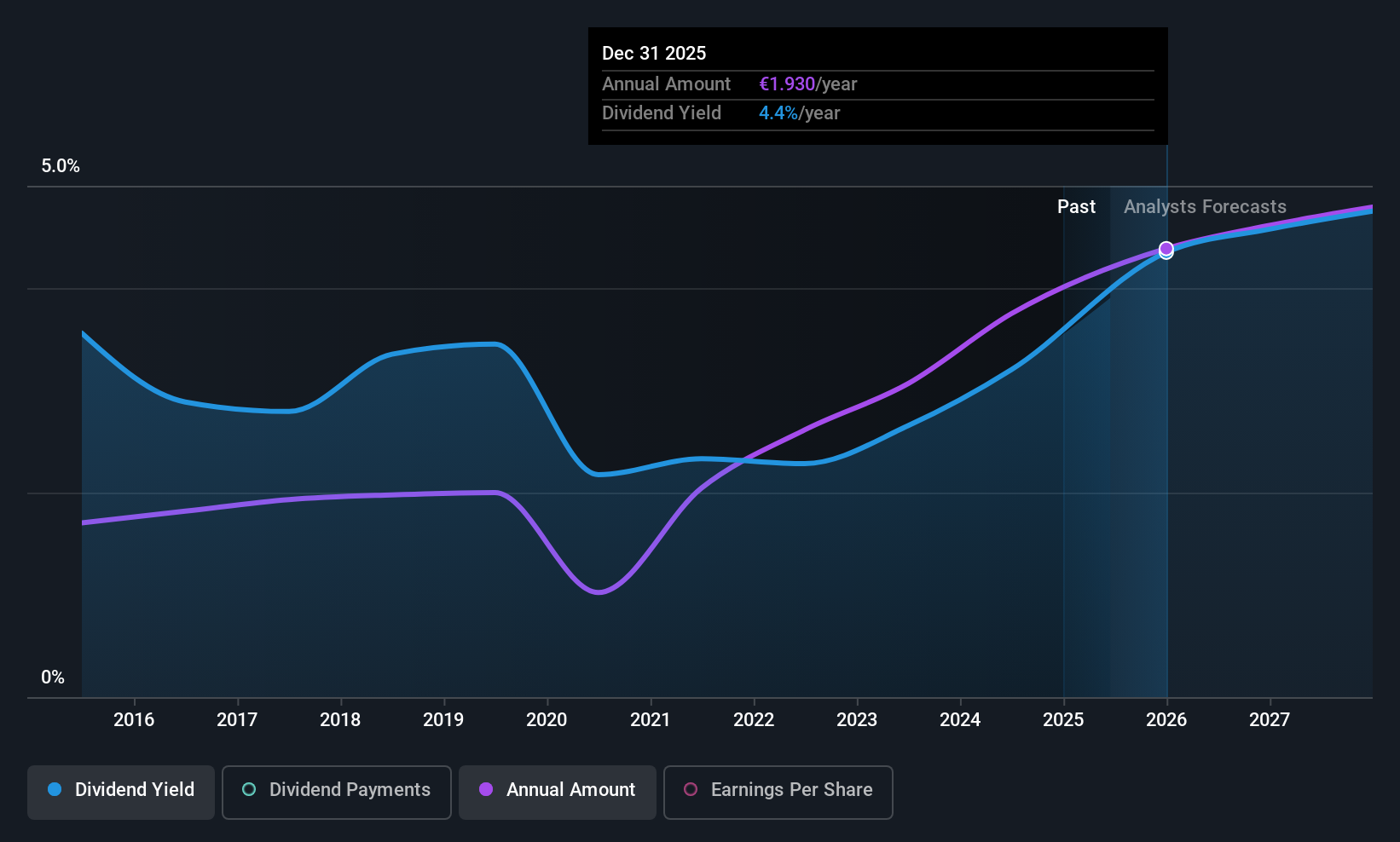

Ipsos (ENXTPA:IPS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ipsos SA, with a market cap of €1.93 billion, operates globally through its subsidiaries to offer survey-based research services for companies and institutions across Europe, the Middle East, Africa, the Americas, and the Asia-Pacific.

Operations: Ipsos SA generates revenue of €2.44 billion from its survey-based research services across various regions worldwide.

Dividend Yield: 4.1%

Ipsos offers a mixed dividend profile, with a yield of 4.12%, below the top quartile in France. While dividends are covered by earnings and cash flows, with payout ratios of 39% and 29.7%, respectively, their history has been volatile over the past decade. Despite this instability, recent revenue growth to €568.5 million and an increased annual dividend of €1.85 per share highlight potential for future income generation amidst favorable valuation compared to peers.

- Click here to discover the nuances of Ipsos with our detailed analytical dividend report.

- In light of our recent valuation report, it seems possible that Ipsos is trading behind its estimated value.

