Stock Analysis

- Denmark

- /

- Marine and Shipping

- /

- CPSE:DNORD

What Can The Trends At Dampskibsselskabet Norden (CPH:DNORD) Tell Us About Their Returns?

What are the early trends we should look for to identify a stock that could multiply in value over the long term? Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. So on that note, Dampskibsselskabet Norden (CPH:DNORD) looks quite promising in regards to its trends of return on capital.

What is Return On Capital Employed (ROCE)?

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. The formula for this calculation on Dampskibsselskabet Norden is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.10 = US$148m ÷ (US$1.9b - US$466m) (Based on the trailing twelve months to September 2020).

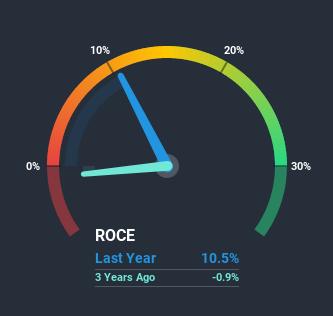

So, Dampskibsselskabet Norden has an ROCE of 10%. On its own, that's a standard return, however it's much better than the 5.6% generated by the Shipping industry.

See our latest analysis for Dampskibsselskabet Norden

Above you can see how the current ROCE for Dampskibsselskabet Norden compares to its prior returns on capital, but there's only so much you can tell from the past. If you'd like, you can check out the forecasts from the analysts covering Dampskibsselskabet Norden here for free.

What The Trend Of ROCE Can Tell Us

We're delighted to see that Dampskibsselskabet Norden is reaping rewards from its investments and has now broken into profitability. The company was generating losses five years ago, but has managed to turn it around and as we saw earlier is now earning 10%, which is always encouraging. While returns have increased, the amount of capital employed by Dampskibsselskabet Norden has remained flat over the period. With no noticeable increase in capital employed, it's worth knowing what the company plans on doing going forward in regards to reinvesting and growing the business. After all, a company can only become a long term multi-bagger if it continually reinvests in itself at high rates of return.

On a side note, we noticed that the improvement in ROCE appears to be partly fueled by an increase in current liabilities. Essentially the business now has suppliers or short-term creditors funding about 25% of its operations, which isn't ideal. It's worth keeping an eye on this because as the percentage of current liabilities to total assets increases, some aspects of risk also increase.

What We Can Learn From Dampskibsselskabet Norden's ROCE

In summary, we're delighted to see that Dampskibsselskabet Norden has been able to increase efficiencies and earn higher rates of return on the same amount of capital. Since the stock has only returned 40% to shareholders over the last five years, the promising fundamentals may not be recognized yet by investors. Given that, we'd look further into this stock in case it has more traits that could make it multiply in the long term.

Dampskibsselskabet Norden does have some risks, we noticed 2 warning signs (and 1 which shouldn't be ignored) we think you should know about.

While Dampskibsselskabet Norden may not currently earn the highest returns, we've compiled a list of companies that currently earn more than 25% return on equity. Check out this free list here.

If you’re looking to trade Dampskibsselskabet Norden, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Dampskibsselskabet Norden is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CPSE:DNORD

Dampskibsselskabet Norden

A shipping company, owns and operates dry cargo and tanker vessels worldwide.

Flawless balance sheet, good value and pays a dividend.