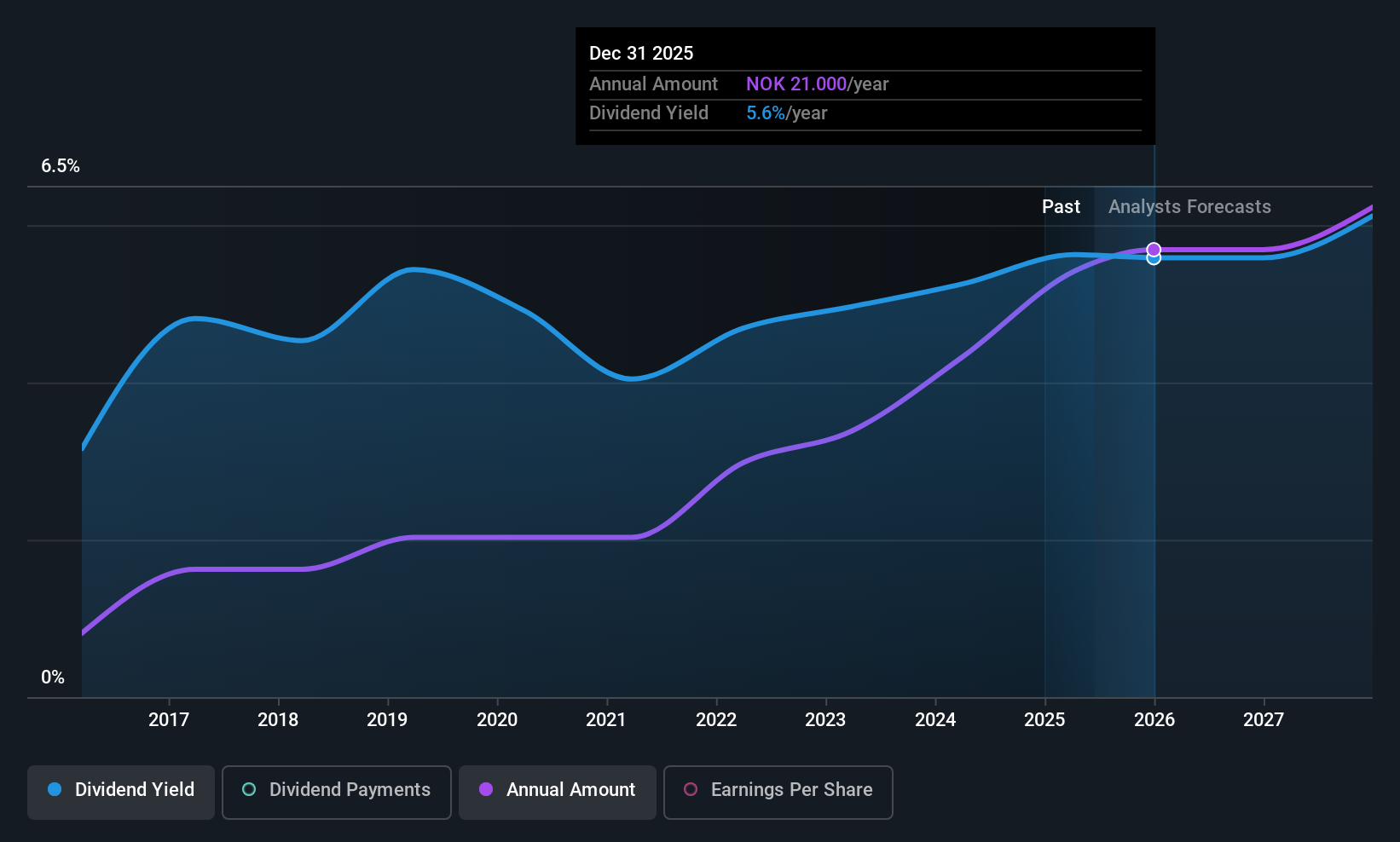

Jæren Sparebank (OB:JAREN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jæren Sparebank offers a range of financial products and services to individuals and businesses in Norway, with a market cap of NOK 1.81 billion.

Operations: Jæren Sparebank generates its revenue primarily from the Retail Market with NOK 279.51 million and the Corporate Market with NOK 168.49 million.

Dividend Yield: 5.4%

Jæren Sparebank's dividend yield of 5.44% trails the top quartile in Norway, and its dividend history has been volatile over the past decade. However, dividends are currently covered by earnings with a payout ratio of 73.1%, forecasted to improve to 67.6% in three years. Despite recent declines in net income to NOK 56.27 million for Q1 2025, earnings growth remains positive at an annual rate of 8%, supporting future dividend sustainability.

- Unlock comprehensive insights into our analysis of Jæren Sparebank stock in this dividend report.

- According our valuation report, there's an indication that Jæren Sparebank's share price might be on the expensive side.

Turning Ideas Into Actions

- Reveal the 232 hidden gems among our Top European Dividend Stocks screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:JAREN

Jæren Sparebank

Engages in providing various financial products and services to individuals and businesses in Norway.

Proven track record with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives